Russian Economy Expands by a Strong 7.7% YoY in February

Bottom Line: According to preliminary figures announced by the Russian Ministry of Economic Development, Russia's GDP grew by 7.7% YoY in February after expanding by 4.6% in January, owing to strong fiscal stimulus, high military spending, invigorating consumer demand and investments. We foresee Russian economy will expand by a moderate 1.9% in 2024 due to lagged impacts of tightened monetary policy coupled with higher price pressures likely muting private spending growth and sanctions hurting oil and gas export revenues.

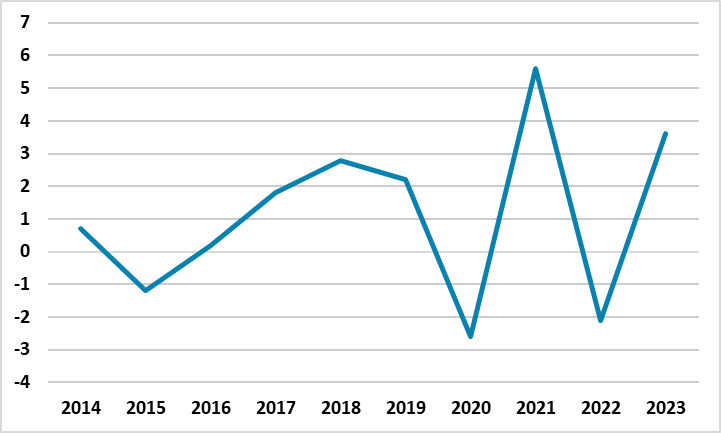

Figure 1: GDP Growth (%, Annual), 2014 - 2023

Source: Continuum Economics

After expanding by 3.6% YoY in 2023, Russian economy continued its strong growth pattern in February and grew by 7.7% YoY particularly due to fiscal stimulus, increased military spending and investment (gross fixed capital formation) coupled with strong household consumption, despite the economy remains strained by economic sanctions, high inflation, tight labor market conditions, and a volatile Ruble (RUB). (Note: The weakening of RUB accelerated particularly after March 11 as the currency lost 2.4% of its value against the USD between March 11 and April 10). Ministry of Economic Development estimated that seasonally adjusted GDP grew by 0.2% in February compared to January. According to announcement, the food services sector saw the strongest acceleration of growth by 8.9% YoY in February from 2.1% a month earlier. It appears growth figures are also driven by

In the meantime, it is worth mentioning that Rosstat revised Q4 2023 growth figure down to 4.9% YoY from the previously announced 5.1% while lifting Q3 growth rate to 5.7% from 5.5%.

Speaking about the growth figures, Russia’s first deputy prime minister Belousov said on April 10 that the GDP may grow slightly above the official forecasts since PMI and consumer demand are higher than expected so far in 2024. (Note: According to the official forecast by the Ministry of Economic Development, Russian GDP is predicted to expand by 2.3% in 2024-2025, and by 2.2% in 2026).

Additionally, Central Bank of Russia (CBR) Governor Nabiullina stated on April 10 that “Russian economy continue to grow rapidly - fears that raising the key rate would end the economy were not justified. Economic growth declined marginally in Q4, but figures reveal that the economy continues to grow at a high rate in Q1 of this year.”

We foresee Russian economy to grow by a moderate 1.9% and 1.1% in 2024 and 2025, respectively, taking into account strong monetary tightening is still feeding through with lagged impacts. Other factors threatening growth and likely lead to a partial slowdown in 2024 are severe staff shortages, falling trend in the utilization rates, higher price pressures likely muting private spending growth, and sanctions leading to a plummet in export revenues.

Despite risks to the growth trajectory, we also think the growth in H2 of 2024 can be partly stimulated by likely higher military spending taking into account that the military analysts foresee Russian offensive operations in Ukraine will likely intensify in the upcoming months, probably after late May or June. The war in Ukraine will continue to be the key determinant for the course of Russian economy in the near term.