U.S. Government Debt and Deficit – How Much Does it Matter?

Post-election U.S. fiscal policy can still cause stress in the U.S. Treasury market given the unsustainable U.S. budget deficit and the high risk of a rating agency downgrade in H1 2025. However, 10yr U.S. Treasury yields above 4% now have a buffer and the prospect for Fed policy is also important. If the economy remains resilient then post-election fiscal stress could push 10yr to 4.5% yields, but if the soft v hard landing debate reignites then U.S. Treasuries could be dominated by the Fed debate (here) and 10yr yields could fall below 4.0% in H1 2025. 10yr Treasuries are currently more two way than the late summer.

With the U.S. election fast approach some players are worried over the U.S. fiscal situation and some are not. What will happen?

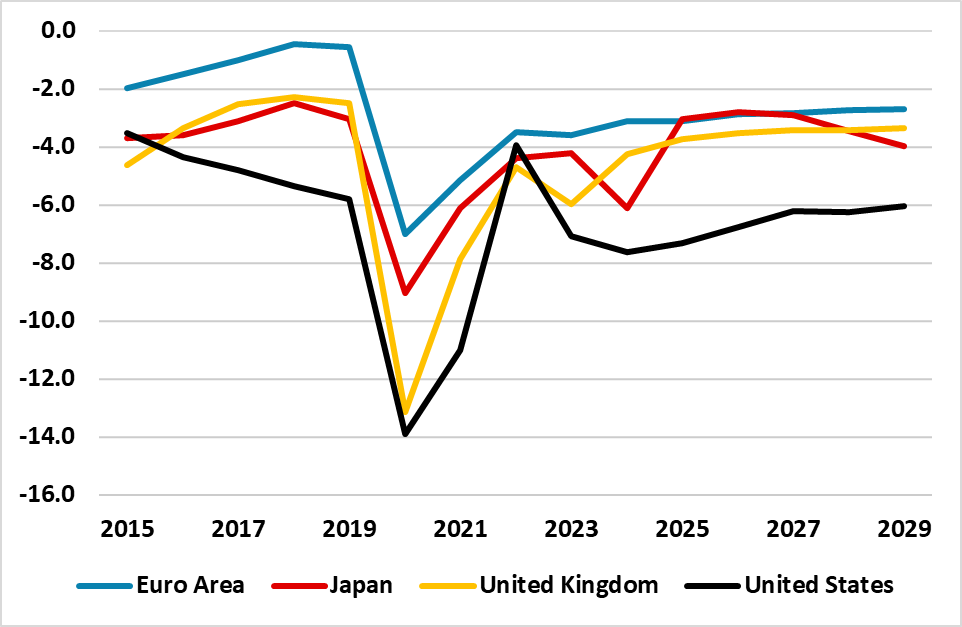

Figure 1: Net General Government Debt/GDP (%)

Source: IMF Fiscal Monitor Oct 2024

Financial market players that are not overtly worried about the U.S. fiscal situation and point to the dominance of Fed policy in determining yields over the past few years and the start of Fed rate cuts heralding an easing cycle into 2025. Additionally, one other reason cited is that the reserve currency status of the USD remains and this allows the U.S. to run a large government debt/GDP trajectory, due to the demand for safe assets around the world.

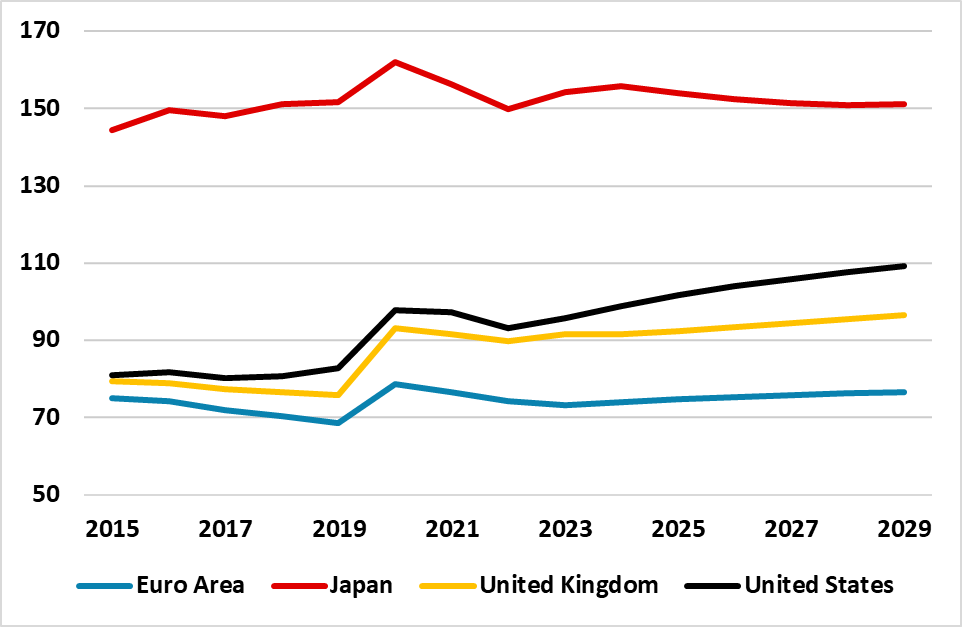

The alternative view is that the U.S. fiscal trajectory is unsustainable, which is a concern as the political will to raise taxes is lower than other advanced economies. The latest IMF projection on net government debt/GDP shows the now familiar increase through the remainder of the decade (Figure 1). While the government debt/GDP trajectory is a long-term concern, it only becomes a major issue when rating agencies cut the U.S. rating due to this concern. What is of greater concern at this point is the prospect of a budget deficit of at least 6% of GDP for the rest of the 2020’s in contrast to other major DM economies (Figure 2). U.S. fiscal policy has become looser since 2019 due to the cyclical boost during the pandemic, but also structural spending by the U.S. including the boost to renewables spending and tax credits. The Achilles heel of the U.S. remains the low Federal tax take to GDP, which a split congress makes very difficult to change. The 2024 IMF article IV argues one option is to allow parts of the 2017 tax cuts to lapse, but both the Republicans and Democrats want to extend some of these cuts due to lapse for political reasons. The IMF suggestion of a 10% Federal VAT rate would raise revenues by 2% of GDP and help budget deficit consolidation, but the idea is politically toxic in the U.S.

Figure 2: General Government Deficit/GDP (%)

Source: IMF Fiscal Monitor Oct 2024

The outlook of the budget deficit is dependent on the outcome of the U.S. presidential election and congressional race (here). A split congress would likely limit the prospect of a significant widening of the budget deficit, but a 25% probability exists of a Donald Trump victory and Republican House and Senate that could mean a worse budget deficit.

The impact on U.S. Treasuries is also dependent on the rating agencies reaction to post-election policy in H1 2025. We have been of the view that temporary fiscal stress (circa 20bps for 10yr yields) would occur under either president, due to the high risk of one of the rating agencies downgrading the U.S. in H1 2025. However, 10yr yields have risen mainly with the rethink on Fed easing prospects for 2025/26 with resilient economic data, though concerns about a Trump victory and or a Republican clean sweep have also been a concern. If the economy remains resilient then post-election fiscal stress could push 10yr to 4.5% yields, but if the soft v hard landing debate reignites then U.S. Treasuries could be dominated by the Fed debate (here) and 10yr yields could fall below 4.0% in H1 2025. 10yr Treasuries are currently more two way than over the summer.