France Debt: Non-Residents Budget Jitters

The 2025 budget could pass via a sequence of events, but the potential outcome is so uncertain that it is difficult to attach a probability to the various scenarios. Drama will be high for the next 12 months, which will also most likely see a parliamentary election from July 2025. France has been successful in convincing foreign investors for decades, but this could be now a weakness. Non-residents will likely reduce exposure to France and this could drive the 10yr France-Germany government bond spread to 100bps in the next 3-12 months.

New French PM Barnier has announced EUR60.6bln of spending cuts and tax hikes for 2025, but what will be implemented and will foreign investors exit the French government bond market?

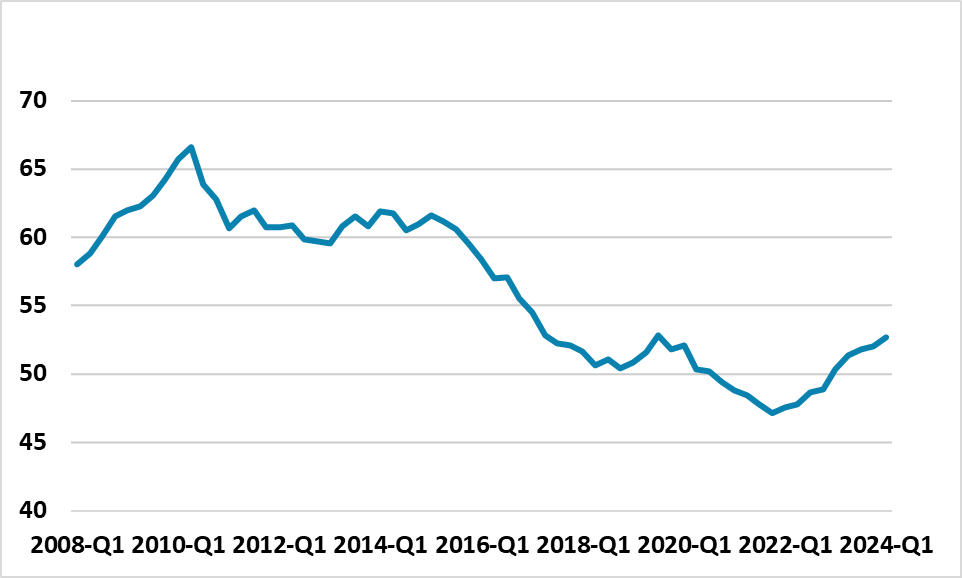

Figure 1: France Non Resident Holdings High

Source: Banque De France

The 2025 budget cuts announced by PM Barnier are large (ie 2% of GDP), but only get the budget deficit to 5% and France now wants to reduce the deficit to 3% only in 2029. Many hurdles exist to get this budget passed and moving back towards fiscal stability.

· Amendments and split Parliament. The far left (193 seats) want higher taxes than under the Barnier plan and will likely propose amendments, but the far right (142 seats) want lower taxes. Opposition to some of the measures also exists within the centrist group (166 seats). Meanwhile, the independent high council of public finance analysis suggests that parts of the budget are optimistic (here). Even so, PM Barnier will try to navigate this through parliament towards a vote, as failure could risk a rating agency downgrade with reviews due from Fitch Oct 11; Moody’s Oct 25 and S&P Nov 29. It is difficult to see the centrist group getting enough other votes to reach the required 289 seats even with amendments. However, Barnier will push hard and in the end this could see Barnier using the constitution to push through the 2025 budget without a formal parliamentary vote of approval.

· No confidence vote risk. However, if Barnier uses the constitution (ie Article 49.3) then this opens up the potential for a no confidence vote for the government. Without a majority of seats this is a high risk strategy for the government, where defeat could then see Macron trying to form a new government. However, the far right do not want to take power, as they focus on the 2027 presidential election and take the view that the French electorate will blame the current government for the fiscal mess. It is not certain that a no confidence vote leads to defeat for the government. Thus the 2025 budget could pass via a sequence of events, but the outcome of events is so uncertain that it is difficult to attach a probability to the various scenarios.

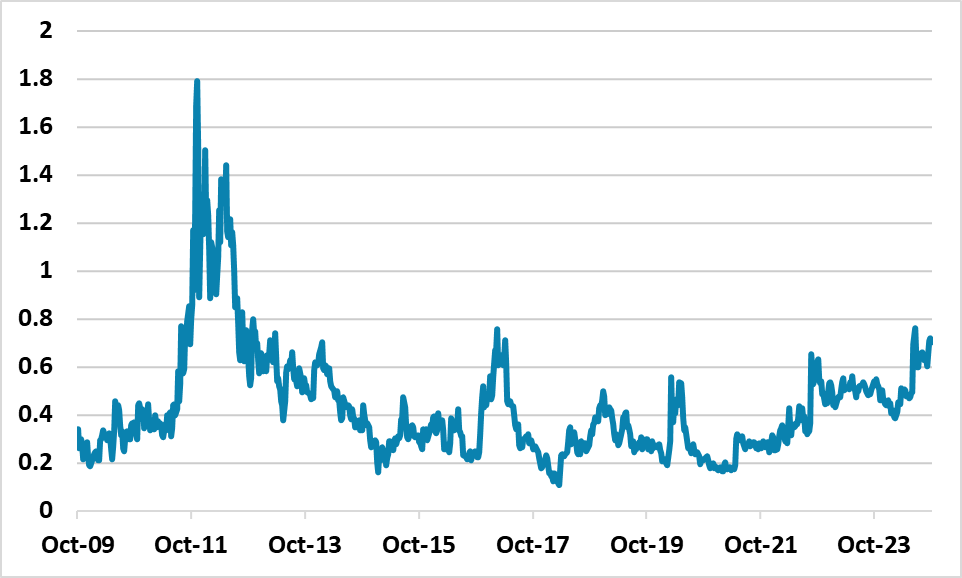

· Jitters for non-resident investors. BDF data (Figure 1) shows that non-residents held 52.7% of French government debt in Q1 2024. France has been successful in convincing foreign investors for decades, but this could now be a weakness. Most are investors from other EZ countries that face no currency risk, but do face interest rate risk if they need to sell before maturity. This has already prompted a widening of the 10yr French-German government bond spread with the surprise election and a minority government having to take power (Figure 2). If the budget is defeated, then another government could be formed, but Macron real hope would be a 2 parliamentary election after July 2025 – but the centrists are not sure of winning a majority! Budget and politics could unnerve non-resident investors. A single rating agency downgrade could worsen the situation and get non-resident examining whether the scale of their outstanding holdings of French government bonds is too high. In a real crisis, the super spike in the 10yr government bond spread above 100bps and towards 200bps is feasible. Our baseline is that the drama will likely push the spread to 100bps over the next 3-12 months.

Figure 2: 10yr France V Germany Government Bond Spreads (%)

Source: Datastream/Continuum Economics