Deceleration Trend Continues: South Africa’s Inflation Cooled to 3.8% YoY in September

Bottom Line: After inflation decreased to 4.4% YoY in August, the downward trend continued in September and CPI hit 3.8% YoY given suspended power cuts (loadshedding), a relatively stable Rand (ZAR), decrease in inflation expectations in Q3 coupled with Fed started cutting rates. Taking into account that the inflation is now below 4% for the first time in more than three years, we think more-than expected fall in CPI could back rate cut bets during the next MPC meeting scheduled on November 21, despite this was not our main scenario earlier. We now think it would not be surprising if South African Reserve Bank (SARB) will cut key rate by 25 bps to 7.75% on November 21 while larger 50 bps move remains unlikely.

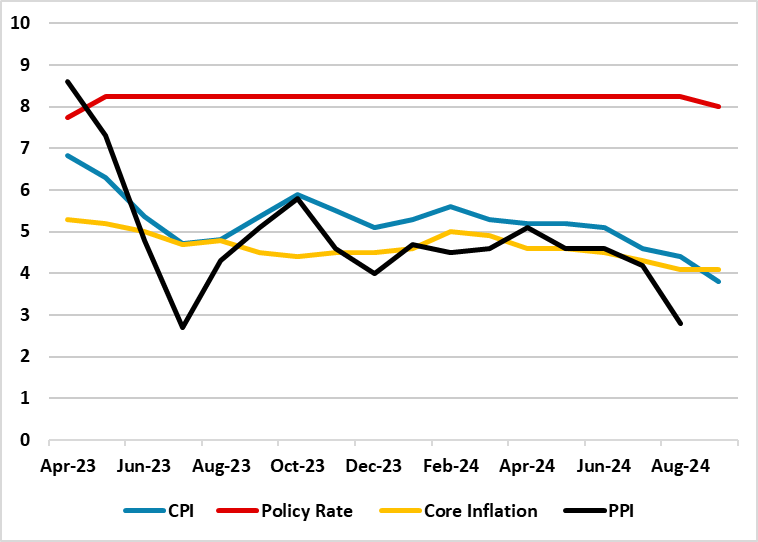

Figure 1: Policy Rate (%), CPI, PPI and Core Inflation (YoY, % Change), April 2023 – September 2024

Source: Continuum Economics

South Africa’s inflation cooled further off to 3.8% YoY in September from 4.4% YoY in August. According to StatSA, the main positive contributors to the annual inflation rate were increases in housing and utilities (4.8%), miscellaneous goods and services (6.9%), and food and non-alcoholic beverages (4.7%, the same in August). Transport was the only negative contributor, which declined for the first time in 13 months (-1.1% vs 2.8% in August), mainly due to plummeting fuel prices (-9%). (Note: According to sources, a litre of inland 95-octane petrol amounted to ZAR 22.2, the lowest since February 2023).

On a monthly basis, consumer prices rose by 0.1% in September, the same as a month before. Annual core inflation steadied at 4.1%, which marked the lowest reading since May 2022. We think deceleration in CPI was supported by the suspended load-shedding, decrease in Q3 inflation expectations, relatively stable ZAR in addition to Fed started lowering borrowing costs, which is expected to loosen global financial conditions and potentially easing pressure on the ZAR.

On the power cuts front, South Africa’s national electricity utility company, Eskom announced on October 18 that load shedding remained suspended for 205 consecutive days since March 26, reflecting an improvement in the reliability and stability of the power generations coupled with new investments. This marks the longest stretch of uninterrupted power supply in five years.

In addition to the suspended power cuts, relatively stable ZAR also relieved the inflationary pressures in September as ZAR strengthened by 2.8% against the USD.

Additionally, there has been a recent fall in the inflation expectations as well. According to the BER survey of inflation expectations 2024Q3 released in late September, the average inflation expectations of analysts, business people and trade unions declined. They now expect headline inflation to be 5.1% this year, before subsiding to 4.8% in both 2025 and 2026. In Q2 they still expected consumer inflation to register 5.3% this year and fall to 4.9% in 2026. (Note: We continue to foresee average headline inflation will stand at 5.1% and 4.7% in 2024 and 2025, respectively).

As SARB intermittingly signalled that it planned to start cutting interest rates after the inflationary pressures are under control backed up by data and expectations, SARB started easing cycle on September 19 as we predicted, and cut the policy rate from 8.25% to 8.0%. Backed up by lowering inflation, stable ZAR and suspended loadshedding while favorable food harvest and soft fuel prices could help inflation slow further, we now think it would not be surprising if SARB will cut key rate by 25 bps to 7.75% during the next MPC meeting scheduled on November 21, despite this was not our main scenario earlier.