U.S. July Employment looks below trend but unemployment is now trending higher

Sentiment on the US economy is seeing some wild swings. Eight days before a weaker than expected July non-farm payroll we saw a stronger than expected 2.8% annualized increase in Q2 GDP, the stronger than expected gain reflecting generally strong data in the month of June. If July turns out to be a below trend month, it needs to be seen in the context of what came before. A rising unemployment rate does argue for Fed easing, but we still expect the first move to be by 25bps in September.

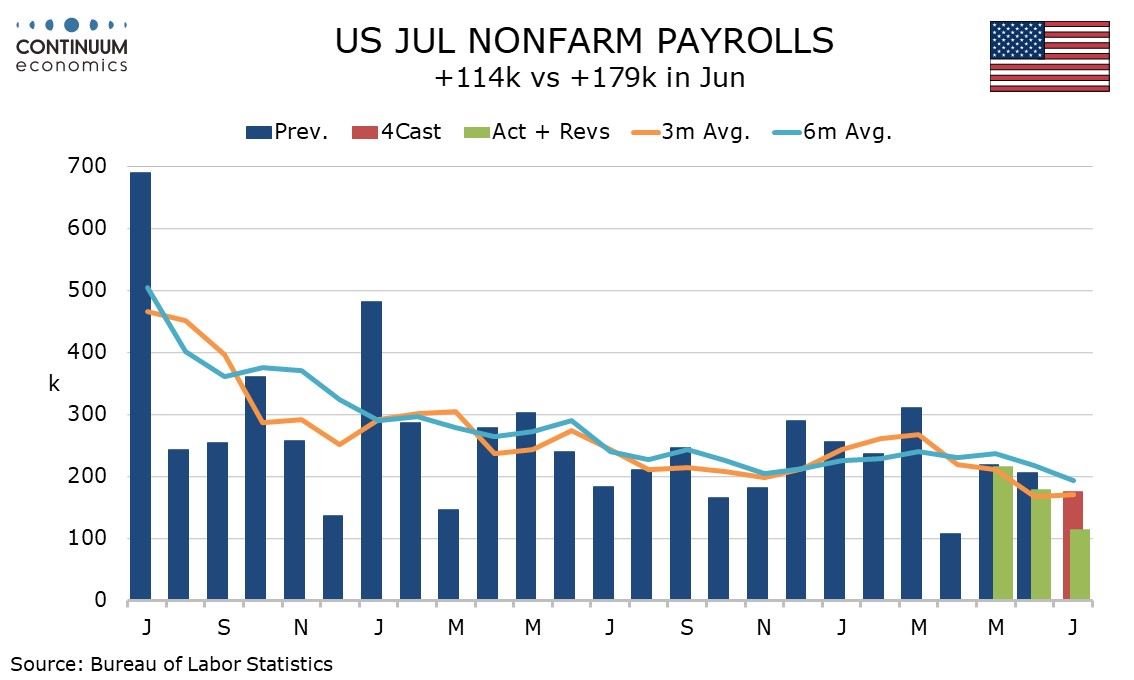

Employment below trend, weather possibly a factor

June’s 114k non-farm payroll increase was the weakest since the last decline (seen in December 2020) bar one, a 108k increase in April of this year, so Q2, which saw a healthy rise in GDP, got off to a below trend start in terms of employment too. Private sector payrolls rose by 97k in July. Since a decline in December 2020 we have also seen only one month weaker than this, by 91k in March of 2023, though October 2023 at 98k was only marginally stronger and April 2024 at 108k not much more so. July’s non-farm payroll was below trend, but not exceptionally so.

Weather may have played a part. The report stated explicitly that Hurricane Beryl had no discernable impact on the national employment and unemployment data for July, but the hurricane was not the only concern. Large parts of the country, particularly in the Midwest, saw exceptionally hot weather. Within the household survey 436k were seen as unable to work due to weather, the highest since January, when adverse weather is much more usual. This figure is not seasonally adjusted and should not be added to seasonally adjusted data to estimate a weather-adjusted number, but does suggest that weather was an issue in July, as it was in January when retail sales saw a weak month.

Payrolls outperforming household survey

Trend in payrolls has slowed, with the 3-month average at 170k while the 6-month average of 194k fell below 200k for the first time since the pandemic. There are concerns that payrolls may be overstated, with the 6-month average in the household survey’s estimate for unemployment being only 19k. However if the payroll is overstated then either GDP growth is also overstated or already respectable productivity growth is being understated. We believe the payroll is more accurate than the household survey which may be missing immigrants.

While the household survey is underperforming the payroll sharply on a 6-month average, the underperformance in July was modest, with the household survey showing a 67k increase in employment, with the rise in unemployment to 4.3% due to an unusual 420k surge in the labor force, and even then was only 4.253% before rounding. June’s household survey showed employment up by 116k. Given that the household survey was adversely impacted by weather it seems likely that July would have seen an above trend household survey employment estimate under normal weather conditions.

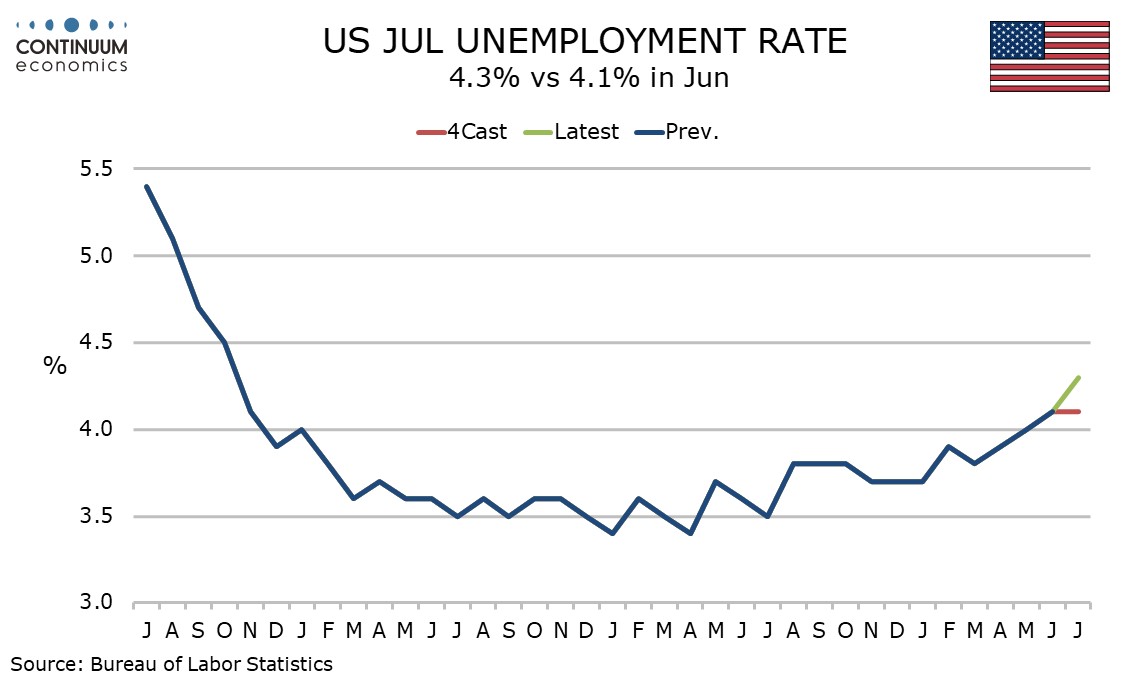

Unemployment rising faster than Fed expected

While there is little reason to see recessionary signals in the non-farm payroll, what is clear is that unemployment is now trending higher, with four straight gains totaling 0.5%. While July’s 0.2% increase is probably overstated and the underlying pace of increase is probably a little less than 0.1% per month, this still suggest unemployment will be a little above 4.5% at year end. The FOMC in June saw the rate ending 2024 at 4.0% and saw the long term rate at 4.2%. That argues for easing.

In fact, the message of the latest data is that the economy can add significantly more than 200k jobs per month while keeping unemployment steady, which ought to be positive for equities in the long run, even if a correction lower in equities is justified in the near term. Still, whether the economy can sustainably return to 2% inflation if the Fed engineers a fresh near term acceleration in the labor market is less certain, particularly given the possibility of less immigration after the election. We are likely to need weak August, as well as July, data, to have the Fed seriously considering a 50bps September move, and a move before then remains unlikely.