Biden Drops Out, But Yield Curve Still to Steepen

President Joe Biden dropping out will create more uncertainty about the U.S. presidential race, but also crucially mean that the House of representative race is a close call. This could stall some Trump trades, though we still see a swing to a positive 10-2yr U.S. Treasury yield curve – given Fed easing starting at the September FOMC meeting.

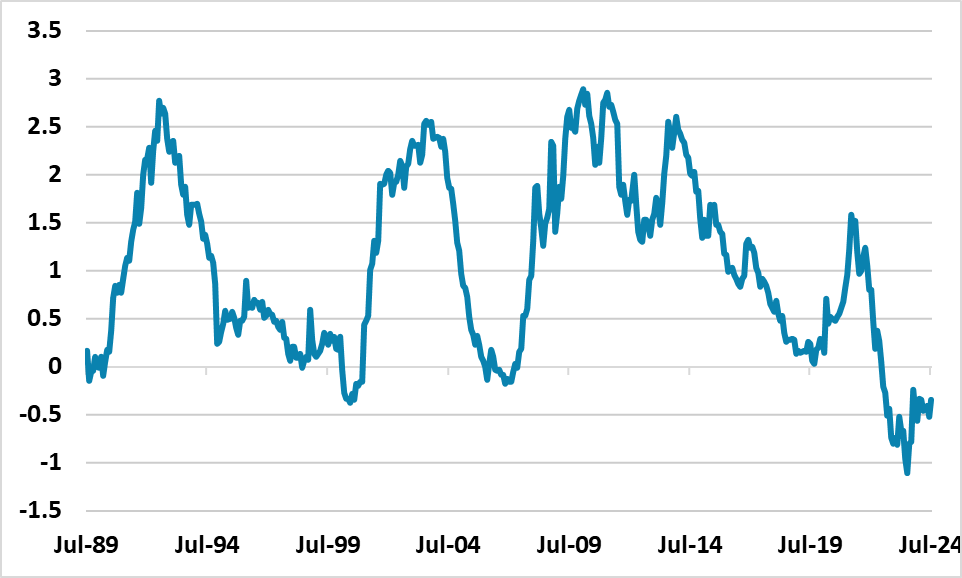

Figure 1: 10-2yr U.S. Treasury Yield Curve (%)

Source Datastream/Continuum Economics

The race to replace Joe Biden as the Democratic candidate for U.S. president is already well underway, with early support by some key figures for Kamala Harris. While Harris has the early momentum, others could yet emerge and it appears likely that the Democratic candidate will only emerge from the Democratic convention August 19-22. Though Harris has had a better rating in some polls versus Trump, this has not been consistent and uncertainty will now increase until a Democratic candidate is picked and goes head to head with Trump – though market will likely still assume a narrow Trump victory. Equally important is that the Democrats could get renewed momentum in trying to capture the House of Representatives, which will be key in the post November policy setting in the U.S. (here).

This all means that certain Trump trades could pause in the next couple of weeks e.g. short MXN on fears of a fight over immigration and USMCA renewal in 2026. Bullishness in some U.S. equity sectors e.g. oil could also be tempered. However, we do still see the shift to a positive shaped U.S. Treasury yield curve continuing. Firstly, the key driver is Fed rate cuts, which the market is becoming confident about starting in September. The July 31 FOMC meeting should see some hints of a more dovish tone, though Powell is unlikely to be too clear given two employment and inflation reports are still to be released before the September 18 FOMC meeting. Even so, 2yr yields will likely trend lower as more rate cuts are discounted and the market prices in consistent rate cuts in 2025. Secondly, fiscal stress is likely in the long-end of the U.S. Treasury curve whoever wins the U.S. presidential race. If Trump wins then making parts of the 2017 tax cuts permanent will be a priority, which risks a rating downgrade. However, a Democratic president would face fiscal stress, as the Republicans would delay a debt ceiling increase – this could be acute if the GOP wins the House. We see a 30-40bps increase in H1 2025 and a shift to a positive yield curve.