South Africa’s Inflation is Expected to Continue its Downward Trend in July

Bottom Line: After inflation decreased to 5.1% YoY in June due to slowdown in costs for food, fuel and transportation, we now foresee that the downward trend will continue in July and CPI will further slow down to 4.9% - 5.0% Yr/Yr given suspended power cuts (loadshedding), a stable Rand (ZAR), fall in global oil prices, and decrease in inflation expectations. The inflation is still expected to remain some way off from the midpoint of target band of 3% - 6% as risks to the inflation outlook are upside due to the supply-side constraints like crisis at ports and rail network, geopolitical risks, the U.S. presidential election in November, and a weaker coalition government, which could continue to lead South African Reserve Bank (SARB) to remain cautious. The July inflation figures will be announced on August 21.

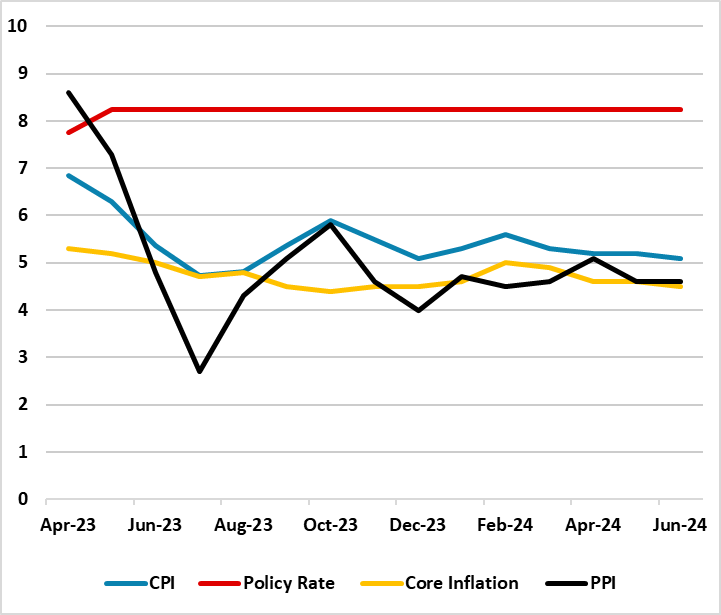

Figure 1: Policy Rate (%), CPI, PPI and Core Inflation (YoY, % Change), April 2023 – June 2024

Source: Continuum Economics

After cooling off to 5.1% backed by falling food, fuel and transport prices in June, marking the lowest reading since December 2023, we predict the decreasing pattern in CPI inflation will continue in July due to suspended load-shedding, relatively stable ZAR and fall in the global oil prices.

On the power cuts front, South Africa’s national electricity utility company, Eskom announced on July 26 that load shedding remained suspended for 121 consecutive days since March 26, reflecting an improvement in the reliability and stability of the generation coal fleet. Eskom indicated that the mentioned period included 87 days of constant supply throughout the winter period. This is a significant development for South African economy as the suspension helped businesses and households to relieve facing increasing costs from using alternative sources such as diesel backup generators, contributing at lower inflation figures. July inflation outlook has been supported by a stable ZAR, which hovered around 18.2-18.4 against the USD, following the formation of the new coalition government late June.

Additionally, there has been a recent fall in the inflation expectations as well. According to the BER survey of inflation expectations 2024Q2 released on July 5, analysts, business people, and trade union officials all lowered their CPI inflation forecast for the entire three-year horizon. On average, they now anticipate inflation of 5.3% in 2024, 5.0% in 2025, and 4.9% in 2026 while their five-year inflation forecast fell below 5% (to 4.9%) for the first time since the fourth quarter of 2021. (Note: We foresee average headline inflation will stand at 5.1% and 4.7% in 2024 and 2025, respectively).

Remaining expectant about the inflation outlook, SARB governor Kganyago underscored on July 18 that “We anticipate further progress as inflation slows, helping to re-anchor expectations firmly at 4.5%. While the forecast has improved, the balance of risks is assessed to the upside.”

Despite positive developments, we think risks to the inflationary outlook remain strong due to mining sector dealing with supply-side constraints like crisis at SA ports and rail network, subdued consumer demand continuing to pressure retail, geopolitical risks, the U.S. presidential election in November, and a weaker coalition government continue to cause concerns. (Note: Residential property price inflation is also on an upward trend, according to the Stats SA’s latest monthly residential property price indices for provinces and metropolitan).

We think the recent CPI readings give SARB room to breathe, as the inflation remains within SARB’s target of between 3% and 6% and is likely to hover around 5% midterm target in the near term. We foresee SARB’s first rate cut could happen in Q4, if inflation trajectory will allow in August and September.