Turkiye’s Closer to 70% Inflation in February Exceeds Expectations

Bottom Line: Turkish Statistical Institute (TUIK) announced on March 4 that Turkish CPI surged to 67.1% annually and 4.5% monthly in February, and annual inflation swung to a 15-month high due to increases in hotel, education and food prices. We feel upside risks remain strong which would likely continue drive the inflation in 1H of 2024, as the impacts of the aggressive monetary tightening are still feeding through. Despite the recent inflation readings put a pressure on the Central Bank of Turkiye (CBRT) to restart tightening cycle in the upcoming months, we foresee CBRT to hold the key rate constant at 45% in the next MPC meeting, which is scheduled for March 21, while CBRT would have to closely watch upcoming inflation figures.

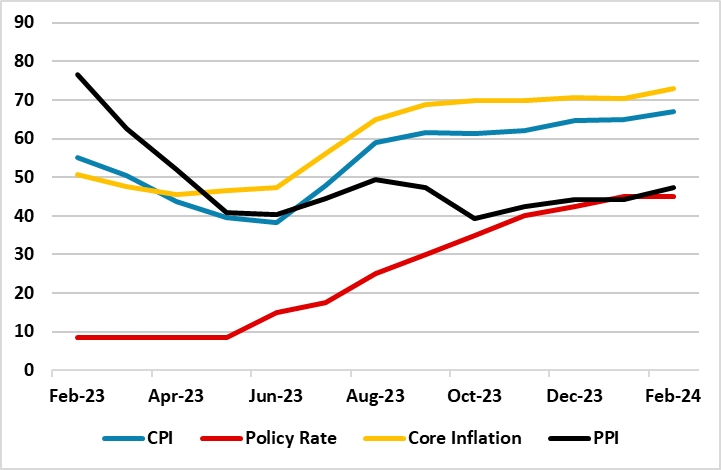

Figure 1: CPI, PPI, Core Inflation (YoY, % Change) and Policy Rate (%), February 2023 – February 2024

Source: Continuum Economics

When annual rate of changes (%) in the CPI’s main groups are examined in February, we see that clothing and footwear with 43.4% was the main group with the lowest annual increase while hotels, cafes and restaurants with 94.8% was the main group where the highest annual increase was realized. It is worth mentioning that education (91.8%), health (81.3%), and transportation (78%) also recorded significant YoY increases. Housing prices contributed 0.49 ppt to the monthly inflation due to uptick in the prices of construction materials and rents, while the food prices were the leading contributor with 2.03ppt.

Core inflation (CPI-C) recorded a strong 3.6% MoM increase, scaling up to 72.9% on an annual basis, particularly due to impacts of the public salary and minimum wage hikes, inertia in services and adjustment in administered prices. After domestic producer price index (PPI) hit 157.69% hike on annual basis in October 2022, domestic PPI stood at 3.7% MoM translating into 47.3% YoY in February demonstrating relative improvement in cost pressures in relation with the favourable commodity price changes and exchange rate developments.

Despite more-than-expected hike in the inflation, Turkish policy makers remained positive pointing out the end of year for a relief. Speaking about the inflation, Treasury and Finance Minister Mehmet Simsek indicated on March 4 that inflation would remain high in the coming months due to base effects and the delayed impacts of rate hikes, but would fall in the next 12 months. President Erdogan mentioned on March 3 that anti-inflation policies will begin to be felt in practice towards the end of the year. (Note: Inflation remains a pressing issue for the government, especially considering that the local elections will be held on March 31 and AKP wants to win back the control of major cities like Istanbul, Ankara and Izmir).

According to the CBRT’s summary of the MPC statement on February 29, normalization in loan growth and composition continue while the current loan rates are assessed to be in line with the targeted level of financial tightness. CBRT also announced that it maintains its 36% year-end inflation target and vowed to keep the key rate for longer to bring inflation down to the forecasted path. Despite this, CBRT appeared to remain concerned about the current level of domestic demand, the stickiness of services inflation, surging food prices, and geopolitical risks that keep inflation pressures.

Despite CBRT recently signalled that it has completed tightening cycle as the current key rate level will be enough to establish the disinflation course in the near term, stating that external financing conditions are improving, foreign exchange reserves are increasing, and the rebalancing process of the current account balance continues, we are of the view that there are strong signs that inflation will continue to stay high in the first half of 2024, as proved by the February data. (Note: We foresee favourable base effects would start relieving the pressure on the inflation from mid-year). Despite strong monetary tightening in the 2H of 2023, lagged impacts of the tightening cycle are still feeding through and we still see upside risks to the inflation outlook. We think recent hikes in salaries and pensions, strong course of domestic demand, deterioration in pricing behaviour, weakening currency, strong inflation expectations and surges in public spending before the local elections continue to ignite general level of prices.

We envisage that policy rate will be held constant at 45% in the next MPC meeting, which is scheduled for March 21. We think CBRT would only prefer to further tighten the monetary policy in case there is significant and persistent deterioration in inflation outlook, as the Bank recently underscored. In spite of that, recent inflation figures are significant warnings requiring CBRT to closely watch the inflation details in the near term.