Indonesia Q2 GDP Review: Resilient Economic Activity

Bottom line: Indonesia's Q2 GDP growth is expected to ease to 5% yr/yr. While government consumption is expected to have remained stable, moderation in Indonesia's external sector will hold growth back. Additionally, with no longer the boost from festive demand, private consumption is also expected to have normalised during the quarter.

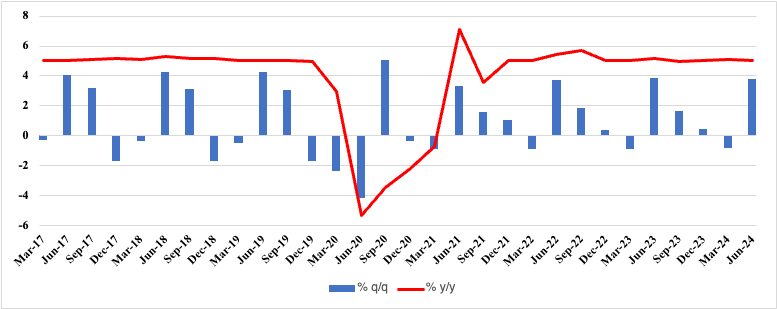

Figure 1: Indonesia Real GDP Growth (%)

Indonesia's economy continued its resilient trajectory in the second quarter of 2024, with real GDP growth clocking in at 5.05% yr/yr. The slight moderation from 5.1% yr/yr in Q1-2024 was commensurate with out view. A significant contributor to this growth was household consumption, which rose by 4.9% yr/yr. This increase was bolstered by festive season spending, underlining the critical role of domestic demand in Indonesia's economic landscape. Meanwhile, investment also played a pivotal role, expanding by 4.43% yr/yr. Notably, expenditure on machinery and equipment surged, indicating a recovery in business confidence and a focus on enhancing production capabilities. The trade sector showed robust performance with exports rising by 8.28% and imports climbing by 8.57% annually. This net positive contribution from trade indicates a dynamic exchange of goods and services, although it reflects a broader trend of global economic recovery post-pandemic.

In contrast, government spending grew by only 1.42% in Q2, a significant deceleration compared to previous periods. This slowdown, however, was effectively offset by the robust performance in household consumption and investment. The data suggests that while fiscal policy support has waned, the private sector has stepped up to sustain economic momentum. On a quarter-on-quarter basis, GDP advanced by 3.79% q/q. This quarterly expansion underscores the economy's steady recovery path, albeit with some signs of deceleration.

In terms of sectoral performance, agriculture output expanded at a sharper pace, bolstered by favourable weather conditions and strong domestic demand. The financial and insurance sectors also experienced significant growth, driven by increased financial inclusion and rising demand for financial products. The expansion of digital banking services further accelerated this sector's development. Conversely, the public administration sector experienced a sharp decline in output, mirroring the deceleration in government spending. Both the mining and manufacturing sectors faced slowdowns during the quarter. The mining sector's performance was affected by lower global commodity prices, while the manufacturing sector struggled with supply chain disruptions and softer demand in key export markets.

Despite the strong H1 performance, concerns linger about the sustainability of this growth. High interest rates, lower commodity prices, and subdued global growth could weigh on Indonesia's economic prospects in the coming months. Consequently, there is anticipation that Bank Indonesia may initiate a monetary easing cycle by October, aiming to stimulate further economic activity amid receding inflationary pressures. We anticipate sustained economic activity though over the course of H2-2024. Our forecast of 5.1% yr/yr growth in 2024 remains unchaged.