Military Spending is Expected to Boost Russian Economy in 2024

Bottom Line: Russian war spending continues to boost Russian economy as military analysts expect Russian spending on defense will rise to around 6% of GDP in 2024 from 3.9% in 2023. We foresee Russian GDP to grow by 1.3% in 2024 since strong monetary tightening is expected to suppress demand and squeeze lending with lagged impacts, but it appears the amount of the war spending would be a significant determinant for the growth path of Russia in the near future.

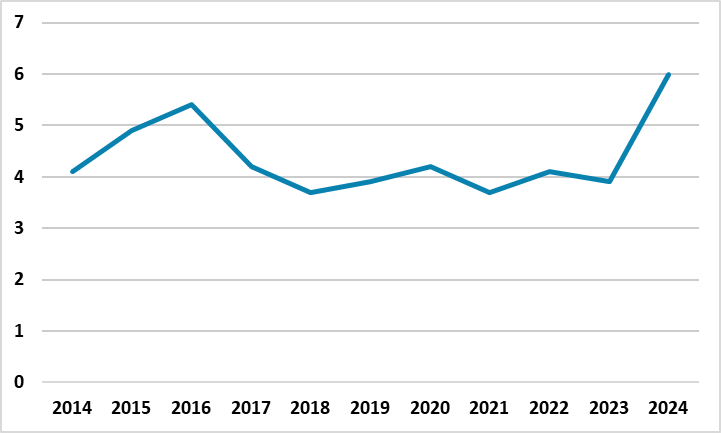

Figure 1: Russian Military Expenditure (% of GDP), 2014 – 2024

Source: World Bank, SIPRI, Continuum Economics

The Russian economy grew fast in 2023, after partly relieved from the negative impacts of the war in Ukraine. Despite the country continues to be strained by high inflation, decreasing trade income and volatile currency, the main accelerator for GDP growth has been the surge in the military spending and manufacturing production. Another contributor to the growth dynamics has been the strong consumer demand amid greater outlays on social support coupled, with higher pensions and salaries.

Russian officials remain optimistic about the 2024 GDP growth figures like in 2023. Underlining strong manufacturing figures, Russian economic development minister Maxim Reshetnikov underscored that the growth in 2023 may reach 3.5%, but he expects a smaller rise of 2.3% in 2024. The Russian president Putin has recently said GDP growth for 2023 could rise above the 3.5% prediction and potentially even past 4%, and added that the country’s economic performance was an amazing result. (Note: We foresee Russian economy to grow by 1.3% and 1.1% in 2024 and 2025, respectively, partly due to sanctions on Russia’s energy sales leading to a steady weakness in export revenues, coupled with growing imports jeopardizing the GDP expansion).

Military analysts believe Russian spending on defense will rise to around 6% of GDP in 2024 while it was 3.9% of GDP in 2023. According to official information, Russia spends 29% of all public expenditures on defense, while the NATO average is only 4.3%. We think this figure is probably larger when considering the reconstruction expenditures in occupied parts of Ukraine.

In a similar vein, IMF also recently upgraded 2024 growth prospects for Russia from 1.1% to 2.6%. Commenting on the drivers behind the upgrade, the IMF underscored that the change reflects “carryover from stronger-than-expected growth in 2023 on account of high military spending and private consumption, supported by wage growth in a tight labor market.”

As Russia has sped up the military production and spending, Russian Defense Minister Sergei Shoigu said in December 2023 that Russia currently produces over 100 tanks and over 200 AFVs per month. Shoigu stated that the increase in tank production of 560% since February 2022, while production of infantry fighting vehicles was up 360% and armored personnel carriers by 350%, demonstrating how Russia increased its military expenditures after the war in Ukraine started.

On the sanctions front, the steep increase in military expenses raises questions concerning how effective the Western sanctions have been to depress Russian financial revenues. Apparently, one important source of income for Russia in 2023 has been the oil revenues despite G7’s imposition of $ 60-a-barrel cap on Russian seaborne oil and hurdling access to shipping and insurance services. (Note: According to sources, India and China remain the significant destinations for Russian oil as now account for around 90% of Russia’s oil exports).

On the war front, we continue to foresee a protracted conflict, coming with varying degrees of intensity into 2024. The peace negotiations remain very unlikely, as both Ukraine and Russia perceive the war as existential. In 2024, the war will likely remain deadlocked and a frozen conflict, unless Donald Trump is elected U.S. president and threatens to curtail Ukraine funding, which may change the whole scenario, including Russia’s eagerness to surge the military spending.