U.S. Q3 GDP Sustains Momentum, Core PCE Prices Still Above Target

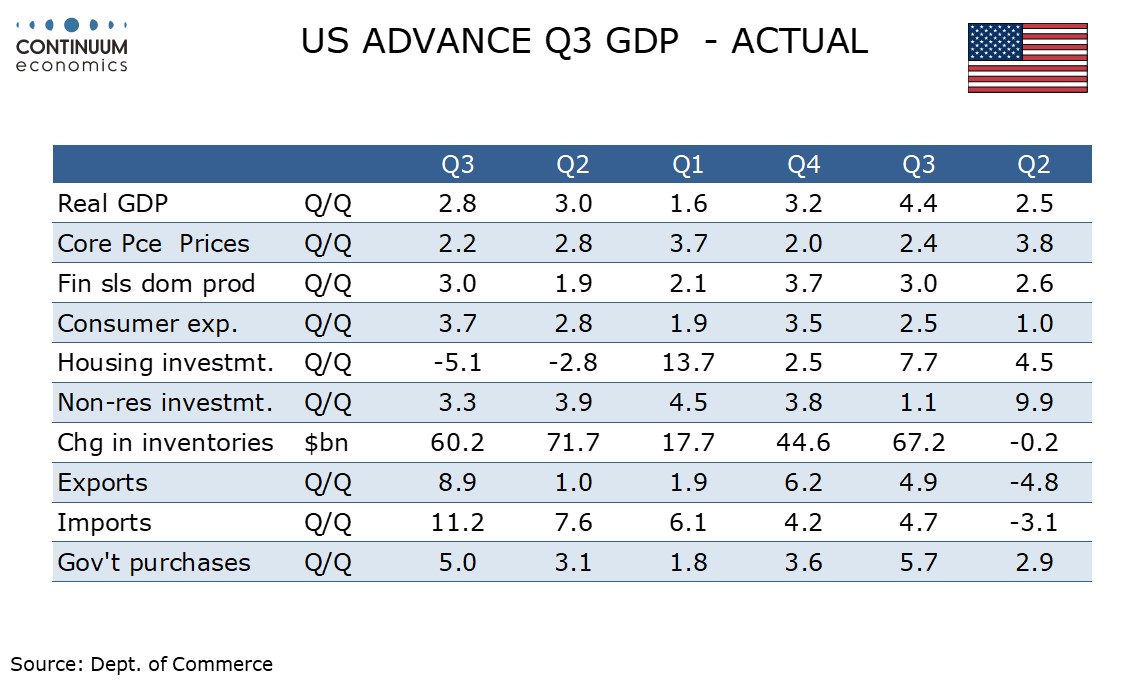

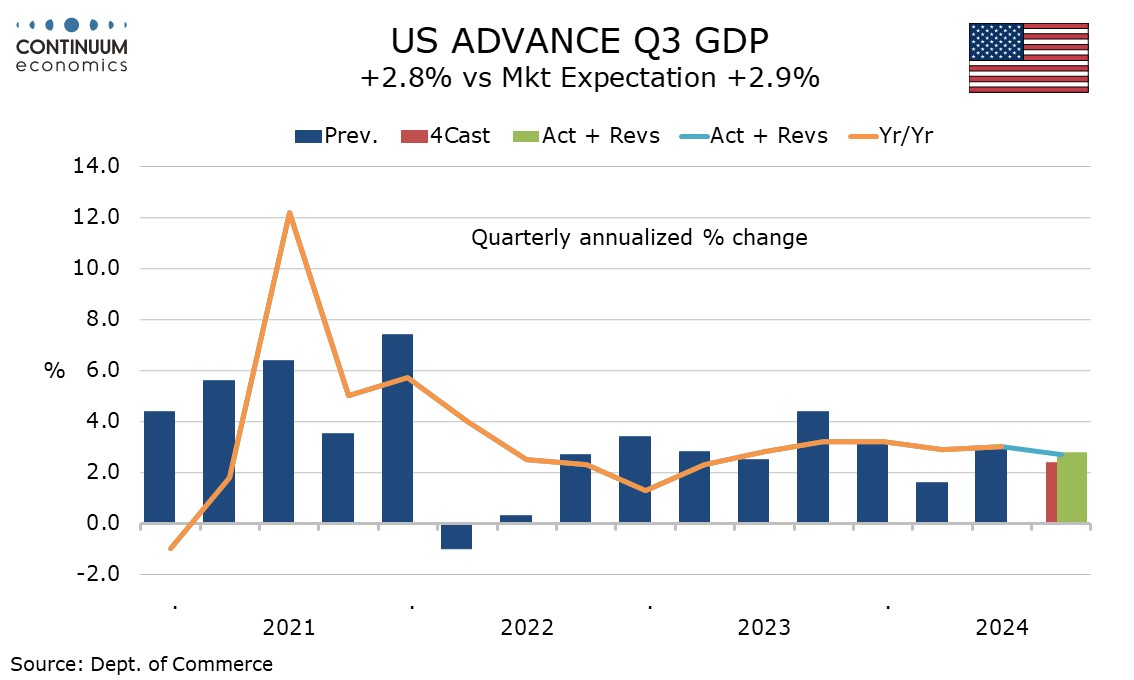

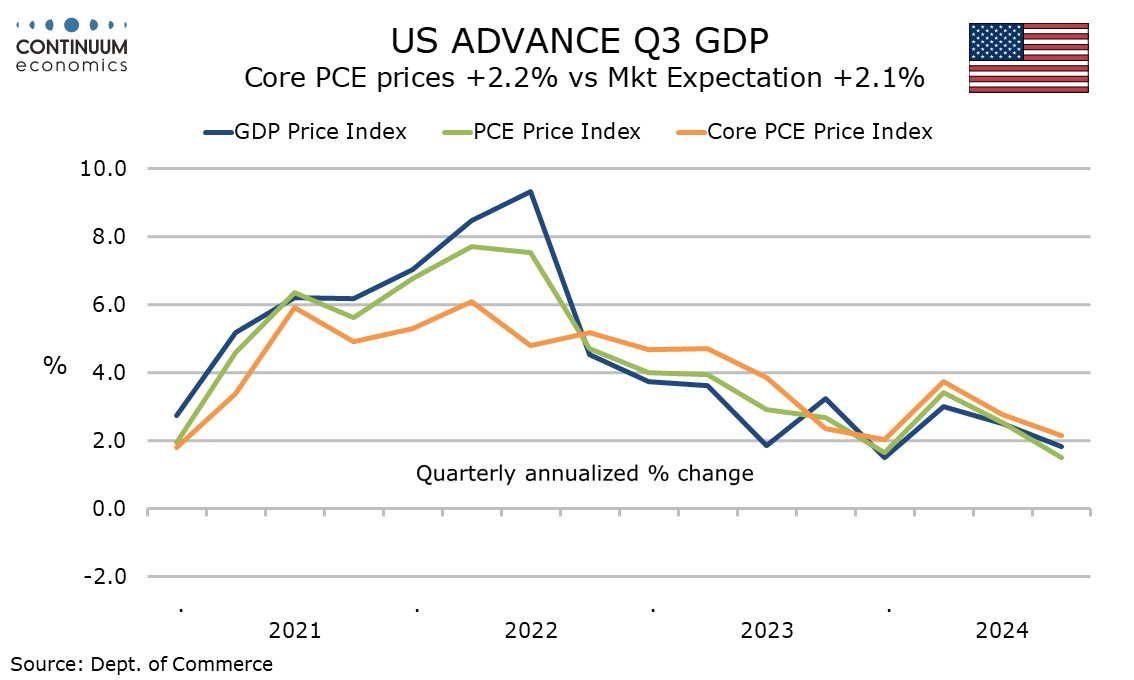

The 2.8% increase in Q3 GDP is in line with expectations and another solid quarter to follow a 3.0% rise in Q2. The gain was led by a 3.7% rise in consumer spending but domestic demand looks healthy outside slippage in private sector construction. A slightly stronger than expected 2.2% rise in the core PCE price index hints at stronger data for September tomorrow.

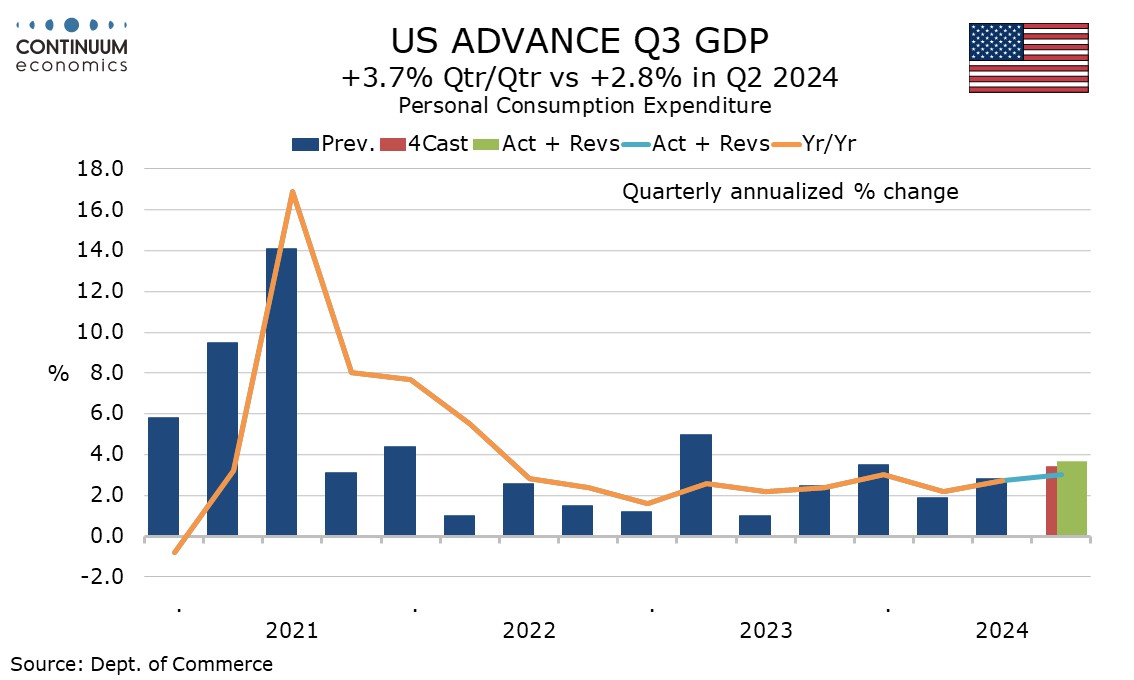

The 3.7% rise in consumer spending is the strongest since Q1 2023. The gain is significantly stronger than a 1.6% increase in real disposable income which hints that spending will struggle to match the Q3 pace in Q4.

However it should be remembered that historical revisions made with the Q2 GDP data left real disposable income looking consistent with spending on a medium term basis, rather than underperforming spending as had been the case, so we would not sound a strong alarm on the sustainability of spending on just one quarter of outperformance of income. Real disposable income is up 3.2% yr/yr, ahead of a 3.0% yr/yr increase in spending.

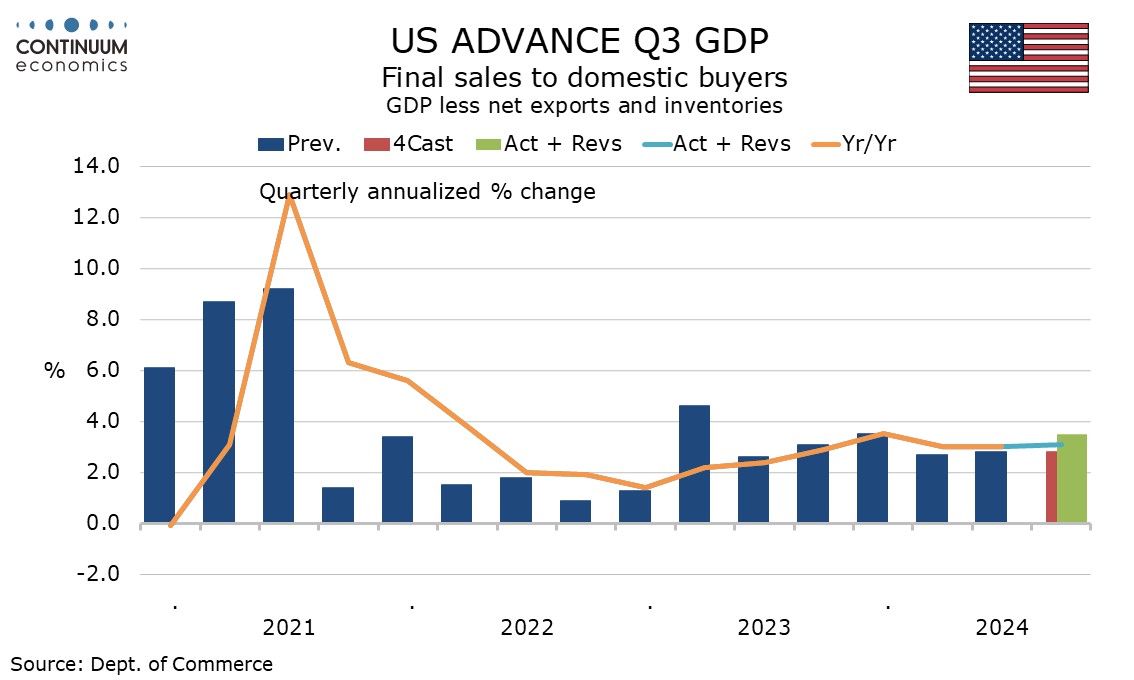

Inventories were a modest negative with final sales (GDP excluding inventories) up by 3.0%. New exports, as suggested by advance goods trade data yesterday, were also negative, with final sales to domestic buyers (GDP less inventories and net exports) up by 3.5%.

Government saw a strong 5.0% increase led by a 14.9% surge in defense. State and local government rose by a moderate 2.3%. Business investment rose by a respectable 3.3% though investment in equipment saw a second straight strong quarter, up by 11.1% after a 9.8% Q2 increase. Structures were weak at -4.0% and intellectual property saw only a marginal 0.6% gain. Housing investment was also weak, falling by 5.1%.

The overall PCE price index rose by a subdued 1.5% restrained by gasoline but a 2.2% core rate is on the firm side of expectations and suggests we are not yet consistent with the Fed’s 2.0% target. The data suggests September will see a 0.3% increase, above recent trend. The overall GDP price index rose by 1.8%.