China: Weak CPI and M2 Trends

China disinflation process is clear in the June CPI data, with excess production and soft consumer spending producing a lower than expected outcome. Combined with weak M2 money growth, parts of China economy remain weak and point to a softening of GDP growth in H2. However, policy action will likely remain targeted.

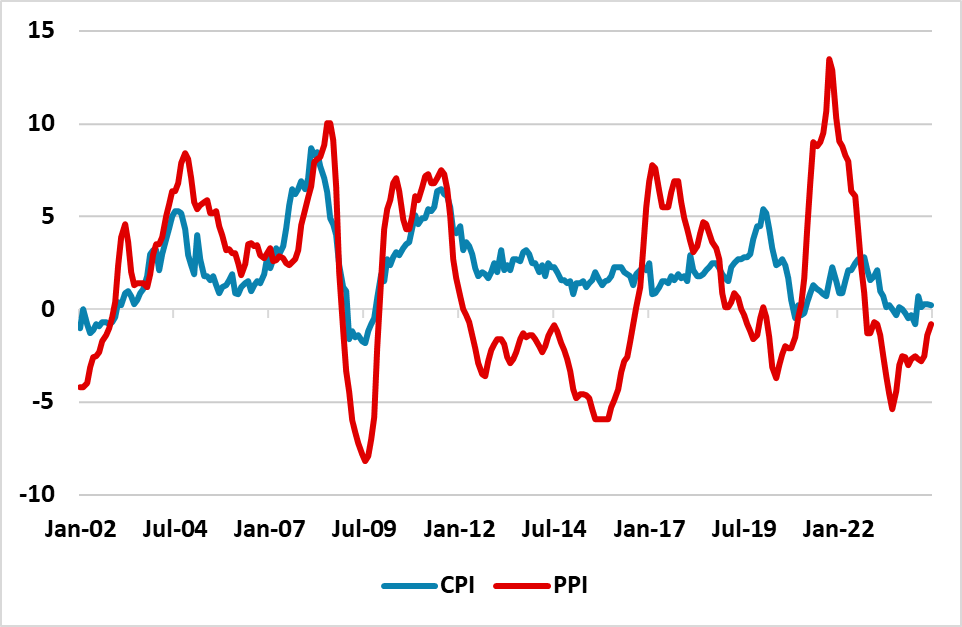

Figure 1: China CPI and PPI (Yr/Yr %)

Source Datastream/Continuum Economics

China June CPI data came in weaker than expected at +0.2% Yr/Yr versus +0.4% expected. The breakdown of the data points to ongoing disinflationary pressures, with headline down 0.2% on the month and a monthly fall in core inflation – Yr/Yr core remains at +0.6%. The 618 shopping festival saw downward price pressures, with weakness in consumer goods and cars falling -5.3% Yr/Yr.

This all reflects excess domestic production chasing weak consumer demand and the end result being persistent disinflationary pressures. Though PPI is less negative Yr/Yr, this process will likely remain in place in the remainder of 2024. Consumer demand is softer, as the post COVID pent up demand in catering is losing momentum. Meanwhile, sour sentiment towards housing, plus slow private sector hiring, is denting consumer spending in household goods/furniture/cars.

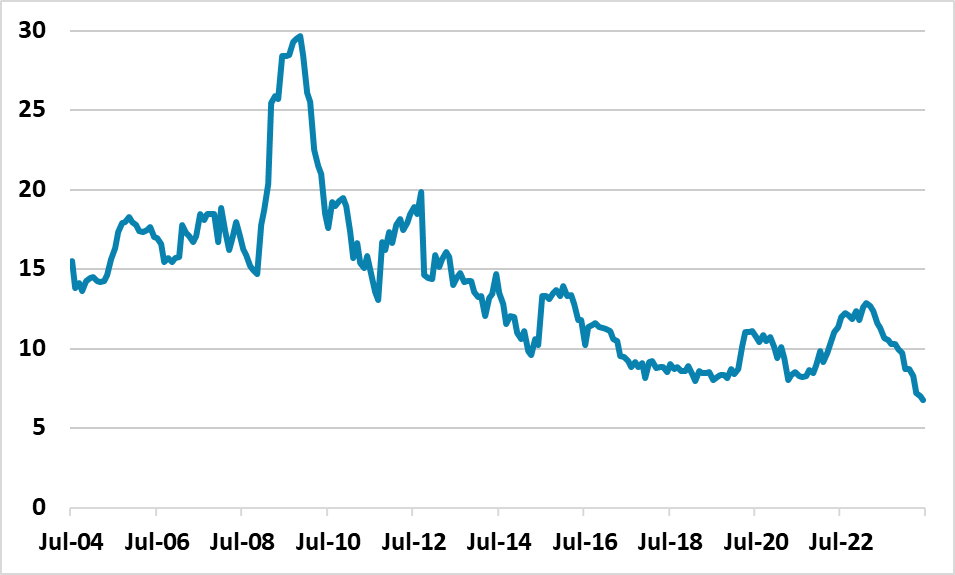

Additionally, weak demand for loans from households is also a drag for consumption and is one of the forces behind the ongoing slowing in M2 growth, which at 6.8% is now very low by China’s standards (Figure 2).

Figure 2: China M2 (Yr/Yr %)

Source Datastream/Continuum Economics

This all underlines the need for extra stimulus and the focus is on the 3 plenum meeting next week for policy signals (here). However, actual actions will likely remain targeted. 2024 GDP looks to be on target for 5% and it is too early for short-term action for 2025 growth. China total debt/GDP is above U.S./EZ and the authorities do not want a Japan style debt recession from excessive borrowing. This limits fiscal action. Meanwhile, monetary policy actions is restrained by the Yuan and we only see a MTF cut in October – after the 1 Fed cut. An RRR cut is feasible July/August, but this is targeted. Meanwhile, the PBOC is getting ready to sell government bonds to curtail the flight to safety that has pushed 10yr bond yields to low levels. While this is not QT, it does show that the authorities are trying to control too much at the expense of boosting growth.