UK: More BOE Easing and Politics/Fiscal Policy

• The BOE will likely deliver more rate cuts than discounted by money markets and we forecast three 25bps cuts in 2026 to 3.00%. The UK labor market is weak enough to prompt further wage inflation and underlying inflation slowdown, while fiscal policy is tightening multi-year.

• This can see lower 2yr gilt yields. However, the UK political situation is fractured and fluid, which could mean a weakening of Labour fiscal rules in 2026 or 2027 and this requires a risk premium at the long-end and a steeper yield curve. In equities, the stagflation fears should ebb and this can see UK equities seeing 2.5-5% outperformance versus the U.S. in 2026. EURGBP can head for 0.90 in this environment, as the BOE cuts more than the ECB.

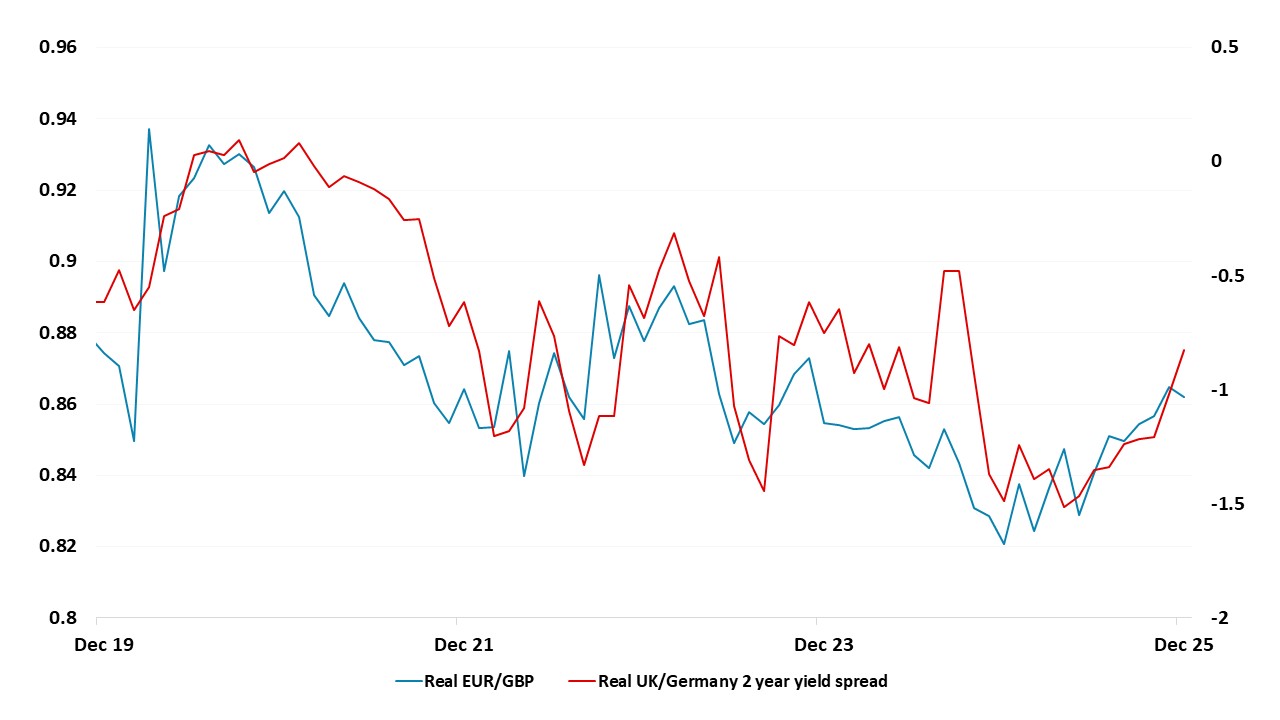

Figure 1: BOE-Fed Policy Rate and 2yr UK-U.S. Government Bond Yield (%)

Source: Continuum Economics

Source: Continuum Economics

UK markets (Figure 1) have started 2026 hoping for more BOE Rate cuts and narrowing spreads versus the U.S. What are the prospects re BOE and fiscal policy?

• BOE: Money Market v Economists. Money market futures discount the next 25bps step at the June MPC meeting, with a 65% probability of a further 25bps by the December meeting. This reflects the splits on the MPC and four of the nine members that have been resistant to recent rate cuts. However, the median for economists is two 25bps cuts in 2026 and a minority looking for three of four cuts – we look for three cuts to 3.00% (See Western Europe Outlook (here)). We feel that the hawks are too backward looking, with a weak UK jobs market likely to led to further slowing in wage growth and underlying inflation throughout 2026.

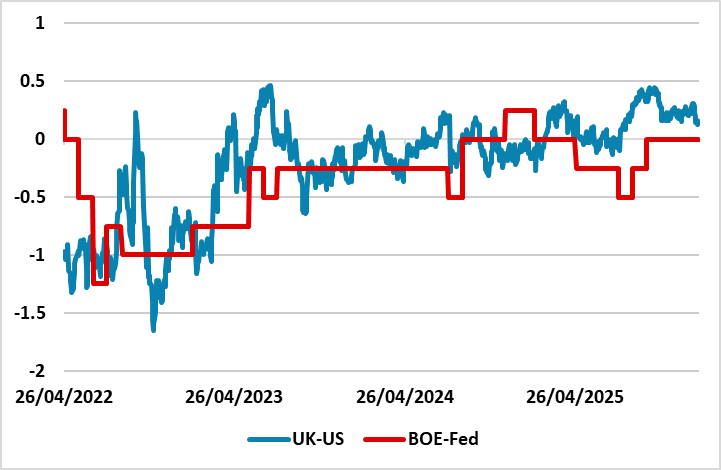

• Latest Credit Conditions Survey. We have also argued that financial and lending conditions are tighter than just looking at the policy rate. The latest January Credit Conditions survey shows mixed signals on credit supply but of great concern is sluggish credit demand from households (Figure 2) and corporates. Refinancing means that the economy is still adversely impacted relative to the ultra-low interest rates between 2008-21. This builds the argument that the BOE needs to do more easing to restimulate the economy, especially given multi-year fiscal tightening that has been hurting business and consumer sentiment.

Figure 2: Demand for secured lending for house purchases and remortgaging

• February 5 for hints on timing. The February 5 MPC meeting is unlikely to see another cut, but will add to guidance on future rate prospects. We see the four hawks eventually softening their view and the five cutters becoming more worried, which will combine to deliver three 25bps cut from the BOE this year. March is possible, but the April 30 meeting is key as the monetary policy report is also delivered. We will also be close to the drop in headline CPI in April as base effects drop out. Timing does depend on when the hawks become more forward looking and change view, which could be gradual or abrupt. However, we are confident that this will happen and deliver three 25bps cuts in 2026. We can see 2yr yields coming down to 3.25% into H2 2026, which is the most attractive short-end of the big DM countries.

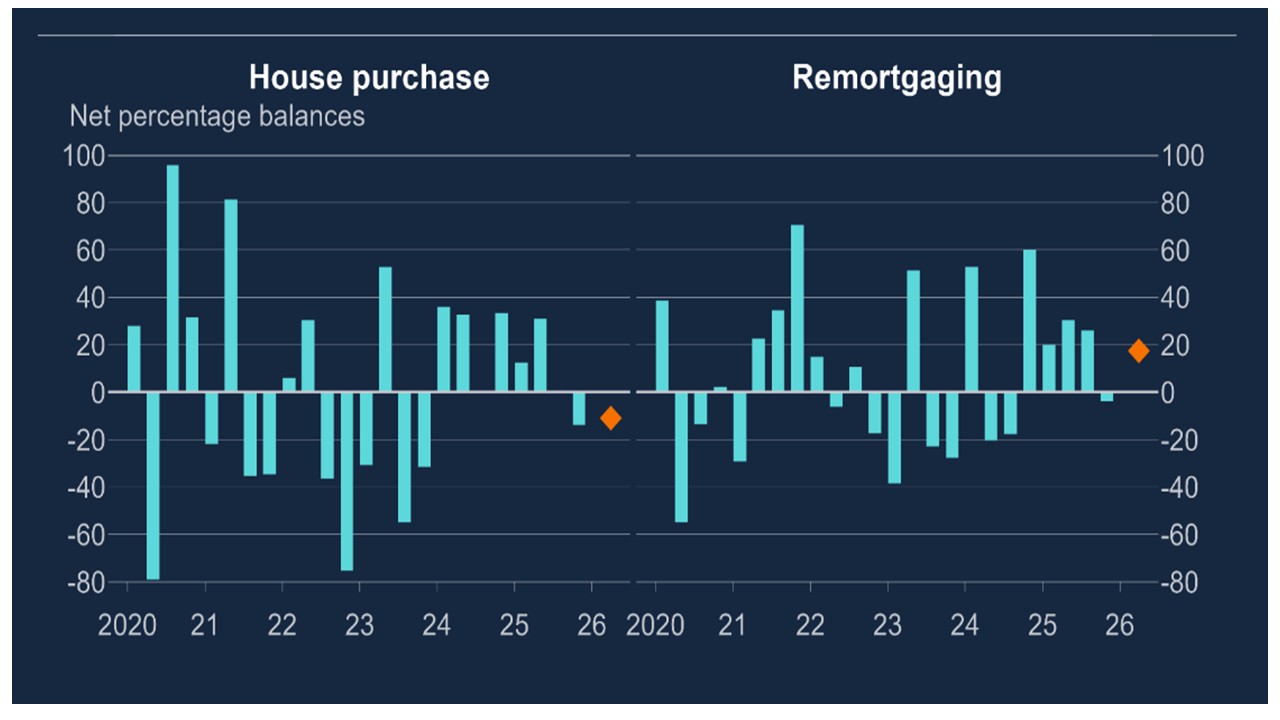

Figure 3: Primary Deficit/Surplus to GDP (%) Source: IMF October Fiscal Monitor

Source: IMF October Fiscal Monitor

UK financial markets have also attracted some interest for the ongoing fiscal tightening process. Though Figure 4 does not include the November budget back year additional fiscal tightening, the UK is already swinging towards a primary surplus. This is also in sharp contrast to the U.S. (here), which is seeing some major portfolio managers tilting towards overweight gilts versus U.S. Treasuries. Based purely on economics, plus the BOE rate trajectory, an argument could be built for still lower 10yr yields. However, supply and politics are two restraints and we see 10yr Gilt yields at 4.40% by end 2026. Supply in the UK is a function of the budget deficit, but also extra financing items (student loans/BOE losses) and £70bln of BOE QT. We do see the BOE slowing QT to £50bln from September 2026, but this contrasts to the U.S. where the Fed are now net buyers.

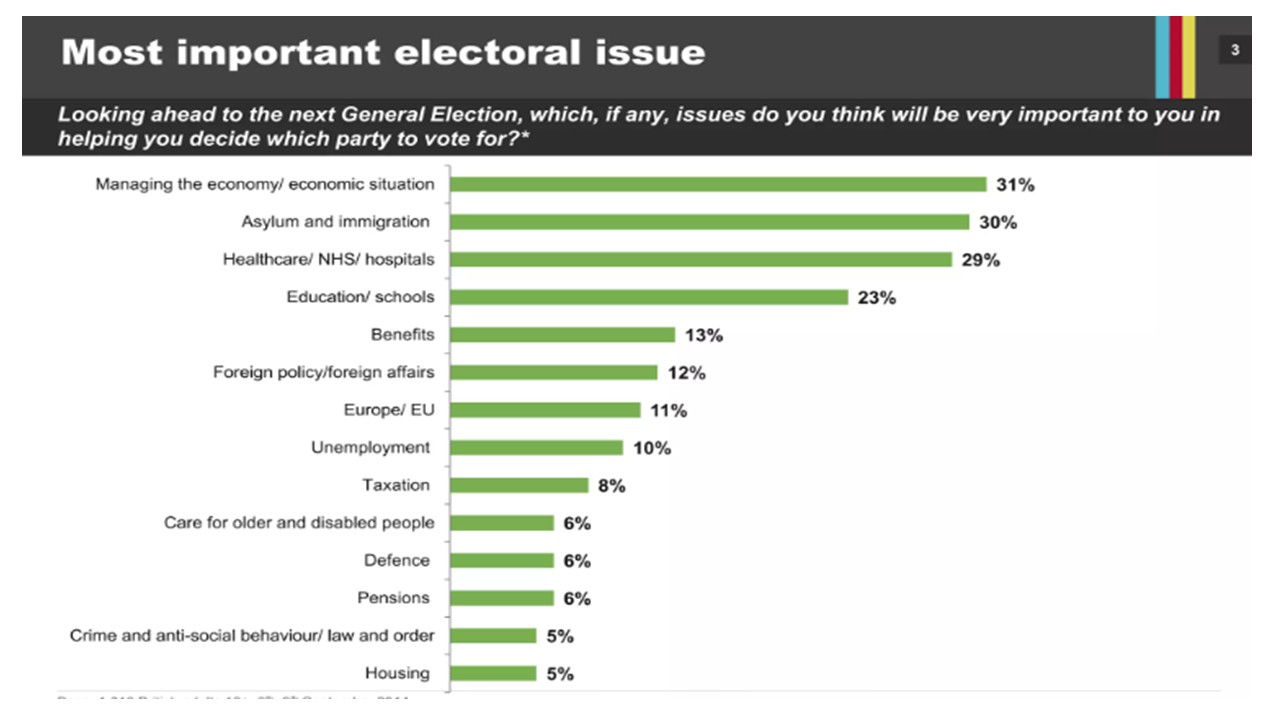

More importantly, the UK political situation remains fractured but fluid, with the government low in the opinion polls. Though a general election is not scheduled until 2029, the situation is so bad that pressure will likely grow in 2026 and 2027 to replace PM Starmer and Chancellor Reeves unless they avoid big losses in the May local and Scottish parliament election. Bookmakers show moderately high odds that they could be replaced in 2026. On the economy, the Conservatives are more trusted by voters, while Reform are more trusted on asylum and immigration and Labour on healthcare (Figure 4 for overall view on issues). However, the situation is fluid, as net immigration is projected to show a further sharp fall in 2026. Additionally, though Reform is seeing defections from the Conservatives and stands high overall in the opinion polls, political analysts note that Reform lags the other main parties on major issues excluding asylum and immigration – this could mean protest for now, but switch to traditional parties in a general election. For 2026, this means a risk premium for 10yr Gilt yields in case Starmer and/or Reeves are replaced and this leads to a softening of the fiscal rules – though in reality the 2022 Truss crisis means this would be modest rather than large.

Figure 4: UK Voters Attitudes On Key Issues (%)

Re UK equities, the FTSE 100 has outperformed FTSE 250 in 2025 on global versus UK factors, as the UK domestic economy is seen to be fiscally restrained and prone to stagflation risks that slows the BOE easing cycle. For 2026, the labor market is slackening more quickly than other DM economies and risks of a hard landing exist. This could mean that despite still attractive valuations, domestic equities continue to lag global equities. However, we see more slowing in service and wage inflation, which should allow more BOE easing than discounted in money markets in the next 12 months. The stagflation fears should ebb and this can see UK equities seeing 2.5-5% outperformance versus the U.S. in 2026. 2027 should see UK equities matching the U.S., as the BOE goes on hold and UK mid-term political turbulence reaches new heights.

GBP to edge lower

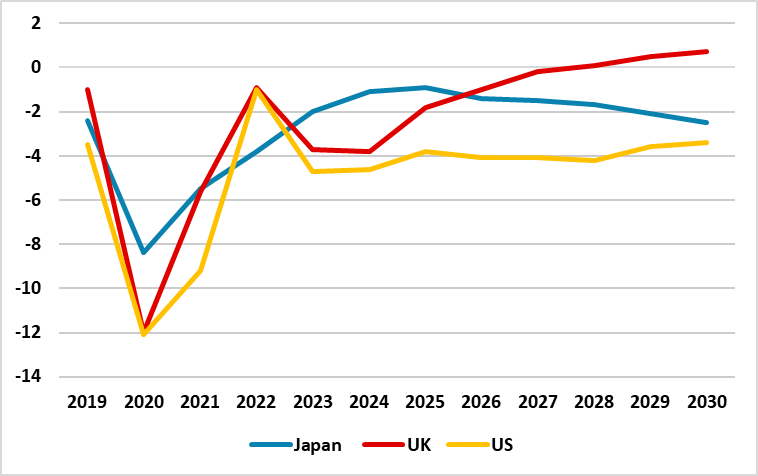

We expected GBP to continue the gradual decline against the EUR seen through this year. We expect the Bank of England to cut rates somewhat more than the market is pricing in, with the latest data on GDP, wages and prices supporting a more dovish stance. While we also see potential for the ECB to ease again, while the market is pricing in no change in policy rates for the next year, there should still be potential for real UK yields to fall slightly relative to the Eurozone. GBP might also suffer from any correction in U.S. equities which causes some general sell off in riskier currencies. It is also worth remembering that UK inflation has outstripped EZ inflation since 2019, so the equilibrium nominal GBP exchange rate should be falling. Even so, GBP weakness is unlikely to be dramatic, with a move to EURGBP 0.90 by end 2026.

Figure 5: Real EUR/GBP and real 2 year yield spread