India Inflation Review: Sticky Prices to Keep RBI Cautious

India’s consumer price inflation eased amrginally to 4.83% yr/yr in April, reflecting lower fuel and light prices. The government cut prices of LPG cylinders in India ahead of the elections. However, food price pressures persist despite various supply side measures, underscoring the sticky nature of prices.

India's consumer inflation dropped to its lowest level in 11 months, reaching 4.83% yr/yr in April, compared to 4.85% yr/yr in March. However, there was a significant surge in food prices, hitting a four-month high. Food inflation jumped to 8.7% from March's 8.5%, particularly impacting rural consumers who experienced an even sharper increase of 8.75% in food prices.

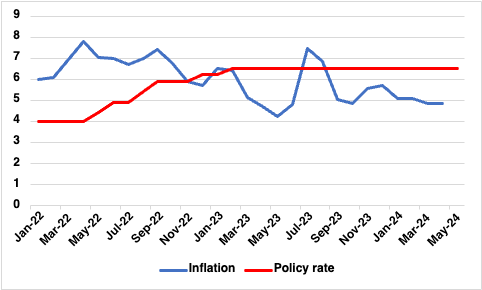

Figure 1: India CPI Inflation and Main Policy Rate (%)

This persistent elevation in food prices is a growing concern for policymakers and households alike, which also prompted the RBI's monetary policy committee to keep the policy repo rate unchanged at 6.5% on April 5, marking the seventh consecutive steady rate decision. RBI Governor, Shaktikanta Das emphasised in a press conference on April 4 that while progress has been made in curbing inflation, the task is not yet complete. Despite various measures, including restrictions on the export of essential food items such as rice, wheat and sugar, prices of these staples remained high. On May 4, the government lifted its ban on onion exports, citing normal availability, stable prices and robust output from the winter-sown crop. This decision is expected to benefit traders and farmers, especially in Maharashtra, the largest onion-producing state in the country, and comes alongside the ongoing elections in India. However, the government has imposed a minimum export price (MEP) of $550 per tonne plus a 40% tariff on outbound onion shipments, aiming to prevent excessive exports at low prices.

The disparity in inflation between urban and rural areas persisted for the second consecutive month, with rural households facing a 5.43% yr/yr rise in prices compared to urban consumers whose overall inflation rate remained nearly constant at 4.11% yr/yr. Month-on-month, prices increased by approximately 0.5% m/m, with urban consumers facing a more pronounced uptick in both overall prices and food items. Meanwhile, the moderation in inflation was supported by a decline in fuel and light prices. However, prices could trend upward in the coming quarter owing to heightened geopolitical tensions weighing on commodity prices, supply chain disruptions and a potential uptick in food prices. Given sticky nature of prices, and the risk of an erratic monsoon impacting rural demand and agriculture output, the RBI is unlikely to cut its interest rates over the coming quarter. We anticipate a small rate cut of 25bps in end-Q3 or early Q4.