India CPI Review: CPI Hits New Heights

Bottom line: The latest CPI figure of 6.2% yr/yr underscores significant inflationary pressures within the Indian economy, primarily driven by food prices but also influenced by housing costs. With inflation now at a 14-month high, the RBI's response will be another rate hold in December. Earliest rate cuts are now expected in February 2025.

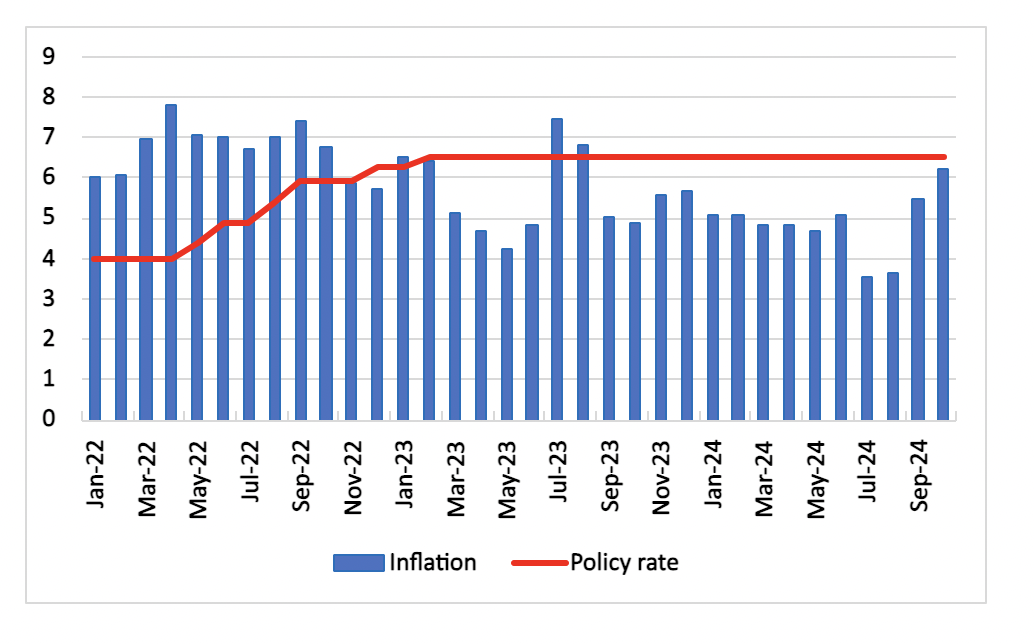

Figure 1: India Consumer Price Inflation and Policy Rate (%)

Source: MOSPI, Reserve Bank of India, Continuum Economics

The Consumer Price Index (CPI) for India has shown significant movement in October 2024, reflecting broader economic trends and pressures. The CPI rose to 6.2% yr/yr in October, uyp from 5.5% yr/yr, exceeding both our and market expectations. On a m/m basis inflation rose 1.34%.

The primary driver of the inflation spike is the surge in food prices, which constitute nearly half of the CPI basket. Food inflation accelerated to 10.87% yr/yr in October, compared to 9.24% in September, with specific categories like vegetables witnessing a staggering 42.2% increase yr/yr. The rise in food costs can be attributed to several factors, including adverse weather conditions affecting crop yields and increased transportation costs.

Alongside food, housing inflation also saw a slight uptick to 2.8% yr/yr, while miscellaneous categories—including transport and health—remained stable but contributed to overall price pressures. The relatively stable prices for fuel and light, which showed deflation at -1.4%, provided some relief but did not significantly offset the rising costs elsewhere.

The CPI data indicates a departure from the Reserve Bank of India's (RBI) target inflation rate of around 4%, which is crucial for monetary policy decisions. The current inflation rate is now more than 2 percentage points above this target, raising concerns about potential interest rate hikes rather than cuts as previously anticipated.

In light of the latest CPI data, the RBI is expected to adopt a more cautious approach regarding interest rate cuts. We now predict that any potential rate cuts may be deferred until early 2025, with February emerging as a likely starting point for easing monetary policy. This cautious stance is driven by elevated inflation levels and concerns over domestic food prices despite government supply-side measures aimed at stabilizing the market. Additionally, external factors such as imported inflation risks—exacerbated by geopolitical developments following Donald Trump's recent electoral victory—may further complicate the RBI's decision-making process. The central bank is likely to remain vigilant about global market dynamics that could influence domestic inflation rates.

The reaction from financial markets has been cautious following the CPI release. Investors are likely to adjust their expectations regarding future monetary policy, particularly concerning interest rates and liquidity measures from the RBI. The heightened inflation may prompt the central bank to maintain interest rates to curb price growth, which could slow down economic activity in sectors sensitive to borrowing costs.