South Africa’s Inflation Ended 2023 with a Promising Slow Down

Bottom Line: According to the inflation figures announced by Department of Statistics of South Africa (Stats SA) on January 24, the downward trend in the inflation continued in December with a 5.1% Yr/Yr reading, given slowing fuel prices and food prices, relatively less power cuts (loadshedding) and a stable Rand (ZAR) in December, coupled with dipped global oil prices.

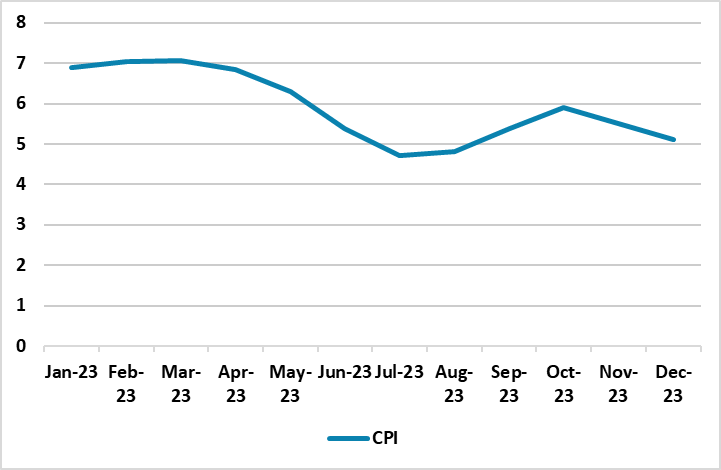

Figure 1: CPI Inflation Rate (%, YoY), January 2023 – December 2023

Source: Datastream

After easing for a second consecutive month, the inflation cooled off to 5.1% in December partly due to relatively less load-shedding and a relative stable ZAR, particularly in the 2H of December. We think the deceleration process were strongly supported by the fall in food and fuel prices in December, coupled with easing global oil prices.

With December reading, the 2023 average inflation rate recorded 6.0% (our prediction was 5.9% for 2023), which was lower than 6.9% in 2022. The highest reading in 2023 was 7.1% in March, and the lowest was in July with 4.7%. Core inflation was unchanged in December at 4.5% in annual terms.

The product categories which ended 2023 with annual rates higher than the average in December were food & non-alcoholic beverages (8.5%), restaurants & hotels (7.0%) and health (6.5%). The fall in the inflation for food and non-alcoholic beverages was remarkable which decelerated to 8.5% in December after hitting 9.0% and 8.7% in November and October, respectively. Additionally, the fuel prices also decreased by 2.5% over the previous 12 months, and by 2.7% between November and December. The transport index surged by 2.6% in the 12 months to December 2023 – much lower than the annual rate of 13.9% recorded in December 2022. The category which experienced a remarkable surge in 2023 was the housing & utilities, whose inflation annually reached 5.7%, the highest annual increase since May 2017, when the rate was also 5.7%.

Under current circumstances, and as we previously underlined, we expect South African Reserve Bank (SARB) will, very likely, keep the rates unchanged at 8.25% on January 25. We think the recent CPI readings is increasing SARB’s radius of the action, as the inflation remains within SARB’s target of between 3% and 6% and the inflation reading hovers around 5% midterm target in the near term. SARB Governor Kganyago has recently said he wants inflation to stabilize around 4.5%, the mid-point of its target band, before considering rate cuts. We also foresee a likely easing to start in Q2 of 2024 if the CPI trajectory allows, as SARB hinted that 2024 rate cuts would likely be smaller.

It is worth mentioning that Governor Kganyago also stated on January 17 that the disinflation process had already begun, and expected inflation to average 5% in 2024, demonstrating positive expectations by the higher economic policy management against the inflation. (Note: We also foresee headline inflation will fall to 4.9% and 4.5% in 2024 and 2025, respectively, thanks to SARB’s sensitivity to inflation and loadshedding will partly relieve in the near future). We feel the inflation is on track now, but sources of worry during deceleration process could be the logistical constraints, loadshedding, adverse global developments, and the presidential elections in May-August, 2024, which can be followed by a likely some moderate political volatility, and repercussions over economic decision making.