India CPI Preview: Weather Disruptions to Propel Headline Inflation

Bottom line: India’s June inflation level is expected to trend up to 4.9% y/y, rising from 4.7% y/y in May, reflecting higher food prices. The persisting heatwaves and the advance of the monsoon and its impact on produce will weigh on food prices in the near term, which could potentially see price growth pick up to beyond the 5% mark in the upcoming quarter. Meanwhile, monetary policy is expected to remain tight and policy rate to be retained at 6.5%.

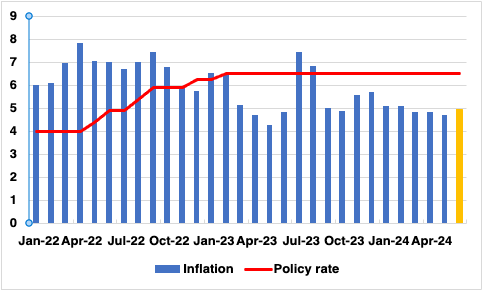

Figure 1: India Consumer Price Inflation and Policy Rate (%)

Source: MOSPI, Reserve Bank of India, Continuum Economics

India's consumer price inflation (CPI) is expected to have risen to 4.95% yr/yr in June 2024, up from 4.7% in May, driven by a surge in food prices. This would reverse the four-month long continuing trend of easing inflation, largely influenced by moderating non-food inflation.

The predominant factor behind June's inflation uptick is food inflation, exacerbated by heatwaves and floods that have disrupted agricultural output and supply chains. Several regions across the country have experienced extreme weather conditions, with heatwaves scorching crops and floods causing further damage and logistical challenges. Consequently, the prices of essential food items, particularly vegetables and fruits, have soared, significantly impacting the overall inflation rate, in our view. The persistent rise in food prices is a major concern for both policymakers and consumers. The increased cost of living has pressured household budgets and was considered a main concern for the loss of vote share that the ruling Bharitya Janta Party witnessed in the recently concluded parliamentary elections in early June. The Reserve Bank of India (RBI) too faces the challenge of balancing inflation control while also propping up growth. Private consumption growth has been sluggish in the past two quarters.

Looking ahead, inflation is expected to remain elevated in the coming months. Food prices are likely to stay high until the new harvest is available, providing some relief to the supply chain. Additionally, a recent telecom tariff hike is anticipated to contribute to core inflation, adding further upward pressure. Despite the uptick, the RBI is unlikely to raise interest rates, viewing the current inflationary pressures as transient. The central bank MPC is already divided between rate hold and rate cut. In our view, the RBI will remain vigilant over Q3 2024, but not hike interest rates, especially as headline inflation remains below the 6% upper target.