India CPI Review: December CPI Signals End of Disinflation Cycle

December’s CPI print reinforces that the inflation trough is behind us. While headline inflation remains below target, a sharp rebound in core driven by gold and jewellery could limit the RBI’s room for manoeuvre in early 2026. With a new CPI series incoming, the next few months will test the credibility and clarity of India’s disinflation narrative.

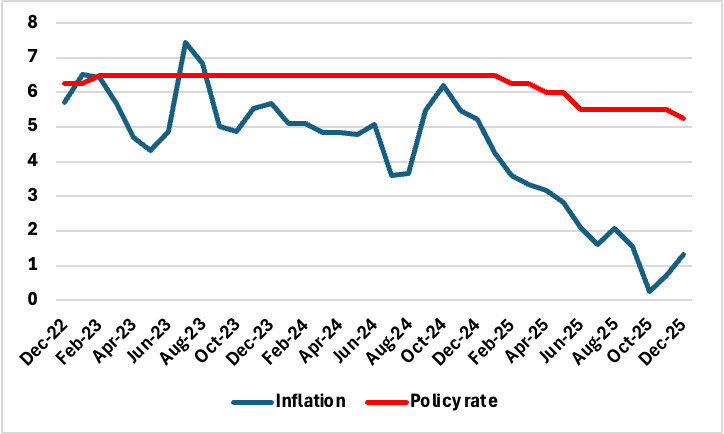

India’s headline CPI inflation rose to 1.3% yr/yr in December 2025, up from 0.7% in November, marking the highest reading in three months. While still well below the Reserve Bank of India’s (RBI) 2–6% target band, the latest data suggests the bottom of the disinflation cycle has passed, with sequential momentum now turning modestly positive.

Figure 1: India Policy Rate and Inflation (%)

Food prices continued to fall in annual terms for a seventh consecutive month, declining 2.7% y/y in December. However, the pace of deflation eased from 3.9% in November, indicating that the deep food price correction—driven by double-digit declines in vegetables and pulses—is likely bottoming out. This continued drag from food masked price pressures elsewhere, particularly in categories linked to discretionary and asset-linked consumption.

Though the National Statistics Office does not publish official core inflation figures, estimates suggest that core inflation (non-food, non-fuel) rose to around 4.6%, up from 4.2–4.3% in November. This would mark the highest core inflation reading in over two years, primarily driven by a 28.1% y/y surge in the 'personal care and effects' category, linked to rising jewellery and gold prices amid a global rally. This divergence between food deflation and firming core adds complexity to the monetary policy outlook. While the RBI cut rates by 25 bps in December, citing benign inflation and a subdued outlook, core stickiness may now warrant closer monitoring, particularly as the headline figure begins to climb from its October trough (0.3%). Inflation eased across fuel and light, health, and transport and communication—sectors that reflect broader economic demand. This suggests no evidence of overheating, and supports the view that the uptick in headline inflation is not yet broad-based.

So far in FY26 (April–December), CPI inflation has averaged 1.7%, allowing the RBI to revise down its full-year forecast to 2.0–2.6%. The central bank has described the current phase as a “goldilocks” period of strong growth and low inflation, but the fading of base effects, alongside volatile core components, could limit further easing in the near term. Moreover, December marks the final CPI release under the existing base year (2012). From January 2026, India will adopt a new CPI series with 2024 as the base year and updated consumption weights, which may significantly alter inflation dynamics, especially in under-represented categories such as services, housing, and digital goods. This transition adds an element of statistical uncertainty at a time when policymakers are trying to recalibrate the monetary policy cycle.