Eurozone Flash GDP Review: Momentum Missing as Divergence Continues?

After a series of upside surprises, EZ GDP both weakened and undershot both consensus and ECB expectations in Q4 (Figure 1). There is a certain irony that for an ECB Council that has evidently shifted its main concern away from broadly falling inflation to real economy weakness, the soft Q4 GDP outcome may make little difference to the ECB’s thinking. Indeed, the ECB may draw some comfort that there does appear to be further signs of a consumer recovery given the messages in some national data, albeit with continued weakness regarding capex. But if the ECB regards the Q4 data as being history, we suggest that the flat quarterly reading reflects actual m/m declines in late Q4, thereby highlighting a clear loss of momentum into the current year that chimes with weak business survey data (Figure 2). Moreover, the GDP numbers continue to suggest an EZ economy that is still diverging as Germany stutters while Spain prospers, with EZ survey data suggesting that political uncertainty is now affecting economic prospects and accentuating growth disparities.

Figure 1: Divergent EZ GDP Picture Clearer?

Clearer Divergences Geographically…

Indeed, the latest ECB Bank Lending Survey (BLS), while it showed further signs of a recovery in demand for credit, also suggested a fresh tightening in both rejection rates and credit standards by banks that could nullify some of that rise in credit demand. Troubling for the ECB is that rise in credit standards largely reflected added perceived risks by banks in Germany and France based around political concerns with standards actually falling in Italy. It seems that the divergence in growth that looming Q4 GDP data may further highlight is also evident in credit and bank thinking, the question being whether it may act to extend, if not accentuate, what are already clear EZ growth fragilities and disparities

…And by Sector

Notably, the Q4 data were softer than both ECB and consensus thinking and as suggested above, very much consistent with the various economies still seeing contrasting fortunes (Figure 1). This contrast reflects the varying size of the industrial sectors in these economies with those with the larger services (eg Spain) prospering more than those more reliant on recession-bound manufacturing (eg Germany). But the message from surveys is that hitherto solid services (which have been the main support to growth of late seems to be slowing). Indeed, while less weak in January readings, the extent and breadth of the slowing in PMI and European Commission survey numbers, has clearly perturbed the ECB, both by signalling downside risks to real activity that may actually be materializing but also in highlighting softer cost and price pressures.

Momentum Lost?

While the ECB may draw some comfort from signs of a Q4 further recovery in consumer spending, possibly a hint that disinflation has persuaded households to run down what seem to be elevated savings, there seems to be general loss of momentum nonetheless, led by continued weakness which may now be spilling over into weak exports. Indeed, this may mean that the recovery the continued consumer recovery the ECB sees through the coming year may falter as the declines in household savings it is partly based upon may already have occurred. Moreover, the risks are that the whole of the EZ is weakening given the possibly gloomier messages from business survey data into the current quarter with it likely that the flat Q4 GDP reading actually reflected fresh GDP declines as the quarter finished.

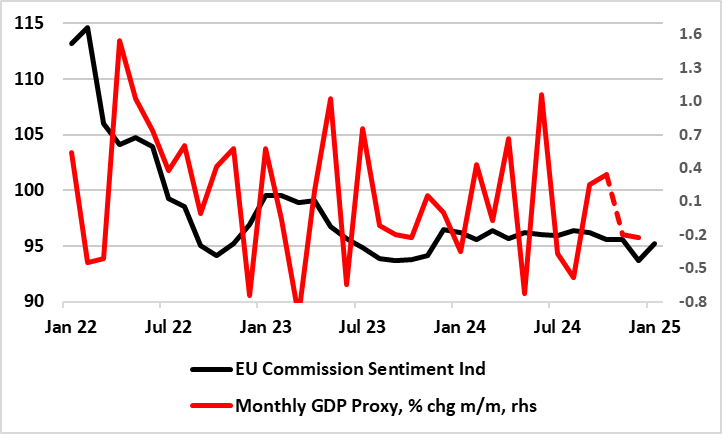

Figure 2: Flat Q4 Implies Fresh GDP Declines as Surveys Suggest

Source: Eurostat, European Commission; dashes are CE projection

GDP Flash Shortcomings

Amid a paucity of reliable data, it is important to recognize that there are clear shortcomings to the flash estimate for EZ GDP. No details come with these flashes and they are prone to clear revisions, where even a 0.1 ppt change can be very meaningful when the economy is hardly growing. They are based on incomplete activity numbers with usually only one monthly published value for services and two for construction and manufacturing. However, aggregating these three output sectors allows the creation of a monthly GDP proxy, albeit a figure that is volatile far from tallies with actual GDP outcomes. Ever so, this suggest that after positive outcomes early in Q4, to get a flat overall reading for the quarter implies that monthly GDP probably fell in both/either Nov/Dec (Figure 2). If so, this chimes with the survey data suggesting an adverse base effect in Q4, pointing to a loss of momentum spilling over into the current quarter that endangers the ECB’s upbeat outlook for this quarter (ie 0.3% q/q) the year and especially for its 2025 view.

At face value, the Q4 flat q/q outcome is still consistent with the central bank’s 0.7% 2024 projection but questions (as we have done for some time) whether the recently pared-back 1.1% official 2025 forecast is still too optimistic. Indeed, we see 2025 growth of just 0.8%! While the ECB may be reluctant to offer clues to the policy outlook after the Council meeting verdict today, likely further real activity downgrades it will likely make at the March meeting obviously have policy implications.