UK CPI Inflation Review: Inflation Fall Further, But Services Momentum Still Evident

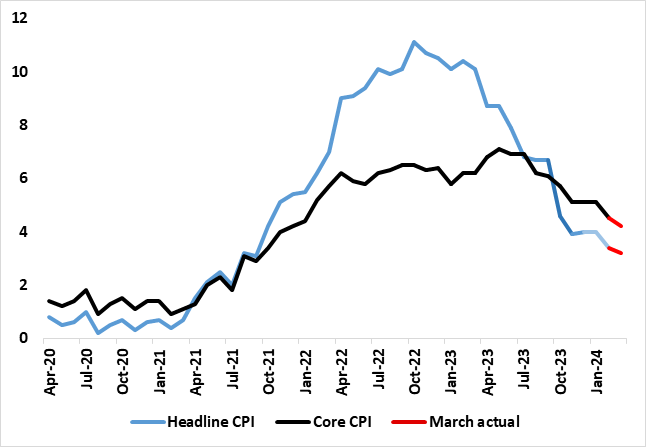

UK headline and core inflation have been on a clear downward trajectory in the last few months, the former having peaked above 10% in February last year and the latter at 7.1% In May. After a pause in the preceding three months, this downtrend seemingly resumed in the February CPI numbers and clearly so (Figure 1), despite higher petrol prices, with food acting as a major offset. Moreover, it continued in the just-released March CPI data, albeit with more signs of resilient services inflation alongside additional hints that core inflation is also showing some resilience, at least in adjusted m/m numbers. Even so, the headline CPI rate fell 0.2 ppt to 3.2% y/y, the lowest in 33 months while the core fell a notch more significantly to 4.2%, albeit both readings a touch above consensus and BoE thinking. We think the data still leaves open the case and momentum for a BoE rate cut this quarter. This partly reflects BoE Governor Bailey choosing to underscore that (more supply-side) UK inflation dynamics are different enough to those in the U.S. to allow a possible cut before anything made by the Fed and thus chime with ever-clearer ECB policy leanings.

Figure 1: Headline and Core Inflation Drop Continues

Source: ONS, Continuum Economics

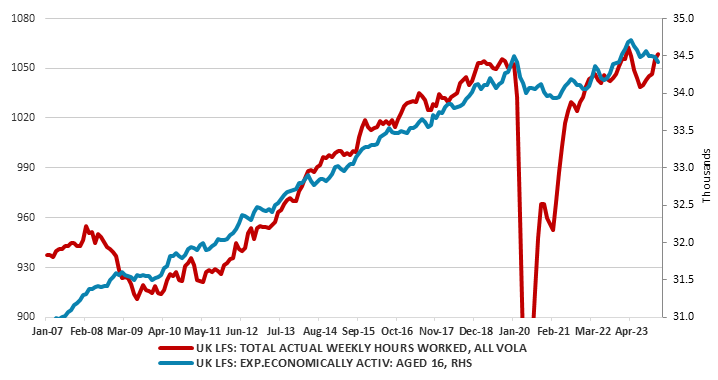

Any such BoE decision will be close and is already openly debated. Three MPC members (most recently Megan Greene) have lingering concerns about price pressures, something that is evident in core inflation. These CPI numbers arrived a day after mixed labor market figures, which revealed slightly higher-than-expected wage outcomes but alongside clearly weak job dynamics, where a perturbing fall in participation is being offset by a clear recovery in overall hours worked (Figure 2), all indicative of a less tight labor market.

Figure 2: Mixed Labor Market Tightness Signals?

Source: ONS, Continuum Economics

The softer March CPI data came alongside mixed PPI data at least for manufacturing. Regardless, CPI headline inflation slowed to 3.2% y/y, down from 3.4% in February. The largest downward contribution to the monthly change in CPI annual rates came from food, with prices rising by less than a year ago, while the largest, partially offsetting, upward contribution came from motor fuels, with prices rising this year but falling a year ago. Core CPI (excluding energy, food, alcohol and tobacco) rose by 4.2% in the 12 months to March 2024, down from 4.5% in February; the CPI goods annual rate slowed from 1.1% to 0.8%, while the CPI services annual rate eased slightly from 6.1% to 6.0%, this making the divergence between the two all the more striking and very much indicative of a disinflation process that seemingly is more supply influenced that demand..

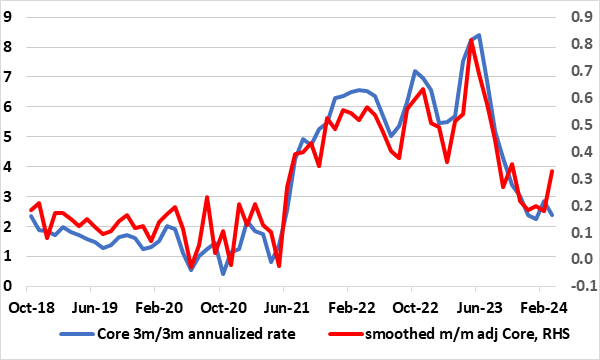

Figure 3: Adjusted Core CPI Pressures No Longer Falling Clearly?

Source: ONS, Continuum Economics, smoothed is 3 mth mov avg

The headline rate in March was some 0.1 ppt above formal BoE thinking but we think this partly reflects the impact of the early Easter, notably on travel but also higher petrol price coming through. But it is also clear that rental costs are becoming clearer, now running over 7% y/y, this factor explaining the greater strength in CPIH inflation.

The March data continued the picture of the disinflation trend in our estimate of the seasonally adjusted data continued seen in months prior to December, albeit perhaps again less discernibly amid swings that we think at this juncture are noise rather than a change in tune. Indeed, on this basis, CPI core inflation was just above target and slightly more so as it was on a 3 mth/3 mth annualized basis, a measure that the B0E is starting to use more formally – indeed, there was some rise in core momentum as measured by the adjusted m/m numbers in the last few numbers however (Figure 3).

Looking ahead, it is notable that favourable base effects and the drop in the energy cap should bring headline inflation down to even a touch above the 2% target by April, an outlook that the even the BoE acknowledges, albeit with the latter thinking this drop will be more on a short-lived basis than we think likely! But we still see a clear case for rate cutting to begin, most probably in June and with more easing to follow through H2, with all upcoming MPC meetings now considered live!