U.S. March Retail Sales - Autos lead bounce ahead of tariffs

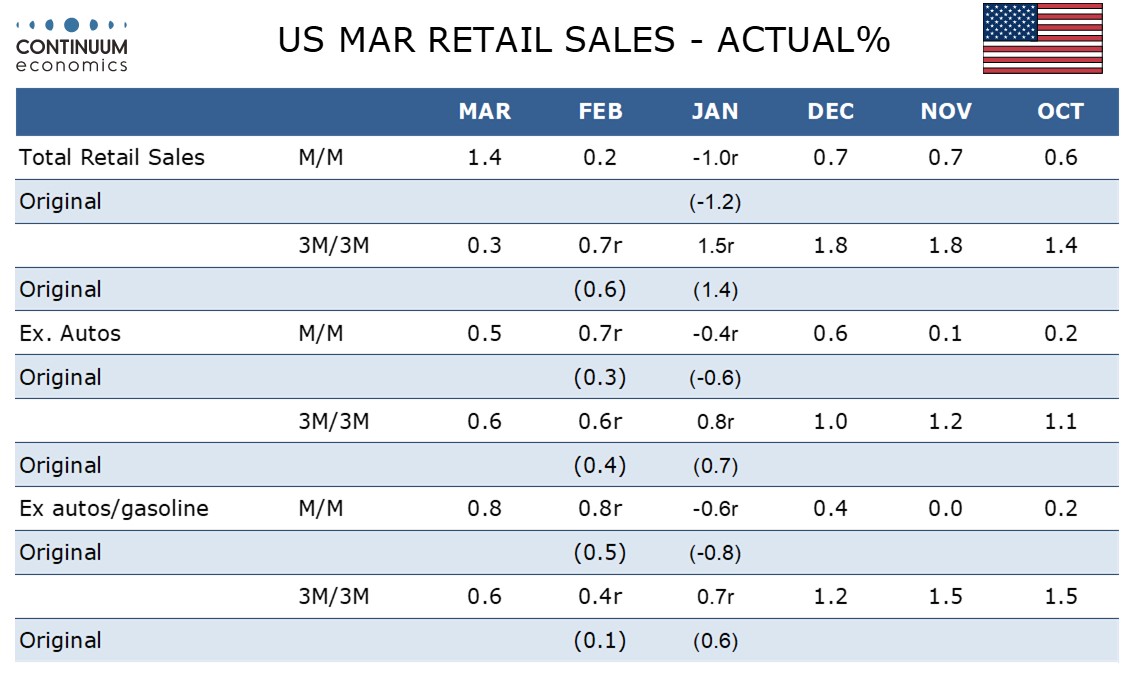

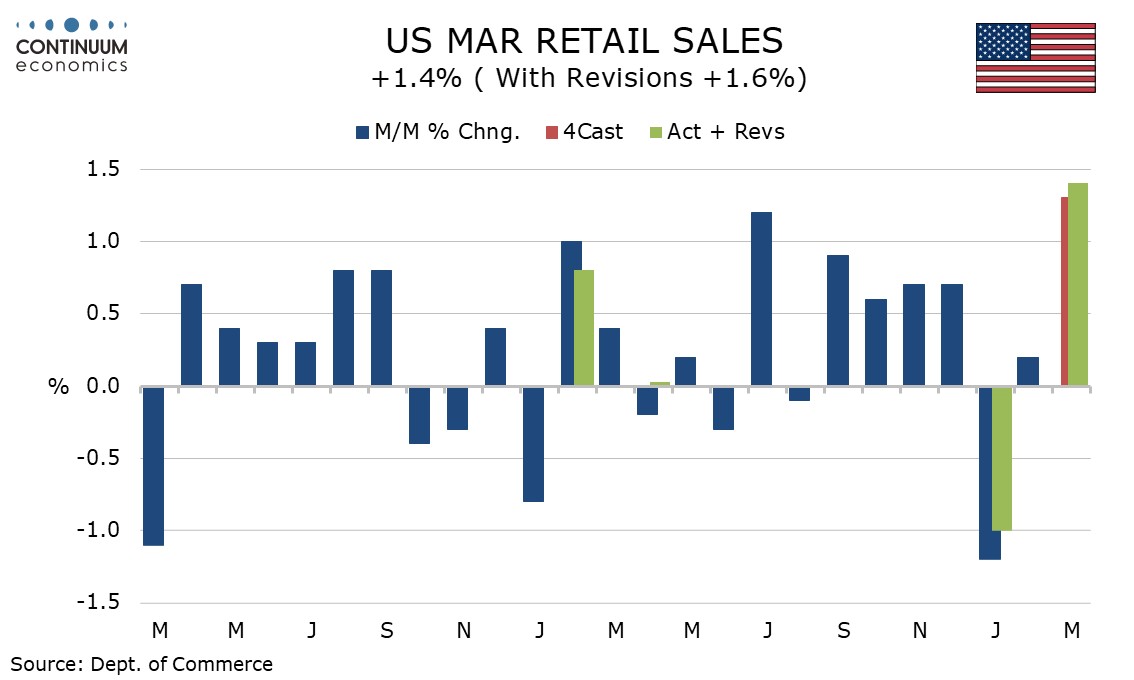

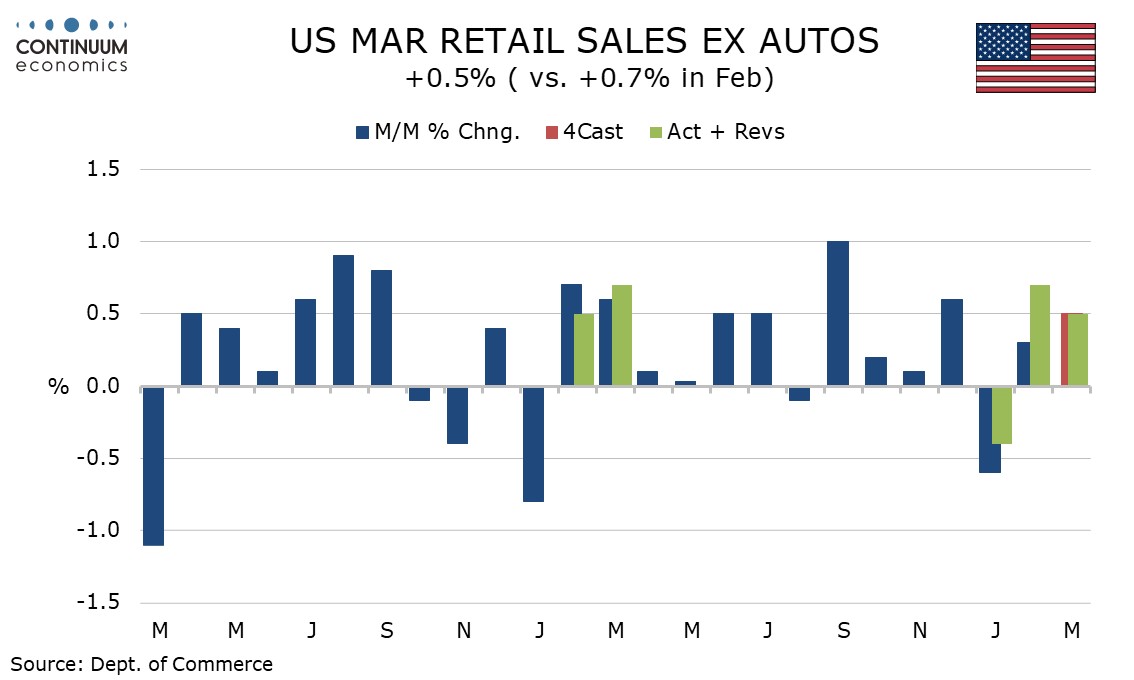

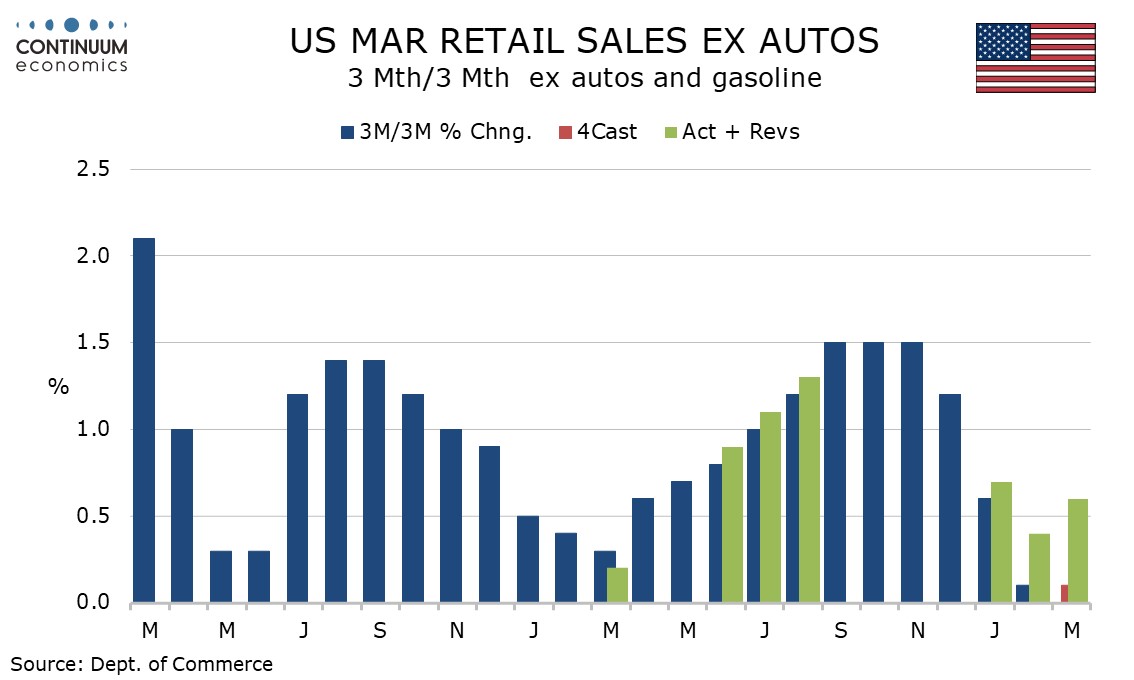

March retail sales with a gain of 1.4% is in line with expectations, led by a pre-tariff surge in auto sales. Gains of 0.5% ex auto and 0.8% ex auto and gasoline are on the firm side of expectations, though the control group, which contributes to GDP, was less impressive with a moderate rise of 0.4%.

Still, the control group gain follows an upwardly revised 1.3% rise in February. Net revisions were positive, modestly at 0.2% overall but stronger at 0.6% ex autos and 0.5% ex autos and gasoline.

Given a weak weather-hit January, the gains in the quarter were modest, 0.3% overall, 0.6% ex autos and 0.6% ex autos and gasoline, the weakest since Q1 2024 which also saw a weather-hit January.

A 5.3% rise in auto sales seems to be an attempt to beat expected tariff-induced price hikes. Building materials were also strong with a rise of 3.3% after five straight declines. This may have got a boost from weather, with a 1.8% rise in eating and drinking places also possibly boosted by weather. A 2.5% fall in gasoline sales was on price declines.

The strength of this report does not tell us much about the future. Q1 as a whole was modest and March sales probably borrowed something from Q2. The future depends on whether tariff-led price rises cause a slowing of demand, and whether a slowing in the labor market adds to downside risks.