Riksbank Deliver 25bps and More to Come

Riksbank appear more concerned about a weak economy, which is causing forward guidance of a faster pace of easing after today’s 25bps cut to 3.50%. We look for 25bps cuts at the September and December meeting and a further 25bps is possible at the November meeting if inflation remains under control and further real sector disappointment is seen.

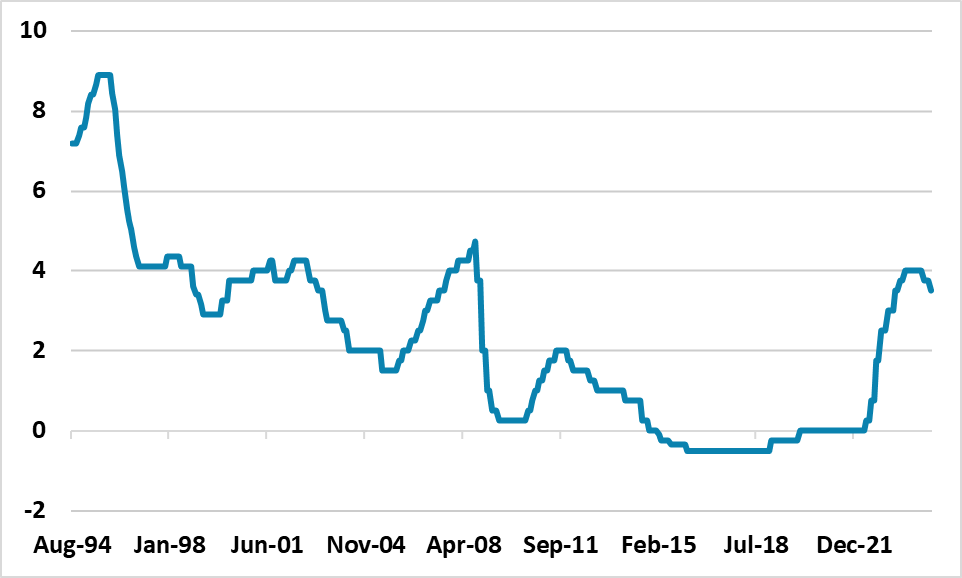

Figure 1: Riksbank Policy Rate (%)

Source Datastream/Continuum Economics

Though the Riksbank delivered the 25bps cut to 3.50% as expected, the statement indicated that the Riksbank would be looking to cut a further two to three times in 2024 and this is more dovish than June. Key points to note.

· Riksbank concerned about weak economy. The Q2 GDP figures were disappointing for the Riksbank, with the statement noting that the interest rate sensitivity sector of the economy (consumption and investment) have disappointed. Given the quick and strong feedthrough of the Riksbank tightening cycle, it could be argued that the Riksbank are perhaps concerned that they tightened too much.

· Inflation is seen to be under control. Recent inflation numbers certainly increase the confidence that 2% inflation has been achieved, with wage growth under control and corporate profit margins being squeezed by the weak economy. With unemployment now rising, plus sluggish growth, the risk of an inflation undershoot exists and it will be interesting to see new projections at the September 25 meeting.

· Easing more quickly. The guidance has not just shifted to two further cuts, but the potential for three cuts before year-end. We had already projected two further cuts and these will most likely be deliver in September and December when new projections are published. A 3rd cut in November is feasible depending on the real sector data in the next few months and whether CPI surprises on the downside.

· Market pricing three more cuts in 2024. After the statement the money market has moved to now discounting 25bps at the September, November and December meetings. Additionally, further easing is seen in 2025, getting down to a 2.0% in 1 year and terminal policy rate of 1.75%. The Riksbank did not comment on the shift in market expectations lower since the June meeting, but should around the September meeting.