ECB Review: Under-Estimating Downside Risks?

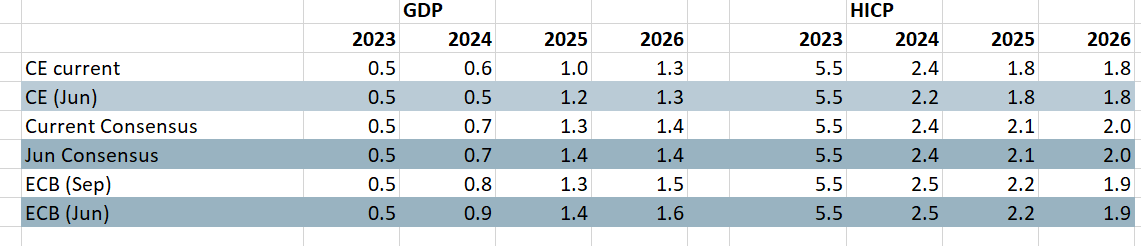

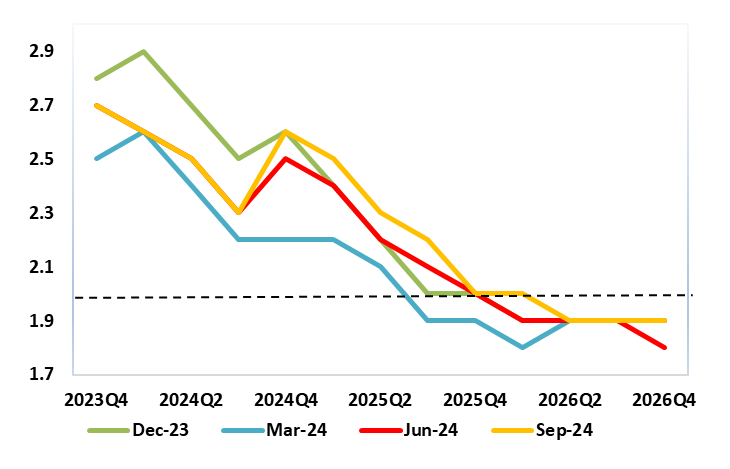

That the ECB cut the discount rate again by another 25 bp (to 3.5%) was no surprise. Neither was an unchanged tone at the press conference, with no clearer acknowledgment of downside risks even given ECB GDP projections (Figure 1) which moved down more toward our long-standing below-consensus thinking. In turn this helped reinforce the ECB view that HICP inflation would move below 2% in 2025 and stay there (Figure 2). Equally unsurprising, there was nothing like any firm pointer to the speed and/or timing of further moves. But as these projections are based on market rate thinking which envisages the discount rate close to 2% into 2026 (), it thereby endorses such thinking too. Moreover, given the stimulus that the circa-40 bp drop in market rates should have brought to the economic outlook, the downward revision the GDP outlook is notable. It suggests that the ECB’s unchanged assessment of downside risks is misplaced as those risks may even have materialized.

Figure 1: ECB Downgraded Outlook Still Too Rosy?

Source: ECB, CE, Bloomberg

This 25bp discount rate reduction came alongside larger reductions to the two other and now lower-profile policy rates thereby fulfilling a shift in the Eurosystem’s operational framework that was laid out six months ago. The array of cuts was well flagged despite the alleged meeting-by-meeting guidance the ECB has underscored it is still using; after all, even the hawks on the Council had conceded that the discount rate can (and maybe even should) fall at this juncture. Indeed, the decision this time was unanimous, this implying that the thinking behind the dissent to the June easing has been reassessed!

Assessing the Risks

But markets are more interested in what was said, aware too that the ECB is adhering to its data dependent guidance. Despite suggesting elevated wage pressures and a short-lived upgrade to core HICP due to service price stickiness, there were also more reassuring comments of wage and price pressures, thereby giving a picture of the direction of travel, albeit not the speed – this backed up by the ECB describing this move as another cut not a final one. Notably, the continued below-target inflation outlook from late 2025 onwards does endorse an outlook embracing rate cuts to around 2% into 2026. But President Lagarde was keen not to use the press conference to back market rate thinking, instead again underlining that the ECB will continue to assess the appropriate level and duration of policy restriction.

Indeed, there have been suggestions that worries about weaker growth are now reverberating within the ECB, albeit with the hawks still more mindful of service price resilience, despite more reassuring wage signs. But these worries chime with our long-standing concern of downside risks to what we still see is a below-consensus growth outlook, emanating not least from tight financial conditions and weaker global activity, also now being accentuated by increased fiscal consolidation measures as economies address budget deficit overshoots – ECB projections strangely made no downgrade to government spending outlook, instead encompassing larger structural budget gaps. Perhaps more notable are now signs that some of these downside risks may be materializing, with business survey data showing continued weak manufacturing and construction but now starting to puncture what has been solid service sector activity, the latter now backed up by official output data for the sector. This risk(ier) outlook is partly acknowledged by the ECB; even though it still suggests growth risks are still ‘tilted’ to the downside, it now points to the recovery ‘facing headwinds’. Moreover, the fact that the ECB’s downward revisions are largely due a weak household spending backdrop is all the more notable not only as the softer rates picture has had no discernible impact but also as the consumer has been at the forefront of its recovery expectations. Indeed, the consumer spending outlook has been revised down a cumulative 0.8 ppt with half of that concentrated into this year. Overall, ECB GDP forecasts were pruned less sizably due to an inter-related weaker import projection.

As for such headwinds, the tightness in financials conditions is only partly being tempered by official rate cuts. Bank lending surveys do not suggest that banks have started to unwind what has been a clear and rapid fighting in credit standards and the latest ECB survey of firm’s access to funding still points to bank credit supply caution. In addition, the ECB balance sheet reduction may be offsetting some of the conventional easing. As explained in the keynote speech by ECB Chief Economist Lane at Jackson Hole last month, the ensuing marked fall in excess liquidity in the EZ banking system means that ‘the transition from a high-reserves environment to a lower-reserves environment can trigger a shift in the risk-taking strategies of banks’.

The Base Case

Regardless, we still feel that neither Fed policy, nor the USD, are likely to affect any ECB thinking and thus policy move(s). Instead, and partly as the ECB remains focused on the labor costs updates, numbers produced quarterly, but also wants to amass a broad but fresh thrust of added insights, then subsequent rate cuts may only arrive in three-month intervals, ie the next in December. Thus, our long-standing view that the ECB may cut only a further 25 bp this year remains intact and this chimes with President Lagarde implicitly hinting more rate cuts are being considered back in June as the ECB has now entered a third policy phase, ie after hiking and then pausing. Moreover, we still think that, by year-end more durable evidence of labour costs easing should convince the ECB to continue easing and we see 100 bp further easing through 2025 (still quarterly), with the deposit rate then nearing 2% and thus more in line with a perceived neutral setting but hardly moving into anything like a clear expansionary stance. This may be a little slower than current (more frenzied) market thinking but we are unwilling to follow this until we see more supportive evidence.

Figure 2: ECB Below-Target Inflation Outlook Intact – Yet Again

Source: ECB

Varying Policy Risks

Overall, President Lagarde did suggest that policy will still have to remain restrictive for some time. But with policy rates very much well above what most consider to be neutral, policy would remain restrictive even with around 150 bp of added official rate cuts that we envisage. To us, the risk is of faster easing than our central case envisages, but the case for additional easing would necessitate a protracted downturn. In this regard, we have downgraded the current quarter GDP picture from a rise of 0.1% to a same-sized fall, on the back of the downturn in services. At this juncture we think this is a blip rather than afresh and weaker trend and are adhering to our rate policy outlook that we have had in place all this year. But we are watching our radar screens acutely for more adverse signs.

What we think though is, that amid these downside growth risks, alongside a target-consistent medium-term inflation outlook will make the ECB more attentive to real economy numbers. This may already be occurring amid the Council’s downward revisions. We have for some time suggested that alongside our below-consensus economic projections the policy outlook risk is also to the downside, but more in terms of faster rate cuts that larger ones – the later would take a fresh recession which we apportion around a 10% risk.

(1) The ECB’s projections are based on arrange of technical assumptions including those for market interest rates expectations, but with a cut-off date of mid-August – NB: market expectations have clearly fallen further since that period.