South Africa’s Inflation Hits 4-Months High in February

Bottom Line: According to the inflation figures announced by Department of Statistics of South Africa (Stats SA) on March 20, the inflation jumped to 5.6% YoY in February due to higher housing & utilities, miscellaneous goods & services, food and non-alcoholic beverages and transport prices, coupled with relatively severe power cuts (loadshedding) and weakened Rand (ZAR). As stronger-than-expected inflation remains far from the 4.5% midpoint, we think SARB could delay the rate cuts to Q3 until after the May 29 elections, if the CPI trajectory allows. We expect the first rate cut could happen either on July 18 or on September 19, while a coalition with an uncertain fiscal and loadshedding policy could delay easing further.

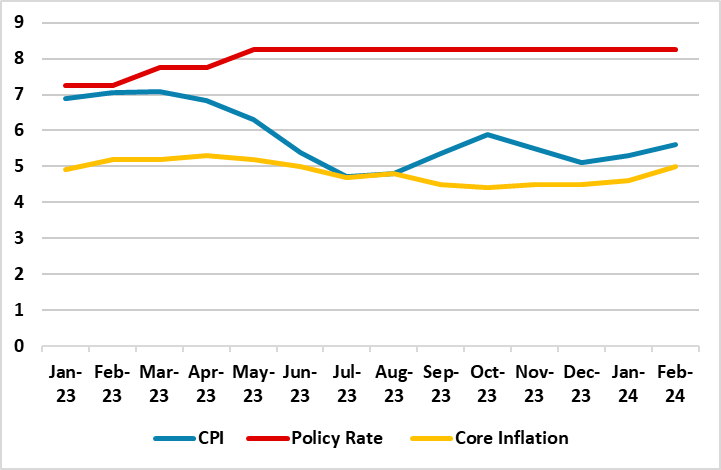

Figure 1: Policy Rate (%), CPI and Core Inflation (YoY, % Change), January 2023 – February 2024

Source: Continuum Economics

South Africa’s inflation picked up to 5.6% YoY in February due to quickening housing, food, utilities and transport. Core inflation also jumped to 5.0% in February from 4.6% in February in annual terms partly due to rising health-insurance costs. The annual price growth in transport costs accelerated to 5.4% from 3.6%, driven higher mainly by hikes in vehicle and fuel prices.

Despite South African loadshedding issue partly eased in January, the falling trend of the electricity blackouts came to an end in mid-January after power cuts rose up to Stage 3 and Stage 4. The country faced the most severe nationwide power cuts in months mid-February, as Eskom implemented Stage 5 and Stage 6 outages due to numerous factors such as shutdown of generating units, the need to continue to do planned maintenance, and excessive demand. On the currency end, ZAR slipped around 3.2% in February contributing to the inflation reading.

Under current circumstances, and as we previously underlined, we expect South African Reserve Bank (SARB) will likely keep the rates unchanged at 8.25% on the next MPC meeting on March 27. We think the recent increase in the inflation figures will probably cause SARB to act cautiously, and wary of potential risks to the outlook while the inflation remaining within SARB’s target of between 3% and 6%; but still far from the 4.5% midpoint. According to the data released on March 19, it is worth mentioning that average inflation expectations for 2024 and 2025 also remained above that midpoint. (Note: After February, March can also see high inflationary pressure due to the 1.20 Rand per liter hike in fuel prices at the start of the month).

Taking into account that SARB Governor Kganyago has repeatedly said job of taming inflation is not done yet, and the central bank will be unwilling to adjust its policy stance until inflation retreats to 4.5% in a sustainable manner and settles there, we think stronger-than-expected inflation figures could cause SARB to delay the rate cuts to Q3 until after the elections, if the CPI trajectory allows in the upcoming moths. This is also related with the elections outcome as a coalition with an uncertain fiscal and loadshedding policy could delay easing further. We expect the first rate cut could happen either on July 18 or on September 19.

In the meantime, national and provincial elections on May 29, food and fuel inflation, logistical constraints, loadshedding, currency fluctuations and inflationary expectations will have to be closely followed by the SARB, as these factors can change the current scene quickly.