India CPI Review: CPI at Eight-Year Low: Disinflation Deepens, RBI Seen Easing in December

India’s retail inflation eased to 1.54% in September — the lowest in nearly eight years — driven by steep declines in food and fuel prices. With CPI now well below the RBI’s 2–6% tolerance band and GST cuts reinforcing disinflation, a December rate cut looks increasingly likely. Core inflation remains contained despite higher gold and housing costs, keeping the overall inflation trajectory comfortably benign.

India’s retail inflation fell to an eight-year low of 1.54% in September, as falling food and fuel prices combined with a favourable base to deliver the weakest price growth since June 2017. The data, released by the National Statistics Office (NSO), confirms a deepening disinflationary trend and bolsters expectations that the Reserve Bank of India (RBI) could cut rates again in December, in our view.

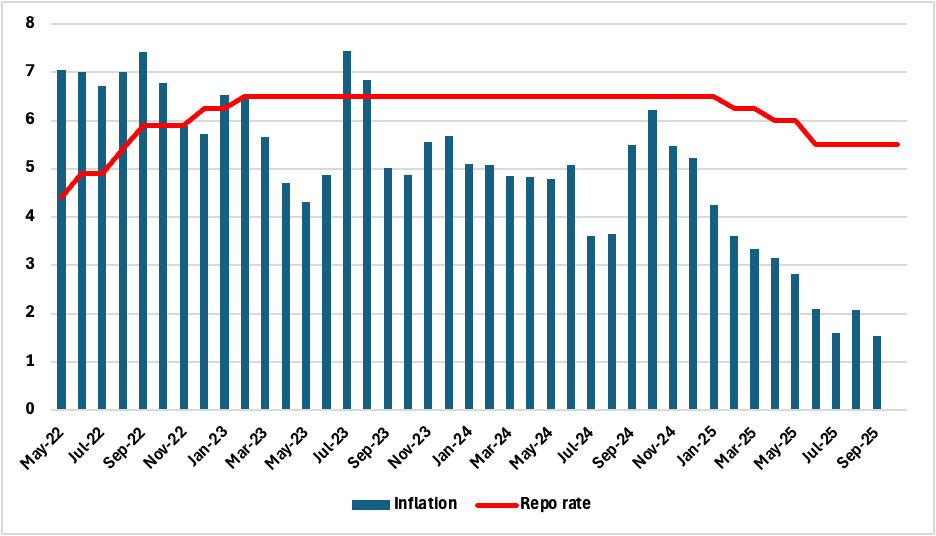

Figure 1: India Consumer Price Inflation and Policy Rate (%)

Source: Continuum Economics, MOSPI, RBI

The latest reading marks the second time in three months that inflation has slipped below the RBI’s lower tolerance limit of 2%, underscoring the strength of the disinflation cycle. For Q2 FY26, inflation averaged 1.7%, marginally below the central bank’s projection of 1.8%. The RBI, which has already lowered its FY26 inflation forecast to 2.6% from 3.1% in August, may now face renewed pressure to ease policy further to support growth.

Food inflation remained in negative territory for the fourth consecutive month, with the Consumer Food Price Index contracting 2.28% yr/yr—a deeper deflation than August’s 0.64%. The drop was led by double-digit declines in the prices of vegetables, pulses, cereals, and edible oils, aided by a favourable base effect and strong monsoon-linked supply. We expect food prices to stay subdued, though localized flooding and delayed monsoon withdrawal could still pose risks to kharif crops.

Core inflation, by contrast, inched up to 4.43%, driven primarily by rising gold and housing costs. Excluding precious metals, however, underlying inflation pressures remain contained at around 3%, suggesting that broader demand-side pressures are still muted.

The disinflationary impulse is likely to strengthen further in the near term. October CPI is also expected near 1.3%, potentially the lowest in the current CPI series, helped by continued food deflation and the impact of recent GST rate cuts on over 380 consumer goods. The tax overhaul is estimated to shave 70–90 basis points off headline CPI annually, assuming full pass-through to consumers.

Rural inflation stood at 1.07%, while urban inflation measured 2.04%, both marking historic lows. With inflation firmly below target and growth momentum holding, the RBI appears well-positioned to extend its easing cycle. Markets are increasingly pricing in a 25-basis-point cut in December, provided the previous rounds of monetary and fiscal easing continue to filter through. India’s disinflation narrative has now become one of the most striking among major economies—anchored by soft commodity prices, prudent supply management, and structural tax reforms. The challenge for policymakers will be to maintain this balance of low inflation and steady growth as global uncertainties—from US tariffs to oil volatility—continue to cloud the external horizon.