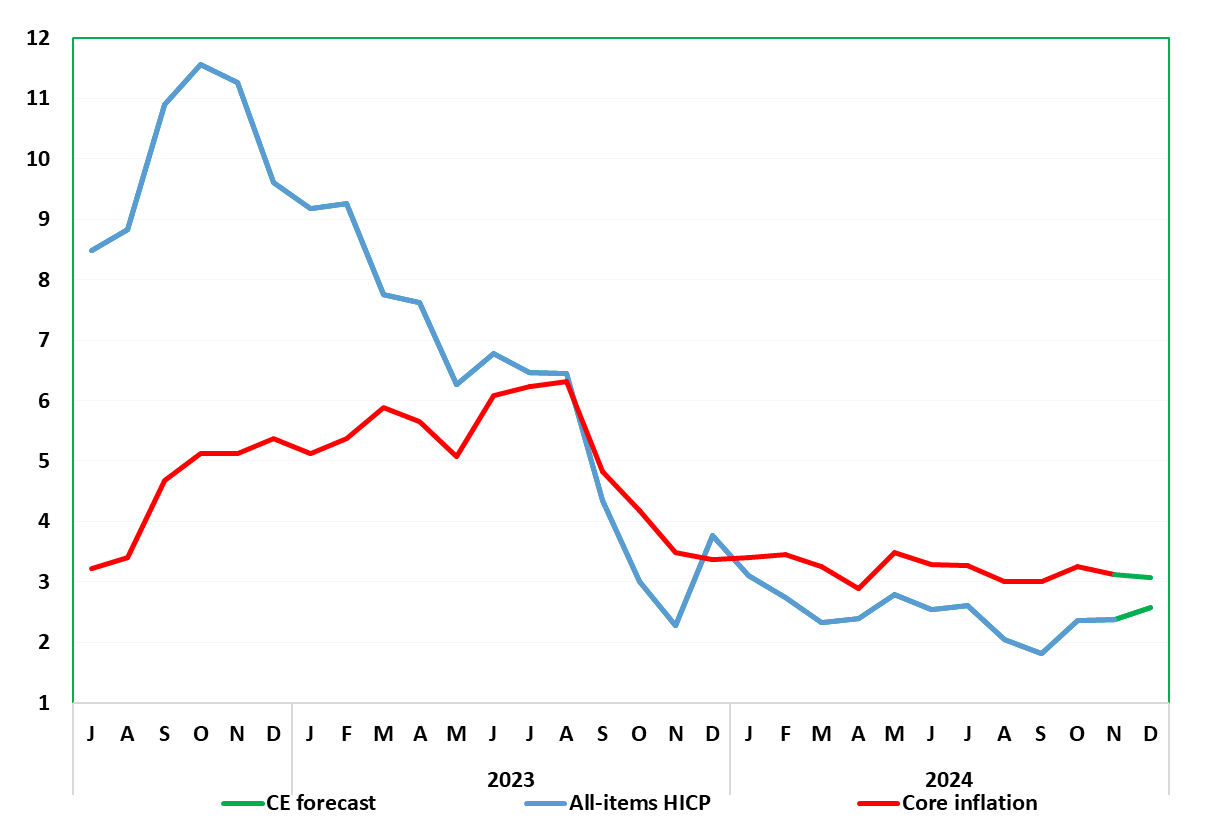

German Data Preview (Jan 6): Services Inflation Slips?

Germany’s disinflation process continues, with the y/y HICP headline stable at 2.4% in the November estimate, lower than widely expected, albeit where the CPI counterpart rose 0.2 ppt to 2.2%. This was again in spite of apparently stable or resilient services inflation. Even so, the core HICP rate fell 0.2 ppt to 3.1 with friendly short-term price dynamics! We see the core down a further 0.1 ppt in the preliminary December data but where energy base effects may pull the headline y/y rate up to 2.6% (Figure 1), a move already flagged in this month’s Spanish CPI data.

Figure 1: Services Inflation Persistence Less Evident?

Source: German Federal Stats Office, CE, % chg y/y

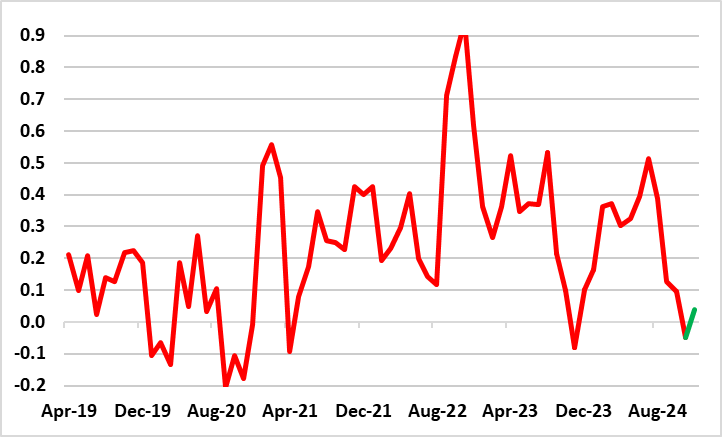

While a further rise in the next month beckons, again due to energy base effects, survey data are pointing not only to more real economy weakness but significant falls in cost and output price pressures. This chimes with weak adjusted core CPI readings from Germany (Figure 2), something we think continued in the December data.

Figure 2: Adjusted Core Rate Still Very Weak?

Source: German Federal Stats Office, CE, % chg m/m adjusted and smoothed