Eurozone Outlook: A Different Inflation Story?

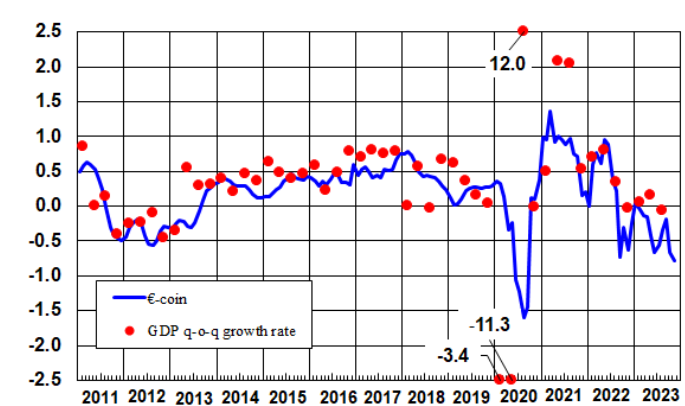

· Our GDP outlook remains well below consensus and ECB thinking! ECB policy is causing a marked tightening in financial conditions encompassing an increase in the cost of credit, alongside a fall in supply. The result is that the economy is already in a modest recession and with downside risks superimposed over the fragile recovery envisaged into 2024 and 2025.

· This precipitates our below consensus HICP outlook in which headline inflation is seen easing further below target even before H2 2024, with the core rate (that is clearly worrying the ECB) likely to follow amid an array of signs of already-softer underlying price pressures. This will surprise the ECB further and we forecast 75 bp of official rate cuts from Q2 2024 and more (100 bp) to follow in 2025.

· Given the growing likelihood of lower official rates, it is still the case that a systemic banking crisis is a low to modest risk, but increasing uncertainty and funding costs are making banks more risk adverse and unwilling to lend. Perhaps the greater risk is that interest rates cuts may be larger and/or faster than we have assumed as the monetary policy transmission mechanism proves even more powerful than we have estimated.

· Forecast changes: Compared to the last outlook, we have (yet again) retained the overall EZ growth outlook, with a gloomy picture for 2024, albeit this masking a fragile recovery through next year that may lead to a return to nothing better than trend-type growth in 2025. More notable is the revised and softer EZ HICP inflation outlook in which the target is undershot on a sustained basis into 2025. This will probably mean easing not only in 2024 but also through 2025.

Our Forecasts

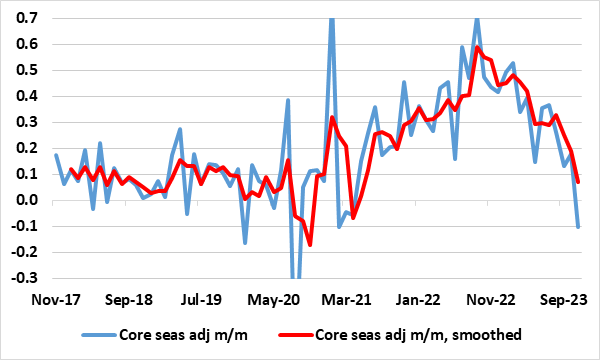

Risks to Our Views

Eurozone: Price Pressures Receding Clearly

That the EZ economy is probably in recession, albeit a modest one, misses the point as the zero growth of the last year would have been some two ppt weaker were it not for the slump in imports. This is important as it not only highlights the weakness in demand but poses an added downside risk for GDP growth into 2024 (and even 2025) as imports are likely to recover. This is only one of the reasons for our still gloomy outlook, albeit one hardly changed from three months ago. As for this year, we still see an anticipated rise of 0.3% but where 2024 GDP prospects see nothing more than this year’s rise being repeated. This below-consensus outlook does mask an anticipated recovery through 2024, albeit a fragile and feeble one and one that comes after a more pronounced but still relatively shallow recession in H2 this year. But we do envisage return to trend-type growth for 2025 as a result of the easing in monetary policy that we predict (see below) this inter-related with a fall back in inflation that will help boost (but far from fully repair) domestic spending power and a more neutral fiscal setting.

Current weakness is being flagged by business and consumer surveys and is very much also consistent with the unprecedented slump in private sector credit, all of which we think are a result of extensive ECB tightening that we think will continue to reverberate through the coming year at least. This continued domestic weakness encompasses weak consumer spending, which has still to return to pre-pandemic levels. Undermined by fragile confidence and higher interest rates, this softness could even see a drop into 2024, although the current reduction in spending power may dissipate into 2025 as inflation eases further and wages grow slightly in real terms. But other aspects of domestic demand will also restrain growth into and through 2024, not least a negative fiscal impulse as recent government support measures are reversed. In addition, construction spending may fall more notably and broadly on a geographic basis, something also hinted at by surveys. Moreover, the anticipated recovery in imports into 2024 will also mean that the return to a current account surplus that is likely this year (at around 1.5% of GDP) may actually be partly reversed in 2024.

Regardless there are risks which may mean a deeper and/or longer recession that could potentially extend into 2024. Much of these risks emanate from gauging how and when tighter financial conditions bite. Furthermore, mounting climate risks, where next year could see an escalation of the extreme weather conditions and unprecedented wildfires and floods seen this summer, also weigh on the outlook. There are upside risks too, most notably around households reducing what are still apparently elevated savings rates. But given the manner in which household bank deposits have fallen we estimate these savings are likely to be in illiquid assets.

Notably, this domestic weakness is yet to cause a reversal in what has hitherto been a solid labor market, with a healthy rise in the workforce (actually to both higher and faster levels than pre-COVID). But this is now occurring alongside a small rise in unemployment and where the latter may start to rise more perceptibly into 2024.

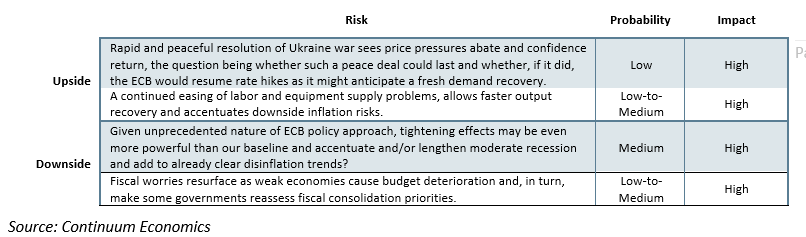

Figure 1: Surveys Corroborate a Broad Drop Supply Constraints

Source: European Commission, % balance

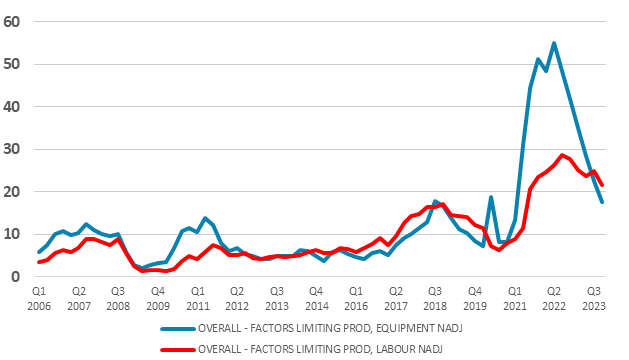

Given the unprecedented nature of the current tightening in financial conditions, it is very difficult to assess the likely full damage to demand and thus how depleted spending power may rein in pricing power. Furthermore, reflecting the weak economy, an easing supply pressures (Figure 1) and the already softening underlying inflation backdrop (Figure 2) we now envisage headline HICP moving below 2% by H2 next year, with the core not far behind, this being some six months earlier than we envisaged in the September Outlook. Admittedly, an added obvious note of caution is that, amid a central assumption that the Ukraine War continues to simmer over into, if not beyond 2024, energy supplies will continue to be compromised into next winter and will only materially improve in 2025. Even so, we envisage inflation staying just below the 2% target out to and through 2025.

Fiscally, it does seem as if budget consolidation is still on the cards for next year on account of the withdrawal of almost 75% of the energy and inflation compensatory measures from the last two years. As a result, the EZ budget gap may drop from a little above 3% of GDP in 2023 to a little under in 2024 and with upside risks due to the weaker and fragile economic outlook backdrop we envisage. But 2025 may see no further consolidation and with an ensuing deficit stuck at 2024 levels.

Figure 2: Adjusted Core HICP inflation Has Been Falling Clearly for Some Months

Source: ECB, % chg

ECB: A Different Kind of Price Shock?

It seems that the ECB is facing a clear undershoot of its near-term inflation projections. As suggested above, this to us reflects both demand and supply factors but where the former is very much being shaped by the impact of tighter financial conditions, reflecting what has been the fastest rise in official interest rates on record and to the highest level since the ECB was formed. However, also unprecedented is the fact that credit standards have been tightening alongside and not with a long lag as in previous cycles and that conventional hiking is also being buttressed in an unprecedented manner by the reduction in the ECB balance sheet. All of which underscores, if not accentuates, our long-standing premise that while the shock to the EZ economy from energy may have diminished it is being replaced by a monetary one in which financial conditions have tightened rapidly and broadly. The problem for the ECB is that the impact of its policy moves may only be halfway through, implying that tightening may (as we have argued) been too much, too fast.

With this in mind, we think that the pause (or ‘hold’) seen at the last two Council meeting will be extended as the Council assesses to what degree the transmission mechanism is indeed working faster and more broadly than in previous cycles and that credit supply is being restricted. Thus we were not surprised that the ECB this month pared back its economic growth projections further, albeit still to rates which we feel remain optimistic. Regardless, even with it seeing inflation back at target in H2 2025 and a notch below in 2026, the ECB is not overtly considering early easing even though it has maintained a bias that it will be data dependent. The ECB may also think the policy outlook is made more complicated as it brought forward the end of PEPP reinvestment as it tries to shrink its balance sheet further as well as the partly inter-related question of reducing excess liquidity.

However, these are side issues and we still think ECB rates may start to fall by Q2 next year, as ever worsening real economy prospects materialize, cause a further slide in core inflation and thus force the ECB to revisit its over-optimistic economic outlook – we see 75 bp of cumulative easing in 2024, an unchanged view from three months ago and for this easing cycle to continue into 2025 with a further 100 bp drop in rates.

Germany: Structural Headwinds Hitting Competitiveness?

Economic weakness is increasingly clear as GDP is almost certainly in a formal recession in H2 this year. But the scale and particularly the durability of the weakness is evident from the fact that we do not see the recent peak in the level of GDP (ie in Q2 2022) being re-attained until end-2024 and possibly later. Admittedly, we have pared back the expected GDP drop this year to -0.2%, but the 0.2 ppt upgrade (largely a result of statistical revisions) is largely offset by the downward revision we have made to 2024 prospects, where the below-consensus 0.2% rise is now seen spilling over into only a feeble 1% 2025 and where fiscal risks have grown (see below). This is below most (including our own) estimate of potential. But the latter may be waning as Germany’s economic malaise is far from purely a cyclical development. Indeed, in the last two Outlooks we have highlighted the structural factors increasingly affecting the economy, including vulnerable supply chains, relatively high energy costs and adverse demographics. These structural factors seem to be taking an understandable toll on German company competitiveness, which is now declining, according to recent Bundesbank estimates (Figure 3), even against fellow EU countries.

All of which not only helps explain why the German economy is now in recession, but why it is likely to remain weak out to 2025 and perhaps beyond. Notably, the current account is actually improving and may be back over 6% of GDP next year, as the weakness in exports is being offset by the astonishing fall in goods imports (down almost 6% in the last year), without which the recession would be deeper. This reflects weakness in domestic demand as ECB policy is biting ever more clearly. We see some respite as inflation has peaked and we see it falling further and actually falling below 2% by mid-2024, albeit with volatility thereafter. Within this, consumer spending is likely to fall too this year but where domestic demand weakness is likely to see the biggest damage emanating from the slumping construction sector. Indeed, building activity is falling increasingly and broadly, albeit led lower by residential construction work, and where surveys very much suggest that difficult conditions will persist for at least the coming year.

Figure 3: German Competitiveness on the Decline

Source: Bundesbank, Inverted scale so that a fall in values implies improved price competitiveness

Regardless, the fiscal picture is in a state of flux given the recent German Constitutional Court ruling, which questions the validity of so-called off-balance sheet budget financing. The ruling very much narrows fiscal room the coalition government has relied upon to sidestep German fiscal rules (ie the debt brake). The debt brake could be suspended again but this would divide further and already split coalition with effective spending cuts of some 0.5% of GDP on the cards for next year instead. Regardless, the budget deficit is likely to fall again next year from just under 3% of GDP in 2023 towards 2.5% as the volume of temporary support measures continues to decrease. However, projected funds particularly in terms of longer-term initiatives on climate policy and defence is rising sharply and this may be accompanied by state and local government budgets remaining somewhat expansionary in the year ahead.

France: Reduced Resilience

As we suggested three months ago, the relative economic resilience seen in H1 has dissipated with GDP dropping last quarter and where business survey data suggest even clearer weakness ahead: the INSEE-compiled business climate has dipped even further below its long-term average. We think this spells conventional recession in H2 this year, which will create an adverse carryover for 2024, this limiting average growth next year to 0.6%, slightly below consensus thinking but the same view of three months ago. Admittedly, this may disguise a somewhat better underlying rate for later in 2024 that will help boost 2025 growth to a near-trend 1.3%. But this comes with downside risks as the economy tries to weather the rise in interest rates and the economic uncertainty that has clearly perturbed the French consumer and now the business community. Notably, while household purchasing power has been preserved thanks to government support measures and a favorable labor market, private consumption will been weak. This does provide scope for spending to pick-up in 2024 but we think that much of what are seen as still-high savings are locked up in illiquid assets and with wealthier households with a lower spending bias, so the boost will be modest and that consumer spending will grow no more in 2024 than overall GDP, this also the case for 2025. Investment from both households and corporations is projected to recover progressively into 2024 but only after fresh drops in coming quarters. Meanwhile, over the forecast horizon, net exports are set to have a minimal and possibly negative contribution to growth. Exports growth, which traditionally relies on a few specialized sectors such as aeronautics and other transport equipment, is expected to be offset by rising imports mirroring the recovery of household consumption. Hence, a still clear current account deficit will persist into next year, albeit staying at around half the 2% 2022 outcome.

However, there are upside risks to activity as inflation has fallen and on a broad basis, a result of which is that we have lowered the projection slightly, so that we now envisage CPI inflation at 1.8% next year, an outcome we see repeated in 2025. This is backed up by business surveys very much suggesting that both actual and expected price and cost pressures are back to pre-pandemic levels generally (Figure 4), something that suggests that the recent downside CPI surprises are no statistical quirk. All of which, however, reflects the growing impact of the marked recent damage to spending power alongside tighter financial conditions. These are which are likely to lead to a further reining in pricing power and arise in the jobless rate back towards above 7.5% % into 2024 and where companies are likely to see profit margins fall.

Figure 4: Price and Cost Pressures back to ‘Normal’?

Source: INSEE, Balances of opinion - * average since 1991

Regardless, fiscal risks remain. Especially given political inertia, fiscal policy is likely to shift to only moderate consolidation in 2024, so that the budget deficit may stay around the circa-5% of GDP outcome seen last year. With a budget deficit of just under 5% of GDP in 2023 and with the medium-term aspiration of 3% looking challenging, the likelihood is that the government debt ratio rises further in the coming two years. Indeed, even the European Commission formally envisage this and it has what we regard as very optimistic economic assumptions while fiscal worries, reflecting slow growth, and a sustained policy impasse exacerbated by social unrest, has already led to the country’s debt rating being cut this summer. Fiscal worries could easily resurface!

Italy: Fiscal Side Still in Focus

While still moving further away from what look like ever-more optimistic official growth forecasts, it is now the case that consensus thinking has moved down largely to mirror our more long-standing relative gloom about the Italian real economy, at least for 2024. Partly this reflects the fact economic growth has already stalled and surveys are weaker (Figure 5). This only partly due to the phasing out this year of the extraordinary incentives for building improvements during the pandemic. But negative economic signs have continued into this quarter, enough to flag a formal recession and enough to depress growth next year even a little more than we envisaged three months ago. Indeed, we still see 2024 GDP growth of 0.4%, entailing a second successive 0.2 ppt downward revision. But we are also wary about the extent of any pick-up next year may bring, with a fragile and feeble recovery likely to mean that 2025 sees GDP up around only 0.8%, this being very much below consensus thinking.

Figure 5: Survey data Highlights Downside Growth Risks

Source: Bank of Italy and ISTAT

Thus the real activity picture is both a reflection of and a cause of the increasingly soft inflation backdrop and outlook. Indeed, we have pared back our 2024 CPI inflation projection by 0.2 ppt to 1.8% and now see inflation even lower at 1.4% in 2025. While both are also below consensus thinking, neither looks too outlandish given that current inflation has dropped below 1%. Very much this has been driven by relatively soft wage pressures despite a tight labor market that may not see much of the recent drop in the jobless rate reverse into 2024. Indeed, demand for Italian work permits next year has far outstripped a quota for non-EU workers set by the government, highlighting a labour shortage that has alarmed business. But this is more likely to continue restraining output than ferment a wage-price spiral and is part of a long-standing adverse demographic trend. Indeed, Italy’s national statistical agency estimate that the working age population will shrink by 6mn by 2040, this accounting for much of what we and many other regard as a potential growth rate into 2025 of well under 1%.

Regardless, the soft inflation picture is not likely to foster much recovery in what has recently been falling real disposable income. A very gradual increase in nominal wages (contractual hourly earnings rising by around 2% next year), together with less positive employment conditions, will keep private consumption growing by less than GDP into 2024, with activity undermined further by the planned expiry of all temporary income-support measures. Capital spending is now contracting and may pick up only moderately in 2024, as the fall in housing construction is offset by RRF-supported increases in investment in infrastructure and equipment. Net exports may provide a little support to growth in 2024, following a likely positive contribution in 2023, but where the return to a current account surplus this year will at best be consolidated next year at just under 1% of GDP.

But of course higher interest rates are the main negative, enough to have triggered overt ECB criticism from a government where policy priorities are in a state of flux given the splits within the coalition. But to date PM Meloni has pursued a fiscally prudent stance. Next year, the budget deficit is forecast to decrease to 4.4% of GDP, following the phase out of energy-related measures with an overall deficit-increasing impact of over 0.5% of GDP. The headline deficit is expected to decrease marginally in 2025 due to the still soft growth picture and a further rise in interest payments. These deficit projections are higher than government thinking and may not lead to any, let alone a sustained, drop in the debt ratio which may actually edge a little further above 140% of GDP in to 2025. But the outlook has not alarmed markets or ratings agencies unduly. Indeed, the country’s sovereign rating outlook was upgrades last month to stable, this decision as much a reflection of the more positive outlook for the banking sector. Regardless fiscal risks are clear in Italy, which may resurface should Italy suffer a major recession and/or if the ECB decided on an aggressive QT option for APP that included outright sales as well as not reinvesting redemptions.

Spain: Domestic Demand Resilience

Spanish Prime Minister Pedro Sánchez has, despite failing to win the snap election he instigated last July, managed to form a minority coalition administration. However, it will need to gain the persistent support of a variety of far-left and separatist parties in Spain’s very fractured and angered parliament to pass any laws. The first questions is whether this may have a fiscal cost as Sanchez is likely to have to buy support, this having budget consequences, enough to mean that the budget gap may start to rise into 2025, as next year’s deficit will be pulled back to just over 3% of GDP by the phasing out of measures to mitigate high energy prices. Instead, weaker growth will take a toll with the clear risk that the debt to GDP ratio may fall no further after next year and even rise afresh into 2025. The second question is how long such a fragile coalition can last, albeit with it notable that the five elections in the last eight years do not seem to have hit consumer or industrial confidence.

Regardless, the growth slowdown we anticipated three (and six) months ago is nevertheless very much evident in both official and survey data. While GDP may grow by a largely unrevised 2.3% this year, this backdrop actually masks a marked slowing with q/q growth rates already having halved so far this year and the near-zero we envisage for this quarter implying a further halving in momentum. This is something evident in business surveys too, all of which are creating a far less favorable base for growth in 2024 than was the case this time last year. It is against this backdrop that the unrevised 2024 projection for GDP growth of just 1%, may even have downside risks attached as it implicitly builds on some recovery in real activity into and through 2024. But while the recovery may pick up into 2025, at some 1.4%, it may be nothing more than a return to potential, albeit still a further year in which Spain tops the Big 4 EZ growth ladder. Even so, these below consensus projections (around half of the official forecast from the Spanish government) reflects an array of factors, not least the fading impetus of the bounce in tourism so far this year. There is also the impact of both weaker global (and especially EZ) demand and tighter financing conditions both likely to trigger softer labor market dynamics into and through 2024. This will help further the drop in inflation already very evident. We see CPI inflation averaging 2% in 2024 and staying there in 2025. Notably and in contrast to the weaker overall 2024 picture, an inflation-induced improved households’ purchasing power may support consumption, but only to an anemic 1.3%, a pace well down on this year. However, lower leverage of the private sector achieved in recent years and the further implementation of the RRP is expected to continue supporting business investment growth into 2024 and also through 2025. But construction is now showing signs of buckling and may even contract through 2024 as real estate activity has already succumbed to high interest rates

Tourism has also helped the current account balance, meaning a larger surplus of around 2% of GDP may be on the cards this year, despite higher nominal energy imports but with the recovery in consumer spending acting to reduce the surplus by a cumulative one ppt in both 2024 and 2025. As for inflation, this is set to fall towards if not through 2% by mid-2024, though base effects may create volatility through next year. Although it may soften, an unemployment rate now under 13% is likely to remain at this cycle low through next year, this all despite what seems to be structural recovery in labor supply. However, and perhaps a result of the growth to record-levels in the labor supply, there has been little pick-up in wage growth and this will help restrain activity into next year as may a continued restraint from construction that is already seeing clear falls in house prices occurring.