South Africa’s Inflation Started 2024 with an Uptick

Bottom Line: According to the inflation figures announced by Department of Statistics of South Africa (Stats SA) on February 21, the inflation jumped to 5.3% YoY in January due to higher fuel and food prices, after declining two consecutive months. Other key contributors to the inflation were relatively severe power cuts (loadshedding) and weakened Rand (ZAR) in January.

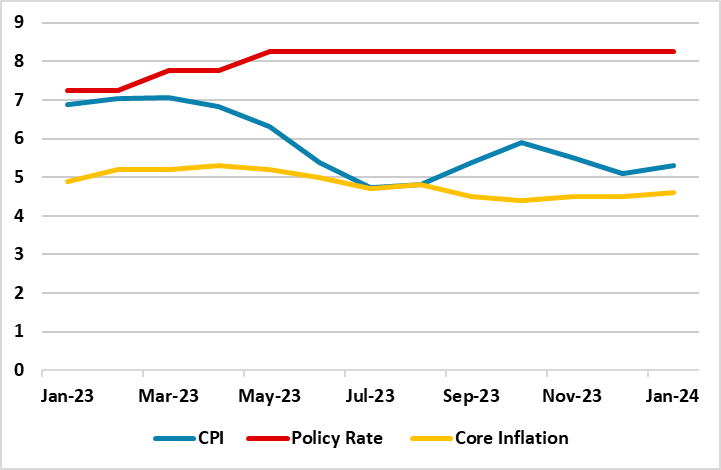

Figure 1: Policy Rate (%), CPI and Core Inflation (YoY, % Change), January 2023 – January 2024

Source: Continuum Economics

After decreasing two consecutive months, the inflation picked up to 5.3% YoY in January due to quickening housing, food, utilities and transport. Core inflation also jumped to 4.6% in January from 4.5% in December in annual terms.

The product categories in the CPI basket, which started the new year with the largest annual price increases, were restaurants & hotels (8.0%), food & non-alcoholic beverages (7.2%), and health (6.5%). Additionally, the annual rate for fuel hiked from -2.5% in December to 3.3% in January, which contributed to a rise in annual transport inflation to 4.6% in January from 2.6% in December.

Despite South African load shedding issue partly eased in early January as Eskom managed to supply three days of full electricity in the first week of 2024, the falling trend of the scheduled electricity blackouts came to an end in mid-January after power cuts rose up to Stage 3 and Stage 4 due to numerous factors such as shutdown of generating units, the need to continue to do planned maintenance, and excessive demand. (Note: The country has faced the most severe nationwide power cuts in months mid-February, as Eskom implemented Stage 5 and Stage 6 outages which can ignite the inflation in February).

On the currency end, the ZAR’s initial reaction to the CPI news today was a slight depreciation. ZAR, which slipped around 2% and 1.6% in January and February, respectively, also contributed to the inflation reading in January.

On the food inflation front, the dry conditions in the country due to current El Nino period, continue to threaten summer crops, and it appears the domestic food prices in the near term would heavily depend on the rainfall. According to the agricultural analysts, the last week of February and the first week of March will be critical for summer crops, and dry and hot conditions can lead to worries over the 2024 outlook despite global food prices or global agricultural commodities are continuing to soften.

Under current circumstances, and as we previously underlined, we expect South African Reserve Bank (SARB) will likely keep the rates unchanged at 8.25% on the next MPC meeting on March 27. We think the inflation figure in January will probably cause SARB to act cautiously, and wary of potential risks to the outlook while the inflation remaining within SARB’s target of between 3% and 6% and hovering around 5% midterm target is good news.

In this respect, SARB Governor Kganyago has recently said the job of taming inflation is not done yet, and he wants inflation to stabilize around 4.5% and stays there in a sustained manner before considering rate cuts. SARB will have time to decide on timing once it sees monthly inflation outcomes in February and March, and we foresee a likely easing to start in Q2 of 2024 if the CPI trajectory allows. We think the developments that will be followed closely by the SARB during this process will be the national and provincial elections on May 29, food and fuel inflation, logistical constraints, loadshedding, currency fluctuations and inflationary expectations.