Turkiye’s Inflation Continues to Jump in April with 69.8%

Bottom Line: Turkish Statistical Institute (TUIK) announced on May 3 that Turkish CPI ticked up 69.8% annually and 3.2% monthly in April due to increases in transportation, restaurant & hotel and education prices, coupled with the lingering impacts of the wage hikes on the services sector. We feel upside risks remain strong which would likely continue drive the inflation in 1H of 2024. We foresee favourable base effects, additional macro prudential measures and tightened monetary and fiscal policies will likely start relieving the pressure on the inflation, likely after July.

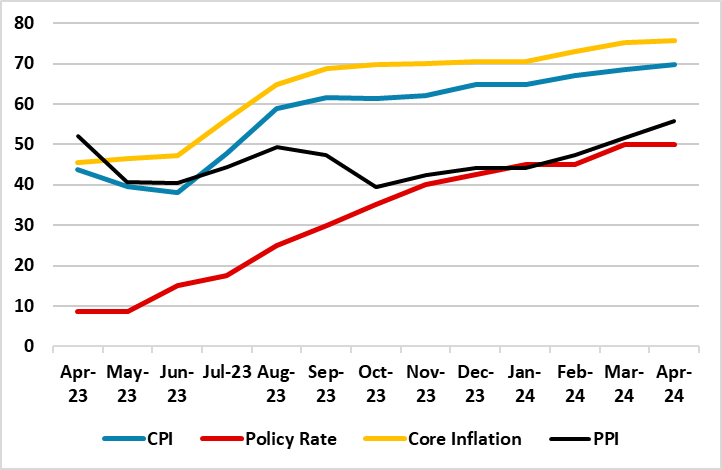

Figure 1: CPI, PPI, Core Inflation (YoY, % Change) and Policy Rate (%), April 2023 – April 2024

Source: Continuum Economics

When annual rate of changes (%) in the CPI’s main groups are examined in April, clothing and footwear with 51.2% was the main group with the lowest annual increase while education recorded the highest annual increase with 103.9%. It is worth mentioning that hotels and restaurants (95.8%), and transportation (80.4%) also recorded significant YoY increases.

Core inflation (CPI-C) recorded a strong 3.6% MoM increase, scaling up to 75.8% on an annual basis, which marked the highest on record, particularly due to impacts of the wage hikes and inertia in services and adjustment in administered prices. One good news about the inflation trend was the early signs of easing in the monthly inflation rate as MoM inflation fell from 4.53% in February to 3.2% in April. The domestic PPI was up 3.6% MoM in April for an annual rise of 55.7%, the data showed.

Despite galloping inflation, Turkish policy makers remained positive in curbing inflation. Central Bank of Republic of Turkiye (CBRT) Governor Karahan underscored in April that the rate-hiking cycle is over and inflation is on track to reach its 36% target by the end of the year. (Note: CBRT foresees inflation softening to 14% in 2025 and falling to single digits in 2026).

We are of the view that there are strong signs that inflation will continue to stay high in the first half of 2024, as partly proved by the April data. Despite aggressive monetary tightening, lagged impacts of the tightening cycle are still feeding through and we still see upside risks to the inflation outlook. We think hikes in salaries, high domestic demand, deterioration in pricing behaviour, weakening currency, strong inflation expectations and surges in public spending during the local elections continue to ignite general level of prices.

In a similar vein, according to the CBRT’s assessment on April 25 regarding higher-than-expected underlying monthly inflation trend; high level of and the stickiness in services inflation, inflation expectations, geopolitical risks, and food prices remained the key drivers of inflation. (Note: Having depreciated nearly 4% against the U.S. dollar in March, TRY was mostly flat in April).

As the recent high inflation readings continue to put pressure on the CBRT, the Bank decided to restart tightening cycle in March and lifted the key rate to 50% on March 21 citing significant and persistent deterioration in inflation outlook. (Note: Our projection is that policy rate will be held at 50% in the next MPC meeting, which is scheduled for May 23). We think CBRT would have to closely watch the upcoming inflation figures in May and June before favourable base effects, additional macro prudential measures and tightened monetary and fiscal policies will likely start relieving the pressure on the inflation from mid-year.