ECB December Council Meeting Account Review: The ‘Last Mile’ Appears to Have Shortened Somewhat?

As the account of the December 11-12 Council meeting noted, a fourth 25 bp discount rate cut was agreed but there appeared to be a minority wanting a 50 bp move. But this account also shows some confusion as to just what the advertised change in forward guidance (in which the ECB accepts that on-target inflation is likely to be durable enough so that it no longer has to pursue policy restriction) actually entailed. Amid what has been faster easing, the ECB must be considering what neutral policy but these minutes show little discussion on this took place – at least at that juncture. But it was clear that a friendlier inflation backdrop and outlook was widely seen so that previous worries from policy hawks about a difficult last mile in curbing inflation looked misplaced. Indeed, it was noted that the on-target 2027 HICP inflation forecast would actually have seen a clear undershoot but for what may be pessimistic assumptiona on emissions trading costs.

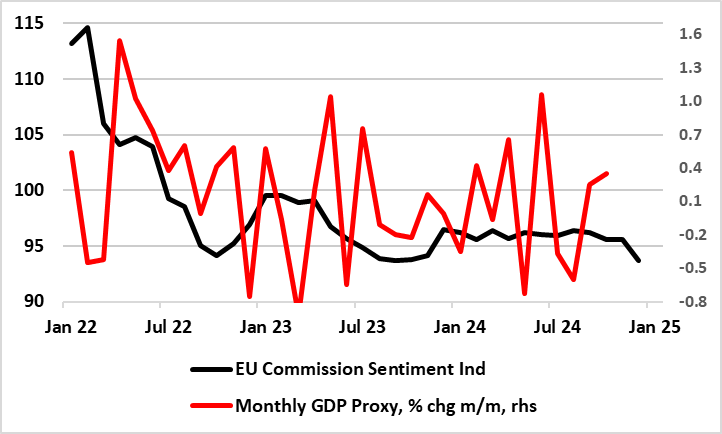

Figure 1: Downside Risks for Activity Still Building

Source, Eurostat, CE - GDP proxy is weighted avg of monthly industrial, services and construction data

Larger Move Clearly Debated

Some members noted that a case could be made for a 50 basis point rate cut at the December meeting and would have favoured more consideration being given to the possibility of such a larger cut. These members emphasised the deterioration in the euro area economic outlook over successive projection exercises and stressed that the risks to growth – amid many global and domestic political uncertainties – were tilted to the downside. They argued that a larger rate cut would provide insurance against downside risks to growth and a possible undershoot of the inflation the target. This suggested that monetary policy might become too restrictive.

But despite the above discussions, it was instead decided that a 50 basis point cut could be perceived as the ECB having a more negative view of the state of the economy than was actually the case, but the 25 bp actual cut was only widely agreed, not universally so. In addition, it was also pointed out that a significant part of the economic slowdown was likely attributable to structural factors that monetary policy could not address and which needed to be addressed by governments.

What Kind of Data-Dependency?

Members also argued in favour of maintaining a data-dependent and meeting-by-meeting approach to determining the appropriate level of policy rates, suggesting (somewhat puzzlingly) that data dependency did not mean only looking backwards at past data but also forwards at the medium-term outlook.

As for inflation, it was noted that indicators of underlying inflation with the highest predictive power for headline inflation were suggesting a sustained return of inflation to target. In particular, the Persistent and Common Component of Inflation (PCCI) remained at around 2.0%. Moreover, a moderation in services inflation dynamics was evident in the three-month-on-three-month seasonally adjusted services inflation rate which had fallen to 2.6% in November, from 3.4% in October, indicating a further softening in momentum – we suggest it fell further in December to around 2.4%! Furthermore, while updated projections saw on-target inflation for 2027, this was only due to an assumed expanded European Union Emissions Trading System. If this were not included, inflation would drop below target in 2027.

Downside Risks to Both Growth and Inflation?

But downside growth risks were clear and we suggest they persist, it not have intensified (Figure 1). The account noted business and consumer confidence remained subdued in an environment of high uncertainty, which was leading to strong household savings and to firms holding back investment. Monthly indicators suggested a deceleration in private consumption growth and a continued contraction in both housing and business investment. The export sector also appeared to have weakened further. Indeed, the point was made that even after the downward revision to GDP growth over the projection horizon, the baseline probably remained too optimistic – a view we highlighted at the time and adhere to. In particular, the weakest spot remained business investment, which was not yet showing any signs of a turnaround. As a result, and, on balance, the Council agreed that the EZ economy remained fragile and that the rebound in GDP growth in the third quarter, following a negative surprise in the second quarter, could be temporary – a view that we share!