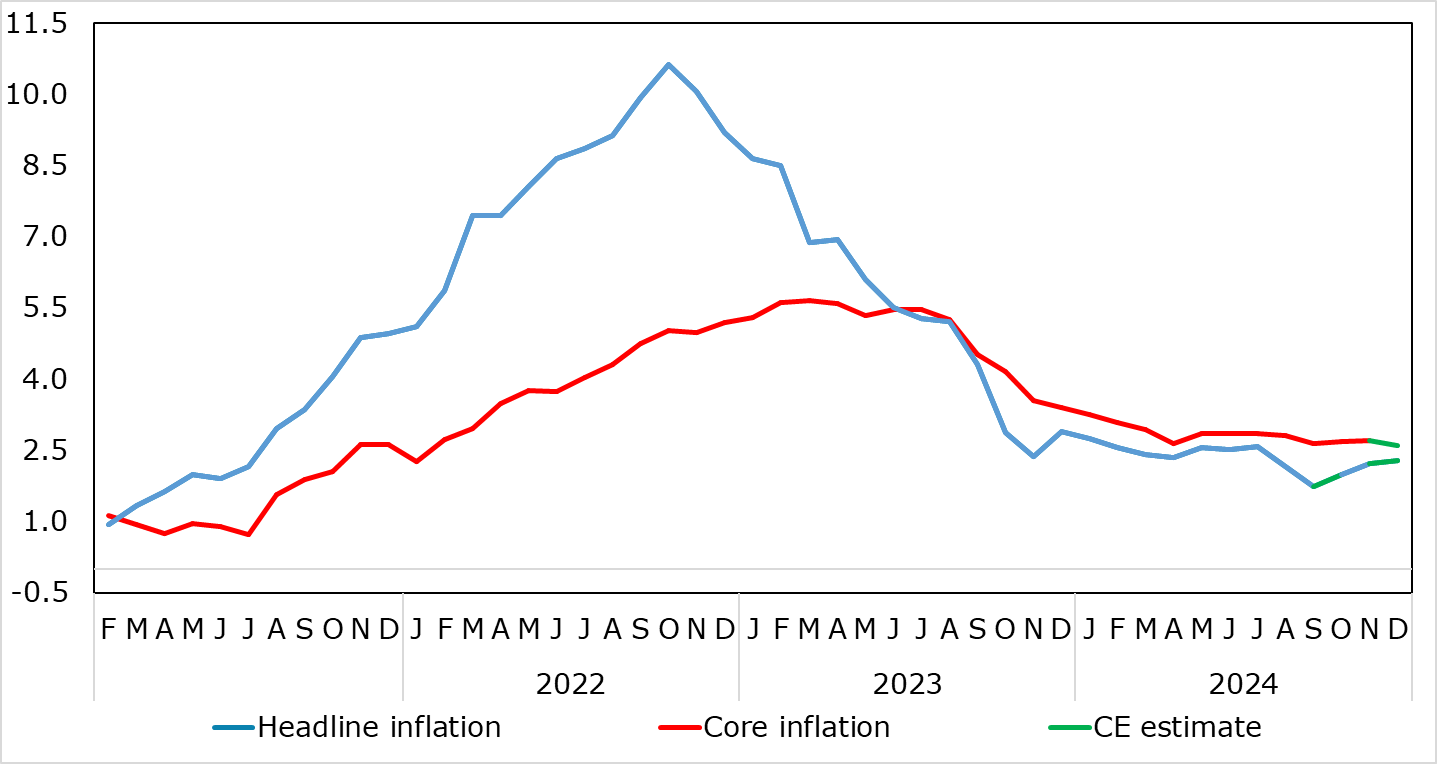

EZ HICP Preview (Jan 7): Headline Higher Again, But Core Still Clearly Friendly?

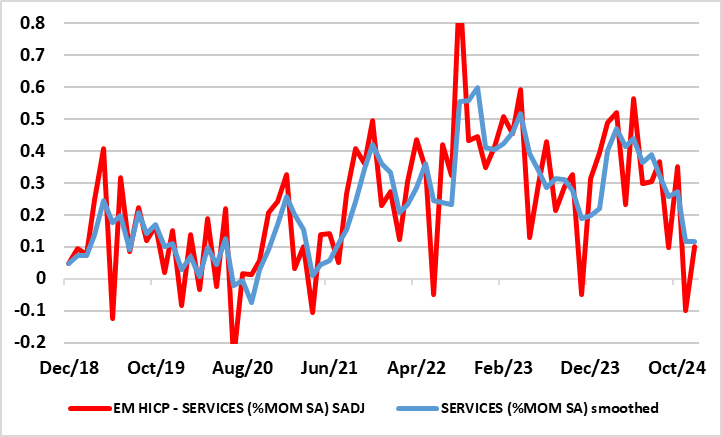

There were mixed messages in the November HICP numbers. After a downward revision, and thus below consensus thinking, the headline rose 0.2 ppt to 2.2%, but where the core stayed at 2.7%, partly due to what is seemingly stable services inflation. Higher energy costs, mainly base effects, were the main factor behind the rise back from October, and these factors may appear again in December data with a rise to 2.3% (Figure 1). Regardless, shorter-term price momentum data already suggest that core and even services inflation are running around target (Figure 2) and given sharp, falls in wage tracker data, headline y/y services inflation may succumb more clearly soon, something backed up by surveys for the sector. Indeed, the core rate may drop another 0.1 ppt in December partly driven by softer service price pressures.

Figure 1: Headline Rises Again But Services Resilience Slips?

Source: Eurostat, CE

However, there are some signs in retailing surveys suggesting disinflation may have stalled. But this may be of increasing secondary importance to most of the ECB Council as a) inflation is already consistent with target and b) a fresh and more demand driven disinflation could be triggered by what seems to be weaker real economy backdrop that could also exacerbate financial stability risks.

Regardless the headline HICP rate may edge up a notch or two in December, partly base effects but also some rise in fuel costs in m/m terms, but with the core staying put, if not dropping. And with adjusted data showing even apparently resilient services inflation succumbing (Figure 2), something that has been noted by some of the ECB Council. This backdrop has persuaded the recalcitrant ECB into a reassessment encompassing this month (as we expected) a change in forward guidance in which the ECB now accepts that on-target inflation is likely to be durable enough so that it no longer has to pursue policy restriction. In this regard, the first glimpse of the ECB’s 2027 economic projections support this as they point to a second successive year of around-target inflation even on a core basis and also on the basis of markets assuming rates fall to around 2% in 2026 – hence, the ECB is largely endorsing such market thinking, showing just how much it has been forced to reassess in recent months.

Figure 2: Even Services Inflation is Around Target in Shorter-Term Dynamics?

Source: Eurostat ECB, CE

But the dominant ECB issue now is the extent to which downside growth risks have turned into reality with it clear that growth worries have risen. Indeed, preserving growth does seem to have become the ECB policy priority. Moreover, these downside risks have other aspects, equally worrying, especially as, they could fan financial instability issues.