Mexico: Mixed Signs for Banxico

The Mexican economy shows mixed signals for Banxico. Economic activity indicates a slowdown, with weaker industrial activity and decelerating formal employment. However, inflation is rising, particularly in non-core components like energy and agricultural goods, influenced by climate conditions. The devalued exchange rate and potential anti-market reforms also pose inflationary risks. On August 8, Banxico must decide whether to cut the policy rate by 25 basis points or maintain it, depending on the second-quarter GDP and July CPI data.

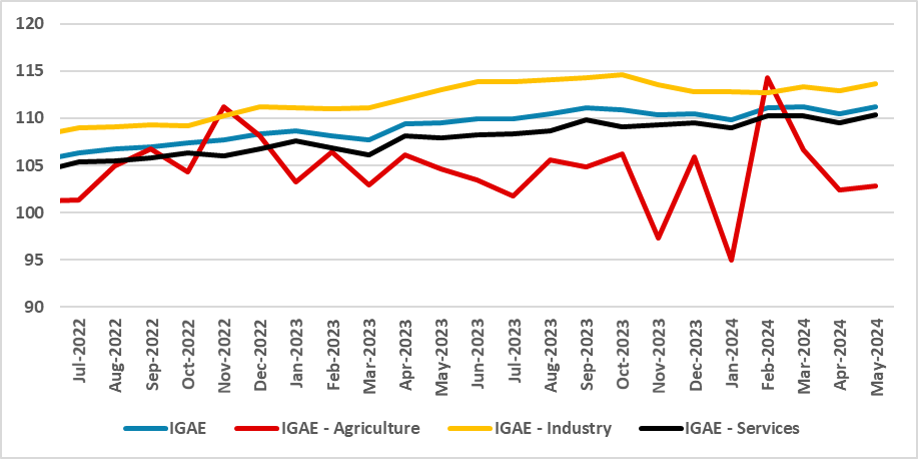

Figure 1: Mexico Economic Activity Index (Seasonally Adjusted)

Source: INEGI

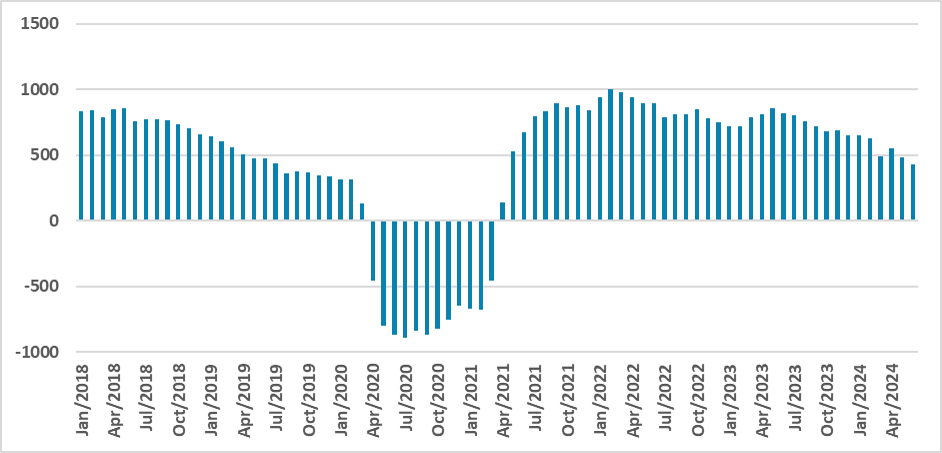

The Mexican economy is giving mixed signals to Banxico on whether they should resume cutting the policy rate or continue with the pause. On one hand, Mexico's monthly economic activity indicates that the Mexican economy is clearly on a deceleration trend. Industrial activity is particularly weaker, and services have yet to show a major force to boost growth in the short term. Additionally, formal employment creation is also decelerating. Although it is not showing signs of destruction in employment, the deceleration points to the Mexican economy slowing down.

Figure 2: Annual Formal Job Creation (Thousands)

Source: IMSS

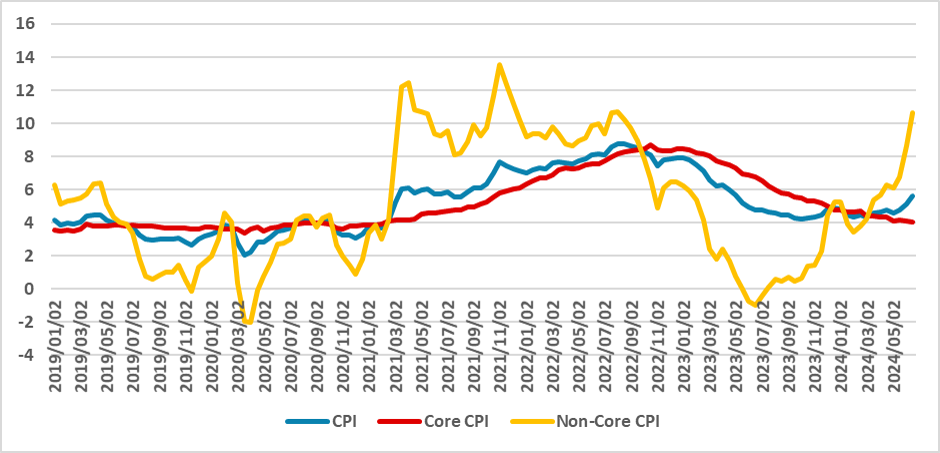

The signs arriving from the economic activity indicator suggest that with the Mexican economy finally slowing down, it would be safe for Banxico to resume cutting the policy rate. However, the signs coming from prices indicate the opposite. Inflation has seen an uptick in recent months, and bi-weekly CPI points to the year-over-year CPI reaching 5.6%. It is important to state that most of this rise occurred in the non-core component of the CPI, specifically energy and agricultural goods, which Banxico has little control over.

Figure 3: Bi-weekly CPI (%, Y/Y)

Source: INEGI

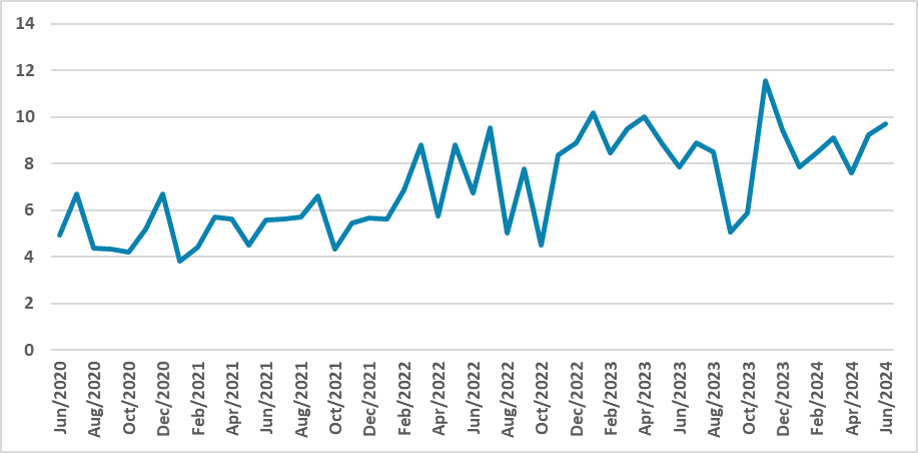

The rise in agricultural goods prices is mainly reflected by climate conditions in the rural areas of Mexico. The country has experienced some droughts, which have affected this year's harvest. Fruits and vegetables have increased by over 30% in recent weeks. Although core CPI continued to diminish, there is always the fear that the rise in non-core CPI could end up affecting core CPI, and a premature loosening of monetary policy would contribute to this effect. Additionally, wage inflation rose in May, with real growth reaching 4.1%, meaning a 9.6% increase in nominal terms. The rise in wages will likely contribute to rising enterprise costs, which could then raise final prices. Finally, the exchange rate devalued in recent weeks, and the fear of anti-market reforms, such as the reform in the judicial system, could keep the Mexican Peso weak, which could have potential inflationary effects.

Figure 4: Nominal Wage Inflation (%, Y/Y)

Source: INEGI

Therefore, on August 8, Banxico will have to analyze both signals from the Mexican economy to decide whether to cut the policy rate by 25 basis points or maintain it at the current level. We will still see the second quarter GDP, which will likely confirm the deceleration of the Mexican economy, and on the same day as the meeting, we will have the Mexican July CPI. If the final CPI number shows some tendency of reversal in the rise of agricultural prices, we expect Banxico to apply a 25 basis point cut; otherwise, Banxico will likely extend the pause.