ECB Review: Inflation Outlook Lowered?

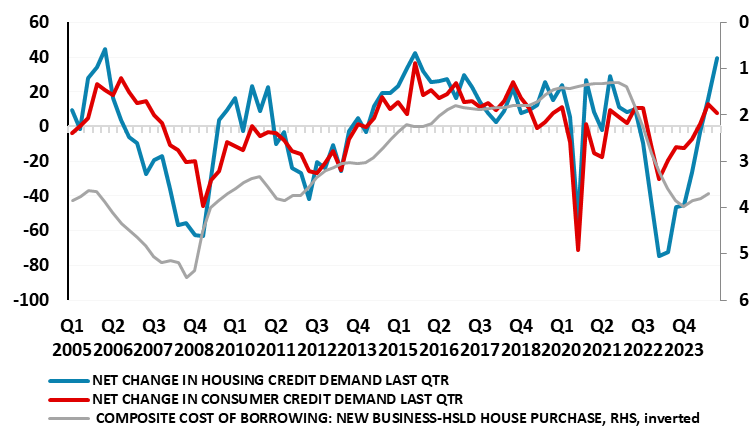

The latest 25 bp rate cut from the ECB was obviously not anticipated at the previous meeting, although perhaps the Council was more open to such a move than the press conference then suggested. But it is clear a reassessment is occurring, not just of the inflation outlook but the real economy too. Indeed, the ECB has brought forward inflation hitting target durably now to be in the course of next year as opposed to late 2025 as suggested in the September projections. Presumably, this revised outlook is based on market interest rate thinking. If so, it endorses the fall in the deposit rate to around 2% that is now being discounted. Regardless, the ECB is clear that it remains data dependent and is not pre committing but with the Council saying the disinflation process is well on track, we continue to see the deposit rate falling to around 2.25% by next summer, a rate that would be around neutral. Without the potential boost of the recent build in household savings and the indications that rate cuts have already stared to boost credit demand (Figure 1) we would be arguing for deeper/faster cuts – the risk of the latter is still clear though!.

Figure 1: Household Loan Demand Recovering Strongly?

Source: ECB, changes in demand for loans to households and cost of borrowing for households

The ECB has cut rates at a successive Council meeting for the first time in this easing cycle dating back to June, with the deposit rate now down to 3.25%. To date the ECB has allowed the impression that it would ease only every other meeting, ie once a quarter, partly to give it access to what it sees as key labor cost numbers. But yet another downside inflation surprise, alongside business survey data highlighting both fresh stagnation risks and much reduced cost pressures, have changed the ECB mindset and very much point to another cut in December. Given that energy base effects may push y/y headline inflation back above target (in contrast to what adjusted monthly data suggest), at this juncture we think the ECB may revert back to a slower easing pace in 2025. But amid signs that downside growth risks may be materializing, the risk from hereon of easing at every meeting into mid-2025 is a growing. After all, that is how policy was tightened amid the marked jump in inflation, but where the subsequent fall has actually been faster.

But these risks are not all to the downside; the ECB did rightly point to some brighter signs from its latest Bank Lending Survey. While still suggesting banks remain cautious about lending, the data suggested a clear improvement in the demand for loans (Figure 1) and very much reflecting an increasing perception that interest rates have started to fall and have further to go. On the consumer side, with households having built hefty savings afresh of late in reaction to higher interest rates, more signs of easing to come may start to unlock those savings and provide a much needed boost to demand – just as policy easing is supposed to do! Importantly, the full impact of recent tightening has yet to feed trough fully, but this does suggest that even the modest cuts to date and the prospect of more to come has started to have a tangible effect. Thus, risks to the economy continue to be biased to the downside, but some upside risks may now be emerging too! Without these emerging upside risks we may very have considered revising our policy outlook lower

A Reassessment Dating Back to September

Clearly, a change of tune from the ECB has been building; as the official account confirms, the ECB September Council meeting seemed not as dismissive of further and earlier rate cut as perhaps President Lagarde suggested in the her press conference last month. Indeed, the minutes (account) did suggest some discontent with both the growth projections and the extent of emerging downside risks that seems to have accumulated if not materialized. Furthermore, the minutes suggest more discussion took place about a further and earlier possible rate cut, specifically citing ‘optionality should be retained as regards the speed of adjustment’ which reinforced the value of a meeting-by-meeting and data-dependent approach that maintained two-way optionality and flexibility for future rate decisions. We would argue that while the inflation news has been the most headline grabbing, other issues are increasingly important, not least real economy matters.

Gauging Restriction

In conclusion, after the cumulative 100 bp moves now seen by year-end, we see 75bp of further easing through 2025 (still quarterly), with the deposit rate then nearing 2% and thus more in line with a perceived neutral setting. This is hardly moving into anything like a clear expansionary stance, let alone the added constraints stemming from the ECB QT program and banks still tight lending standards.

To us, the risk is of faster rather than more significant easing than our central case envisages; the case for additional easing beyond 125 bp would necessitate a protracted period of weakness. In this regard, we have downgraded the current quarter GDP picture from a rise of 0.1% to a same-sized fall, on the back of the downturn in services. At this juncture we think this is a blip rather than a fresh and weaker trend and are adhering to our rate policy outlook that we have had in place all this year. But we are watching our radar screens acutely for more adverse signs.