UK CPI Preview (Nov 20): Inflation Back Above Target But Core Pressures Lower

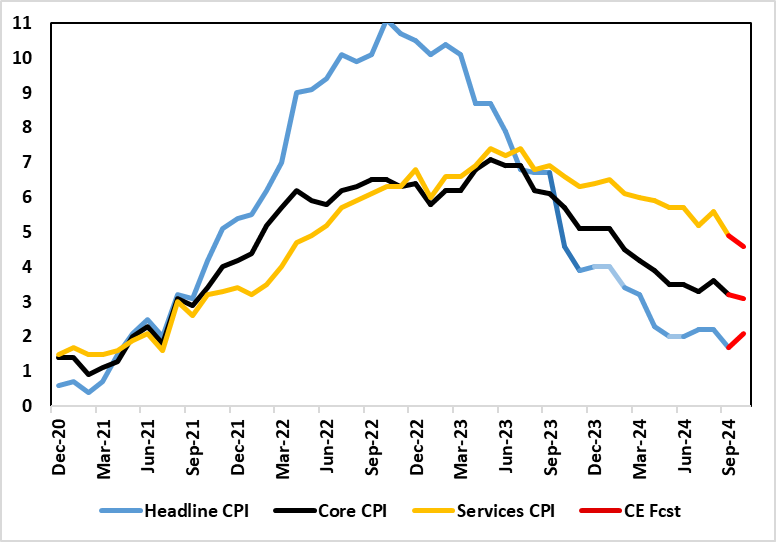

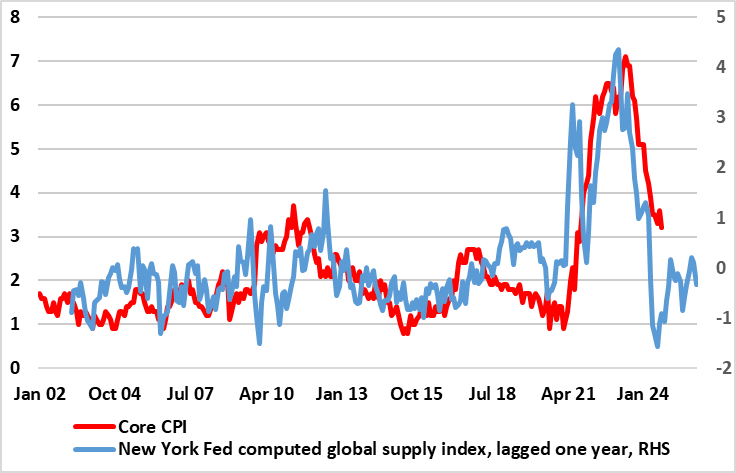

Helped by a fall in fuel prices and airfares, amplified by base effects, alongside some belated broader softening in services costs, UK inflation dropped to 1.7% in the September CPI (from 2.2%), thus falling below target for the first time since April 2021. This drop was greater than expected and included an unexpectedly large fall in services inflation to a 28-mth low of 4.9%, in turn dragging the core down 0.4 ppt to a cycle low of 3.2% (Figure 1). Admittedly, that drop in the headline is likely to be short-lived as last month’s rise in the energy price cap (partly dampened by a drop in fuel prices) should pull the headline rate back to around 2.1% in October and average a notch or two higher for the whole of Q4. Regardless, the data backdrop is consistent with underlying inflation having fallen, especially when assessed in shorter-term dynamics (Figure 2) and where supply side factors still suggest disinflation to continue (Figure 3).

Figure 1: Clear Inflation Drop in Core to Continue?

Source: ONS, Continuum Economics

The last CPI picture was weaker than BoE thinking by almost 0.5 ppt, and broadly so and made the much-vaunted Bank Rate cut at last week’s MPC meeting almost a given. But despite clear signs of abating price pressures, the MPC stuck to a gradualist easing outlook approach, partly based on what we think are optimistic assumptions about the Budget measures and perhaps an unwillingness to consider how much weak demand may yet add to a disinflation process driven by supply factors.

The Details

Consumer Prices inflation fell to 1.7% y/y in September 2024, with larger negative contributions from air fares and motor fuels; the largest offsetting upward contribution came from food and non-alcoholic beverages. Core CPI (excluding energy, food, alcohol and tobacco) slowed to 3.2% encompassing the CPI services annual rate falling from 5.6% to 4.9%. The drop came in spite of a pick-up in food inflation while the drop in services inflation has not yet be sustained enough to convince the BoE hawks that apparent price resilience is starting to ebb; one driven by a fall in restaurant/hotel inflation, this often seen as a bellwether indicator of price persistence.

BoE Needs More Disinflation Evidence?

The headline measure of services inflation has been driven mainly by volatile and indexed categories of late, so the MPC has built a gauge that excludes those categories and this has seemingly fallen more markedly and now for a few months in a row. Moreover, looking at shorter-term price dynamics, services inflation has fallen towards a near-target rate, this in turn pulling core measures even lower, either on a smoothed m/m basis or the 3-mth ann rate favored by the BoE (Figure 2). Moreover, around 0.5 ppt of services inflation is a result of rising rents, something some (not least ourselves) suggest is pro-cyclical element of the BoE policy stance. But this has not persuaded BoE Chief Economist Pill from citing policy caution ahead about how gradual a rate easing cycle may be. But amid a much sifter inflation backdrop now emerging, albeit one we have stressed as being likely, it may actually be real economy matters that determined the pace of BoE easing ahead.

Figure 2: Adjusted Core CPI Pressures Falling Afresh

Source: ONS, Continuum Economics, smoothed is 3 mth mov average

How Restrictive?

Regardless, the BoE will probably agree with us that much of the recent (and possibly looming) disinflation is supply driven (Figure 3 shows the extent to which easing global supply pressures as computed by the New York Fed has probably driven UK underlying inflation – both up and now down). This means that even with some reduction in the excess supply picture evident in the November Monetary Policy Report, domestic price pressures should add to this easing in supply strains – hence the only slightly and deferred below target inflation outlook the BoE last week looks pessimistic. Regardless, the extent to which the BoE must consider how restrictive policy must be with the clear proviso that even with the scale of cuts markets currently discount policy would still be far from neutral.

Figure 3: Global Supply Pressures Suggest Clear Fall in Cost Backdrop?

Source: NY Fed, ONS, CE