Russia’s Inflation Slightly Slows Down to 7.4% in December

Bottom Line: After increasing continuously in the last seven months, Russian inflation unexpectedly decelerated to 7.42% YoY in December after hitting by 7.48% YoY in November. The figures announced by Rosstat on January 12 may give a boost to present the economy as an area of strength ahead of presidential elections this March, despite the consumer demand stayed strong, labour market remained tight, coupled with high military spending and currency volatility.

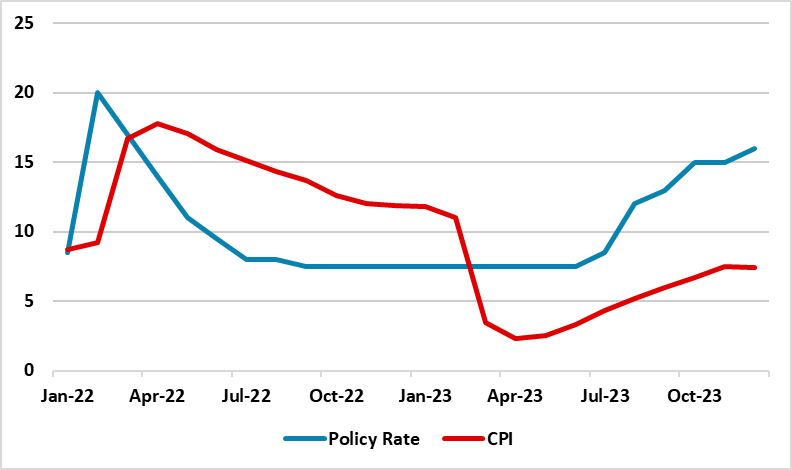

Figure 1: CPI (YoY, % Change) and Policy Rate (%), January 2022 – December 2023

Source: Datastream, Continuum Economics

According to Rosstat figures, prices of food, non-food products and services rose by 8.16%, 5.96% and 8.33% on an annual basis in December, respectively. The consumer price index (CPI) shot up by 0.7% on a monthly basis.

Despite a slight slowdown in the inflation reading in December, we think the inflationary pressures remained strong in the last month of the year, particularly due to growth in domestic demand continued to outpace the supply expansion capacity, coupled with high military spending, lagged feedthrough of the weak RUB and tight labour market.

December’s 7.42% YoY inflation is still very close to the upper boundary of the Central Bank of Russia’s (CBR) 2023 forecast range of 7%-7.5%, and it is far above CBR’s medium term target of 4%. On this matter, CBR Governor Elvira Nabiullina affirmed in December that inflation would be close to the upper limit of the official forecast of 7.0-7.5% after the outlook worsened over the year due to weakening ruble, supply-side constraints and labor shortages.

It appears the recent inflation debate is centered around the food inflation, particularly on the egg prices, as Russia will choose its president in March 2024. The country announced in December that it was scrapping import duty on eggs after prices edged up by some 40%. Interestingly, President Putin apologized for the surging grocery bills during a televised call-in show last month as the data demonstrated that food products led the increases in 2023, with the cost of eggs, chicken and vegetables surging by 61%, 28% and 24%, respectively.

It is worth mentioning that CBR continues its key rate hiking cycle (Note: Current policy rate is at 16% after CBR’s 100 bps increase on December 15, citing inflationary pressures remaining high triggered by strong demand and lending). Taking into account that CBR’s determination, we predict this can suppress demand and imports and squeeze lending particularly in 2H of 2024, but only gradually with lagged effects.

In addition, CBR recently signaled that the tightening process may continue if the inflation will remain sticky despite the rate hikes, while we expect CBR to hold the rates unchanged at 16% in the next rate decision on February 16, as the deceleration in the December inflation has given the CBR an elbow room.

Despite CBR’s actions, we feel cooling off inflation will not be straightforward as it is very likely that the country would continue to be squeezed by sanctions and the Ukraine war in 2024. Taking into account that the government spending remains high due to war-related military expenses, labor market is getting tighter day-by-day and the presidential elections are fast approaching in March 2024, these bring forth the risk of upward inflation pressures staying longer than expected.