Despite Favourable Metrics RBI Committed to Tightening

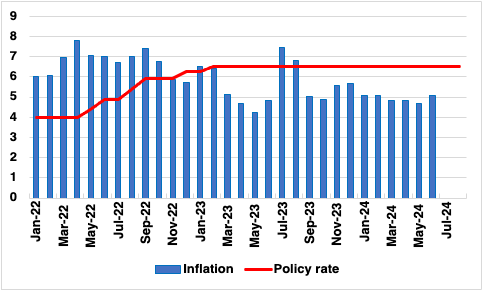

The RBI will retained its stance of withdrawal of accomodation and maintained benchmark rate of 6.5% in its August meeting, staying on the path of inflation target. Concerns around high food inflation and geopolitical instability ensured that the RBI remained committed to its monetary tightening stance. Meanwhile, the central bank remained confident of a 7.2% y/y growth in FY25.

For the Monetary Policy Committee (MPC) meeting this week, the key development since its last assembly in June is not the Federal Reserve Chair's signal towards interest rate cuts, but rather the substantial rainfall that India has witnessed recently. Governor Shaktikanta Das, who has previously dismissed the notion of aligning India’s monetary policy with the developed world, might be poised to alter his stance in the upcoming decision, despite previously withholding any guidance.

Figure 1: India Benchmark Policy Rate and CPI (%)

The Reserve Bank of India's (RBI) latest monetary policy decision on August 8 to hold the repo rate steady at 6.5% reflects a cautious but calculated approach to managing the country's economic landscape. With a majority vote of 4:2, the Monetary Policy Committee (MPC) chose to maintain the status quo, signaling a focus on sustaining economic growth while keeping inflation in check.

RBI Governor Shaktikanta Das highlighted that the central bank's monetary policy is closely aligned with market expectations, particularly in addressing inflation concerns. Food prices remain stubbornly high, posing a significant challenge. While core inflation—excluding food and fuel—has moderated, and fuel prices have seen deflation, the overall inflation picture remains complex. The anticipated moderation in headline inflation during Q2 is largely due to favorable base effects, which are expected to reverse in Q3. The central bank's strategy underscores the importance of a disinflationary approach, aiming to gradually align inflation with the 4.0% target. Given the resilient domestic growth, supported by steady urban and improving rural consumption along with strong investment demand, the MPC has opted to maintain its stance on the withdrawal of accommodation. This approach ensures that the focus remains on inflation control while supporting ongoing economic growth.

The RBI's real GDP forecast for FY25 remains unchanged at 7.2%, with consistent quarterly projections ranging from 7.2% to 7.3%. This steady growth forecast suggests confidence in the underlying strength of the economy, driven by robust domestic demand and investment. Inflation forecasts, however, present a mixed picture. For FY25, inflation is projected at 4.5%, with slight variations across quarters. The central bank has adjusted its Q2 inflation projection upward to 4.4% from 3.8%, acknowledging short-term pressures. However, the overall trend is expected to ease.

Governor Das expressed confidence in the economy's resilience, citing healthy kharif sowing and a favorable southwest monsoon as key factors supporting agricultural output and, by extension, rural consumption. The RBI also remains vigilant on price monitoring, particularly concerning mobile tariffs and milk prices, which could impact inflation. On the financial stability front, the RBI expressed concerns over the rising disbursals of top-up home loans, urging lenders to take remedial actions to mitigate potential risks. Additionally, the central bank is taking proactive steps to address third-party outsourcing risks for banks and financial institutions, especially in light of the recent global Microsoft outage. A public repository of digital lending apps is proposed to prevent unauthorized lending, reflecting the RBI's commitment to safeguarding the financial ecosystem. In a bid to enhance efficiency, the RBI has increased the UPI tax payment limit from INR 100,000 to INR 500,000 per transaction. Moreover, steps are being taken to introduce continuous check clearing, significantly speeding up the clearance process.

Overall though, the RBI remains hawkish with concerns around inflation dominating its approach. Economic activity remains resilient supported by a favourable monsoon. As a consequence, the RBI remains reluctant to start cutting rates for now. This is aligned with our expectation of a single rate cut of 25bps in Q4-2024. The 2024 eop benchmark rate is expected at 6.25%.