Russia’s Inflation Continued to Surge in May: 8.3% YoY

Bottom Line: According to Russian Federal Statistics Service data released on June 14, inflation surged to 8.3% YoY in May after hitting 7.8% YoY in April, the highest since February 2023, due to high military spending, currency weakening, tight labour market, and fiscal policy igniting domestic demand. Additionally, the new set of sanctions by the U.S. Treasury Department targeting the country’s financial system on June 13, which prompted the Moscow exchange to hold trading of dollars and euros, will likely increase the cost of doing business and further stoke inflation. We now foresee Central bank of Russia (CBR) will likely hike the rate in Q3 to 17% due to surge in inflation, increase in cost of borrowing and new set of sanctions.

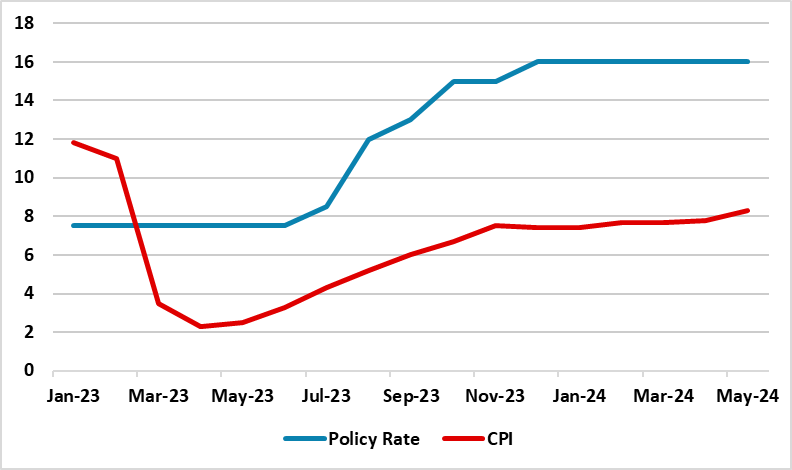

Figure 1: CPI (YoY, % Change) and Policy Rate (%), January 2023 – May 2024

Source: Continuum Economics

According to Rosstat figures, the inflation rate hit 8.3% YoY in May. The consumer price index (CPI) shot up by 0.7% on a monthly basis from 0.5% in April, with services seeing the highest rise at 1.5% MoM. We think the inflationary pressures remain strong basically due high military spending, strong fiscal policy, lagged feedthrough of the weak Ruble (RUB) and tight labor market.

Inflation is also ignited by the rise in food prices, and cold weather in May creating further risk for 2024 harvest. The inflation projections stay stronger than expected particularly due to a weaker RUB, demand-cost pressures stemming from high demand and lending. Taking into account restrictive monetary policy partly suppresses prices with lagged impacts, we feel cooling off inflation will not be straightforward as it is likely that the inflation would remain higher than CBR’s expectations in H2 2024 as we envisage annual average inflation to record 6.9% in 2024.

In addition to the war in Ukraine overheating the economy, the new set of sanctions by the U.S. Treasury Department targeting the country’s financial system on June 13, has prompted the Moscow exchange to hold trading of dollars and euros, which would likely ignite the cost of doing business and further stoke inflation. (Note: According to Russian newspaper Kommersant, some Russian banks and exchange offices raised rates as high as 200 rubles to the dollar while the rate set on the Moscow Exchange was just under 90 rubles to the dollar on June 12. The CBR said it would set daily dollar and euro exchange rates based on aggregated data from commercial bank purchases and sales, and fixed official rate at 88.2 rubles to the dollar on June 13).

As mentioned, May’s 8.3% YoY inflation remained far above the CBR's 2024 forecast range of 4% - 4.5%, and CBR’s medium term target of 4%. CBR Governor Elvira stated last week that there is a possibility of a significant rate hike in July if inflationary pressures don’t start to ease.

Despite CBR held the key rate constant at 16% in H1, we now foresee CBR likely hike the rate in Q3 to 17% due to surge in inflation, increase in cost of borrowing, and negative impacts of new sanctions, and the Bank will likely not start cutting the rates until the end of 2024. The risks to the outlook remain strong as the fiscal policy making a big contribution to domestic demand coupled with high military spending due to ongoing war in Ukraine. The risk is even higher as a larger Russian offensive operation started in Kharkiv and Donetsk which would likely pump up the military spending.