Preview: Due July 25 - U.S. Q2 GDP - A second straight subdued quarter, with slower Core PCE Prices

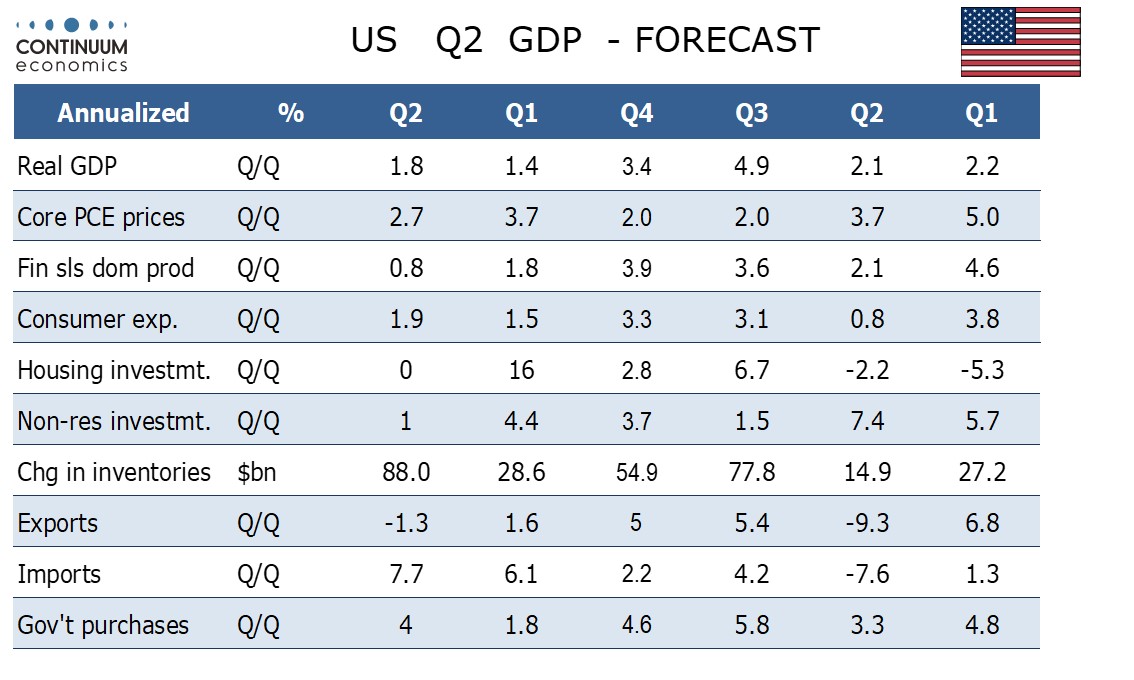

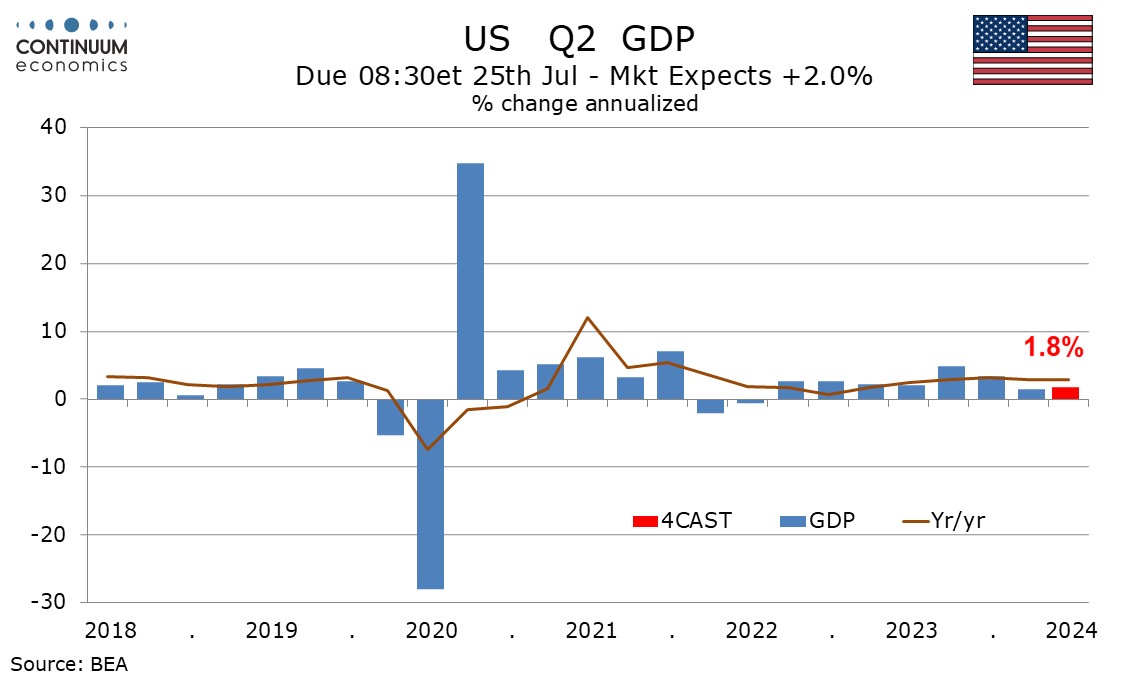

We look for a 1.8% annualized increase in Q2 GDP, slightly stronger than the 1.4% seen in Q1 but still leaving a significant slowing from the strong second half of 2023. The first two quarters of 2024 are set to be the weakest since the first two quarters of 2022 recorded modest declines.

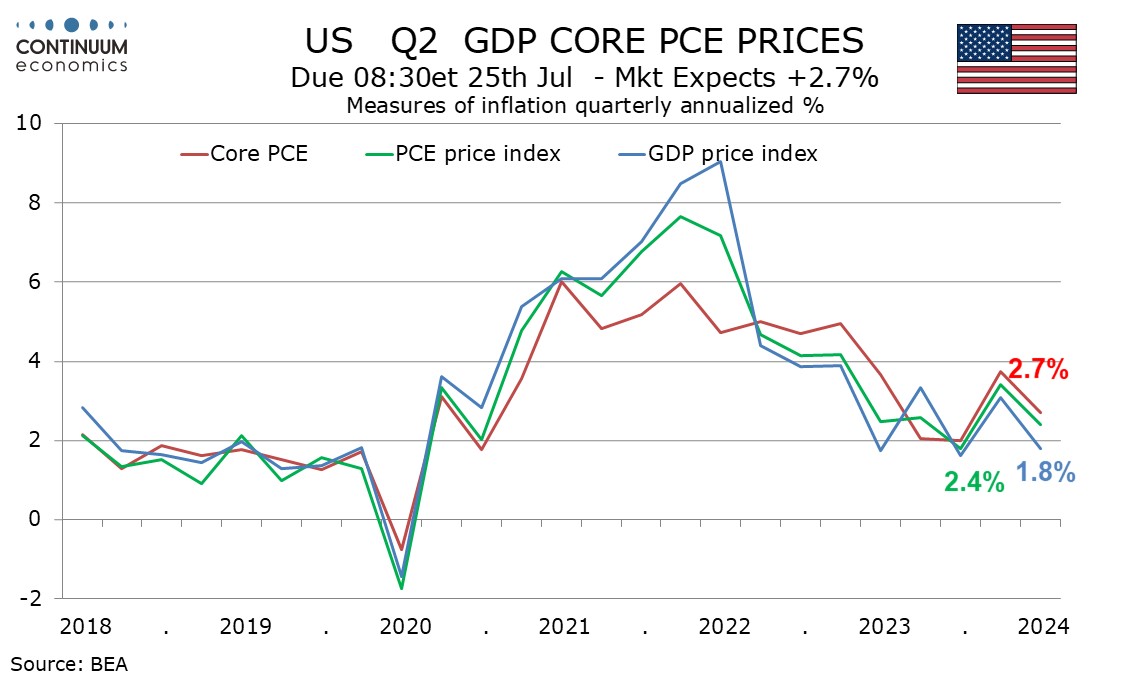

Core PCE prices are losing some momentum and we expect a 2.7% annualized increase in Q2, assuming another subdued month in June. This will remain above target but well below the 3.7% bounce seen in Q1 after the second half of 2023 came in consistent with the Fed’s 2.0% target.

We expect overall PCE prices to rise at a 2.4% pace and the GDP price index to be softer still at 1.8%, restrained by a rise in import prices, which will restrain the GDP price index due to imports being a negative in GDP.

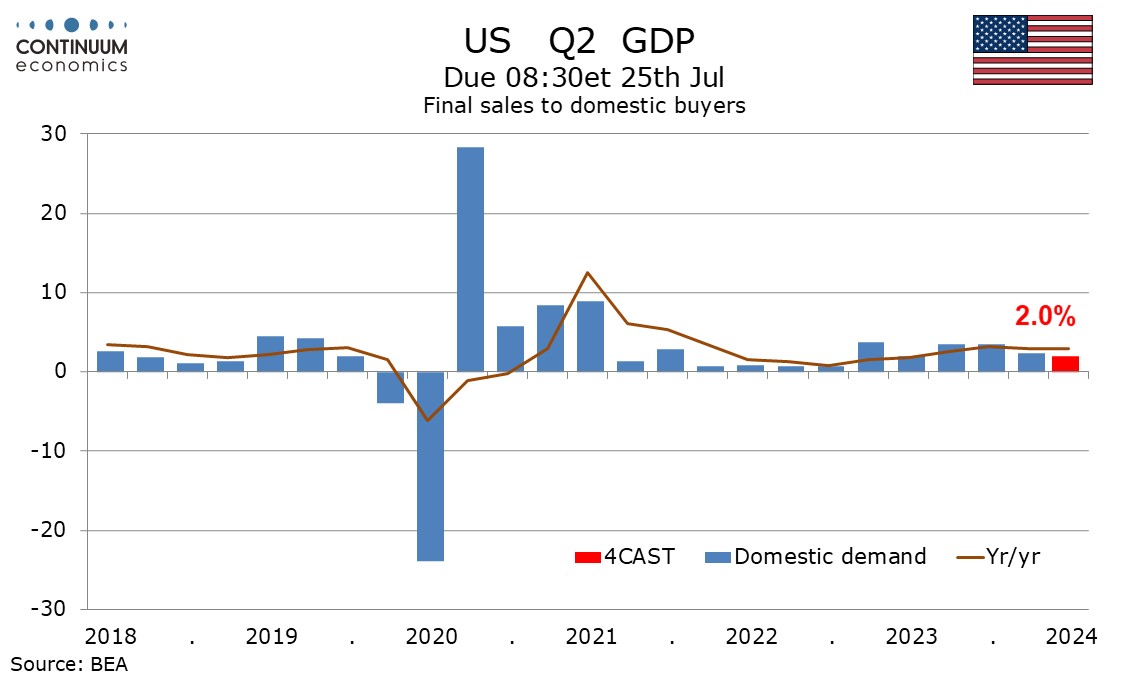

Q1’s weaker growth was downplayed due to the slowdown coming mostly from inventories and net exports, with final sales to domestic buyers (GDP less inventories and net exports) rising by a respectable 2.4%. In Q2 we expect a modest slowing in final sales to domestic buyers, to 2.0%.

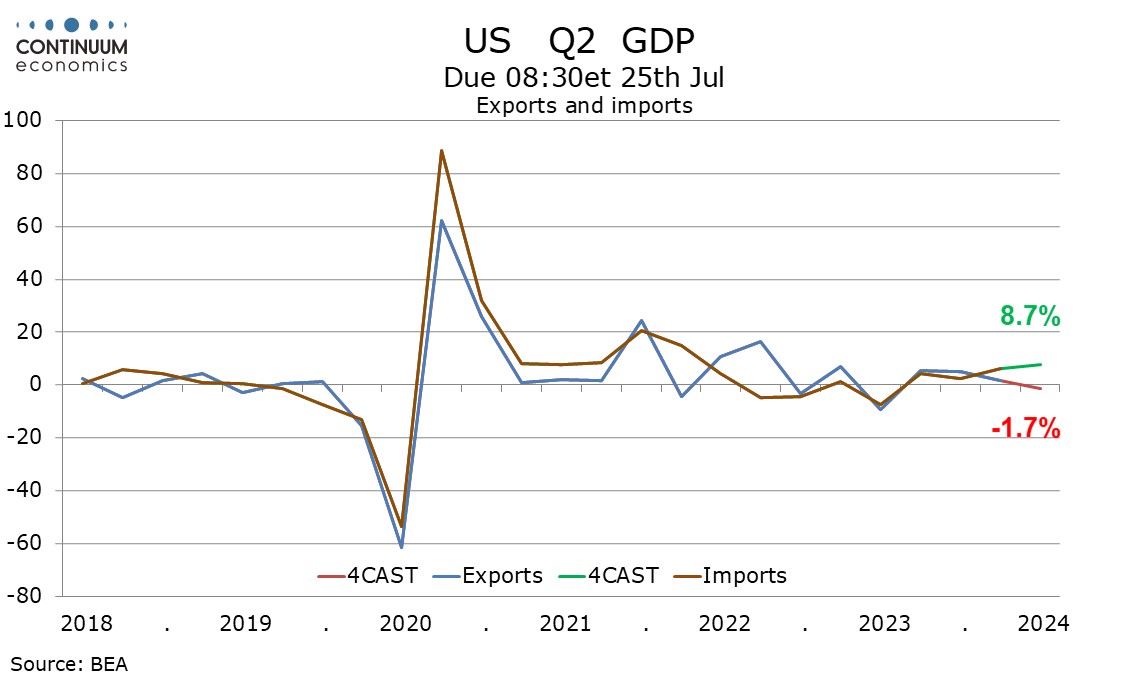

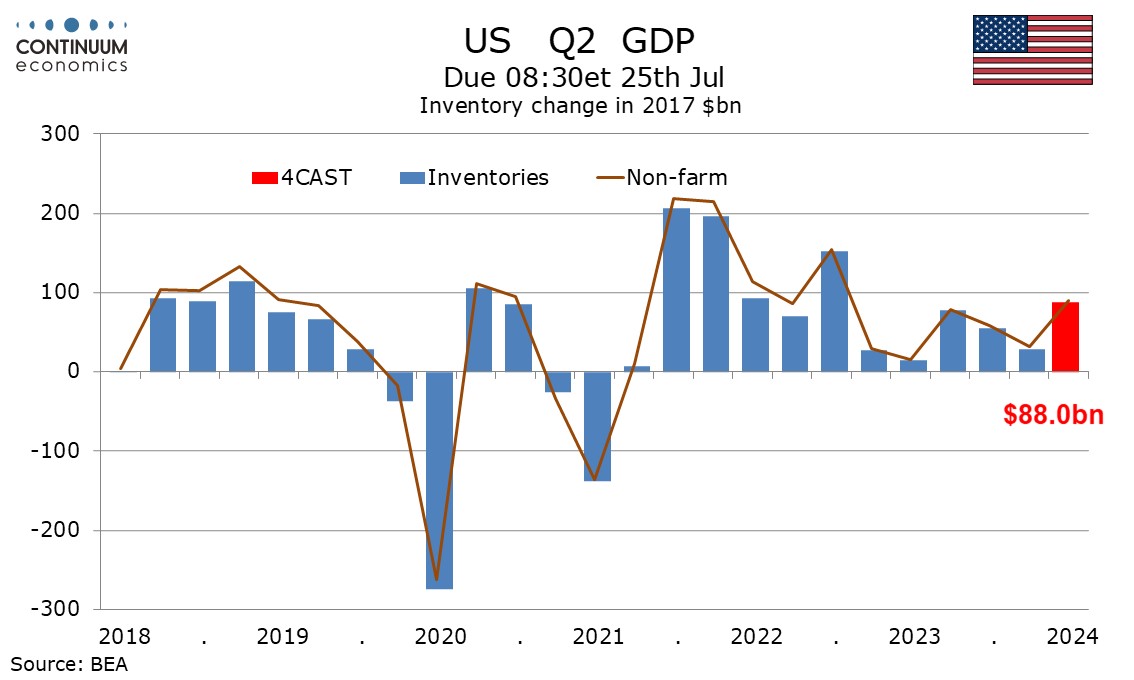

Data for April and May however suggest a pick-up in inventory growth, which will largely offset the negative coming from rising imports. While now seeing some slowing in June, we expect inventories to add 1.0% to Q2 GDP, with the buildup providing downside risk to Q3.

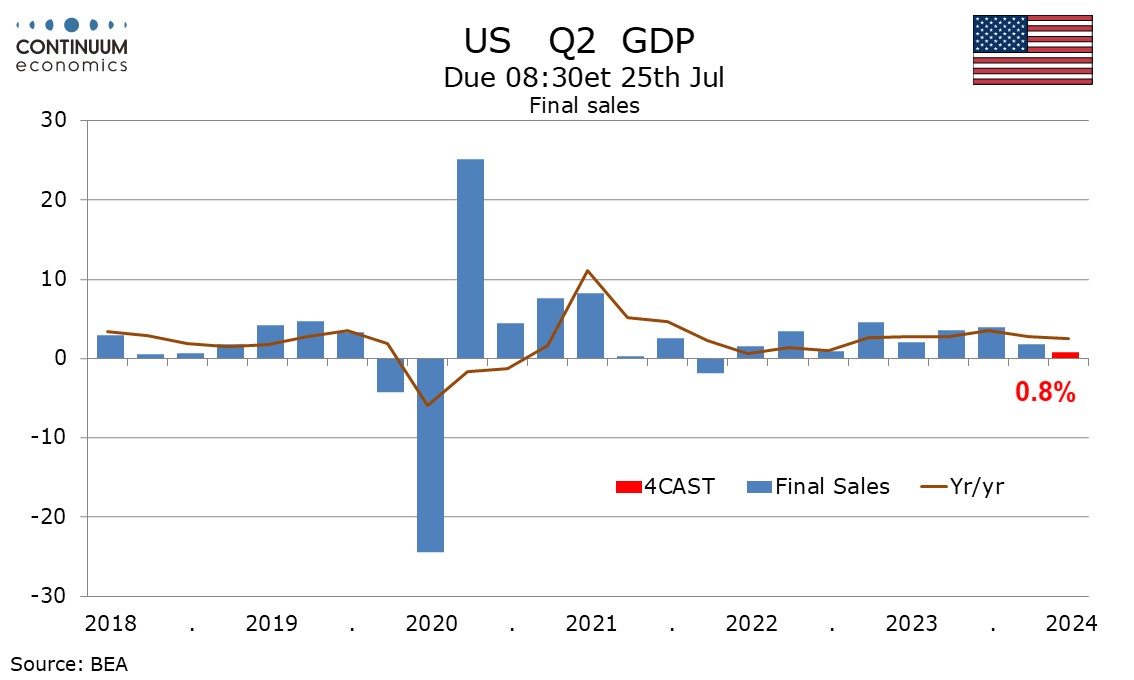

We expect final sales (GDP les inventories) to rise by only 0.6%, the weakest since a decline in Q1 2022.

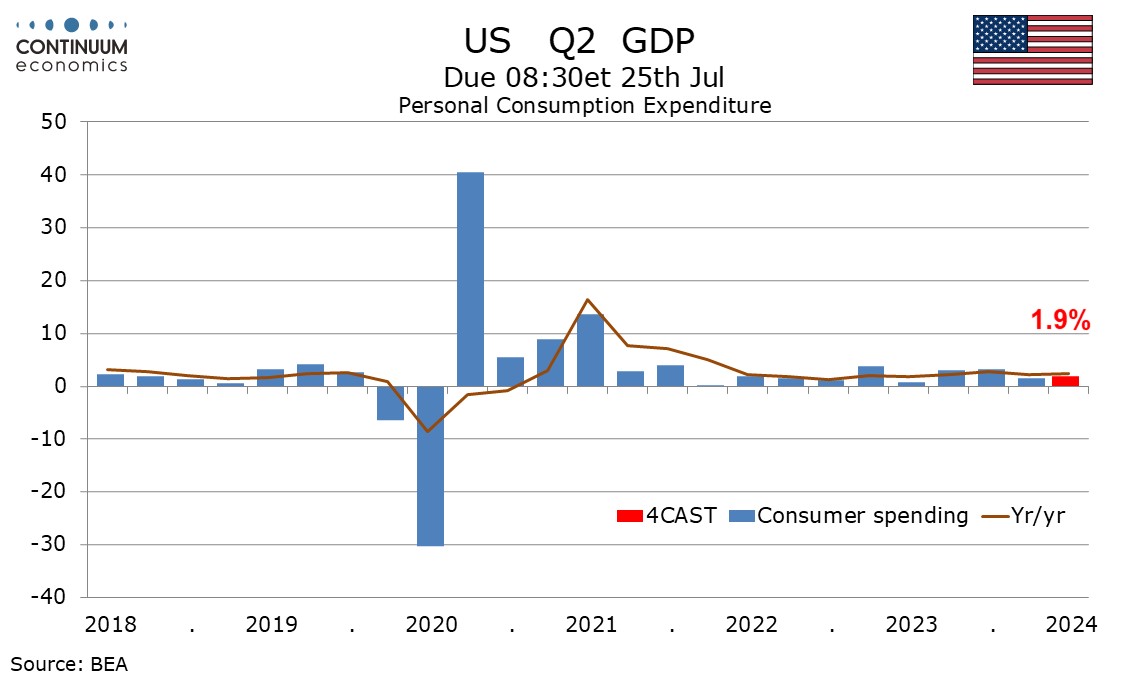

We expect a rise of 1.9% in consumer spending, like GDP marginally improved from Q1’s outcome. Gains of over 3% in consumer spending in the second half of 2023 looked difficult to sustain with real disposable income rising by less than 1%, In Q2 however consumer spending looks set match a 1.9% rise in real disposable income.

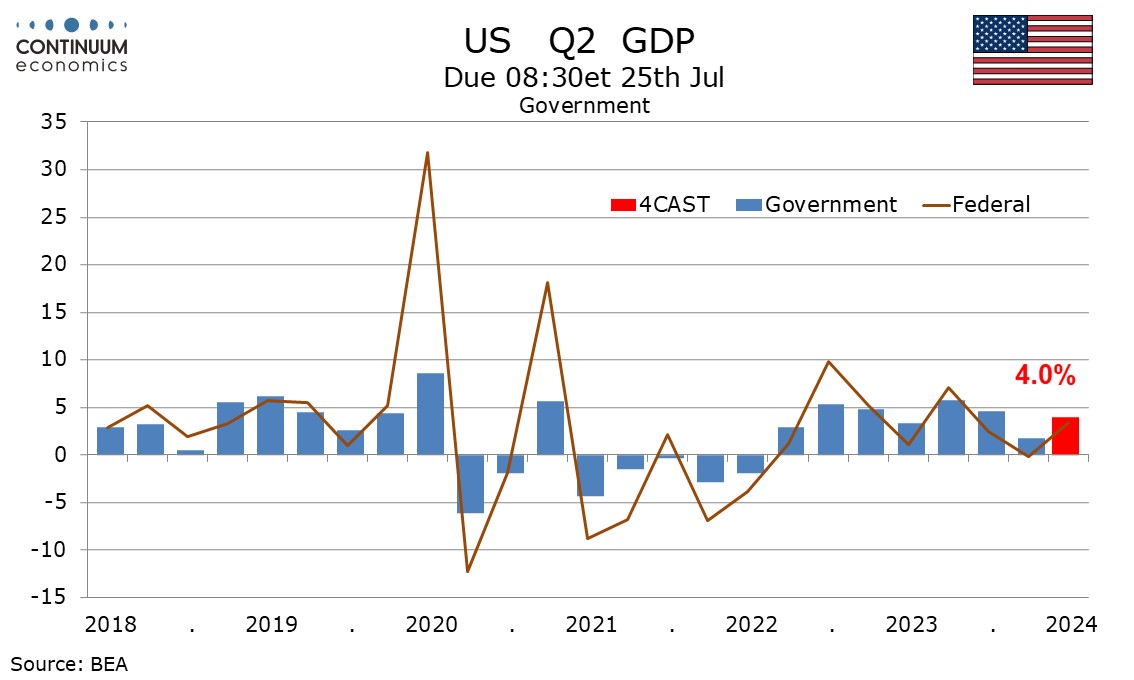

Public construction however is looking a little stronger and we expect government to rise by 4.0% after a weaker 1.8% gain in Q1. Higher defense spending will also provide some support.