South Africa’s Inflation is Expected to Further Slow Down in December

Bottom Line: After inflation decreased to 5.5% in November, we now foresee that the downward trend will continue in December and inflation will further slow down to 5.2% Yr/Yr given relatively less power cuts (loadshedding) and a stable Rand (ZAR) in December, coupled with dipped global oil prices. The inflation figures will be announced on January 24.

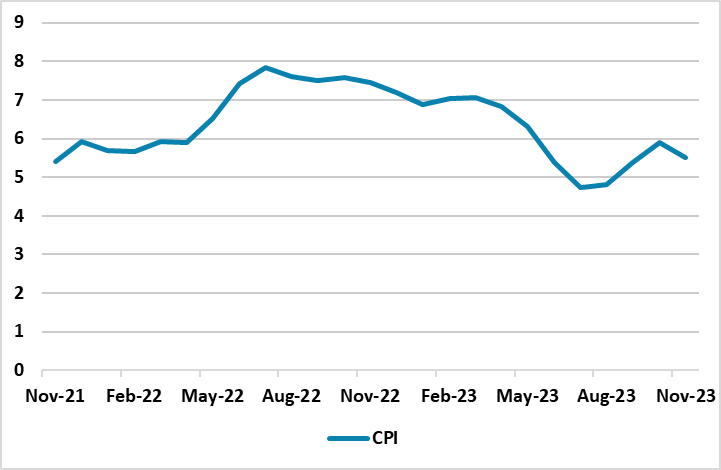

Figure 1: CPI Inflation Rate (%, YoY), November 2021 – November 2023

Source: Datastream

After cooling off to 5.5% thanks to falling fuel prices and transport prices in November, we predict the decreasing pattern in CPI inflation will remain in December, partly due to relatively less load-shedding and a relative stable ZAR, particularly in the 2H of December. We think the deceleration process is also supported by the fall in the global oil prices. (Note: As underscored by the Bureau for Economic Research (BER), the spot and one-month future Brent crude oil prices have so far failed to rise above $80/barrel in 2024).

Hereupon, South African Reserve Bank (SARB) Governor Lesetja Kganyago said on January 17 that the disinflation process had already begun, and expected inflation to average 5% in 2024 (here). We also foresee headline inflation will fall to 4.9% and 4.5% in 2024 and 2025, respectively, thanks to SARB’s sensitivity to inflation and loadshedding will partly relieve in the near future.

Despite positive developments, though, it appears risks to the inflation outlook such as supply side problems like crisis at SA ports and rail network and uptick in inflation expectations continue to cause concerns. On this matter, Kganyago underscored that although it was difficult to quantify, it was clear that the inability of the rail network to move goods efficiently was feeding into inflation, and added that “There will be a lot of contestations in South Africa in the near future and that could spill into the labor market and that has implications for wage setting and domestic inflation.” Additionally, Kganyago mentioned in a televised interview earlier this week that inflation has remained stickier than anticipated, which shows SARB remains cautious.

We think the recent CPI readings give SARB room to breathe, as the inflation remains within SARB’s target of between 3% and 6% and the inflation reading is likely to hover around 5% midterm target in the near term. We think the source of worry during deceleration process would be the presidential elections in May-August, 2024, which can be followed by a likely some moderate political volatility, and repercussions over economic decision making. We feel the elections can put pressure to increase populist spending could also impact domestic inflation.