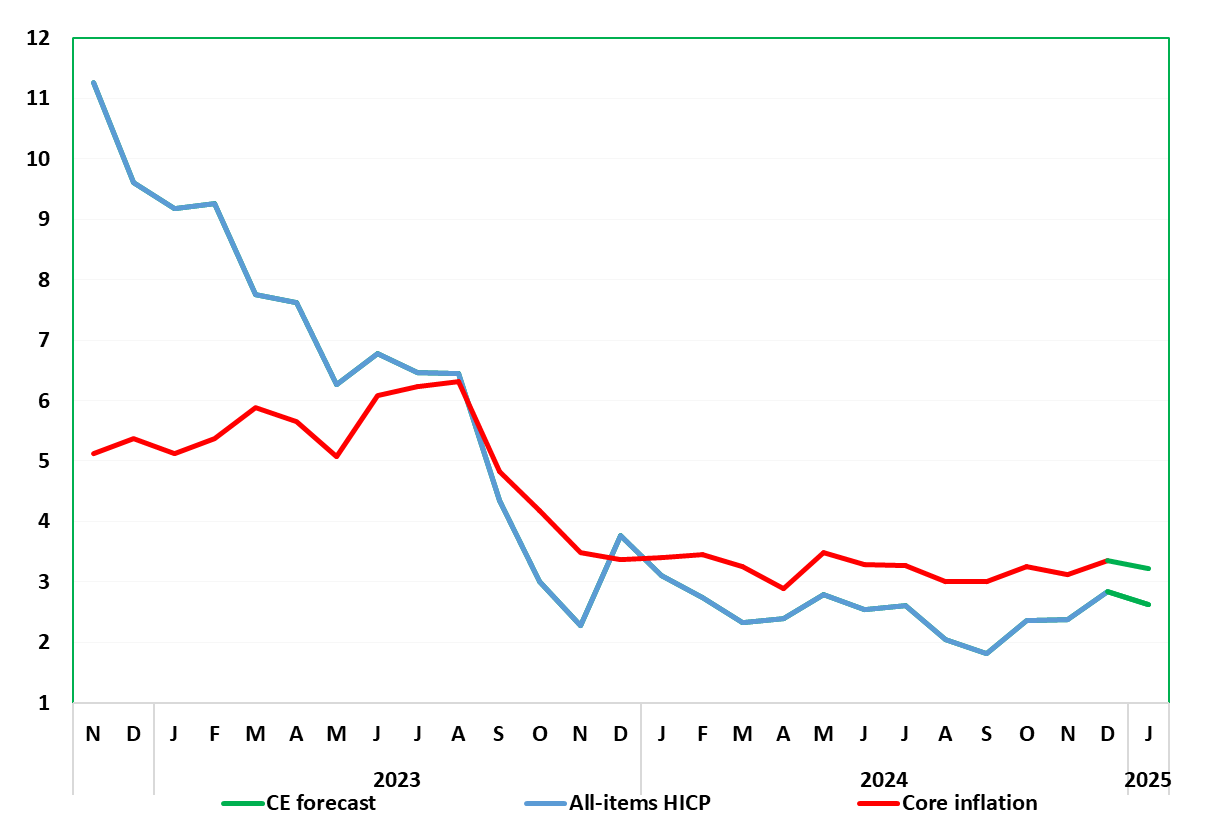

German Data Preview (Jan 31): Services Inflation Slows Belatedly?

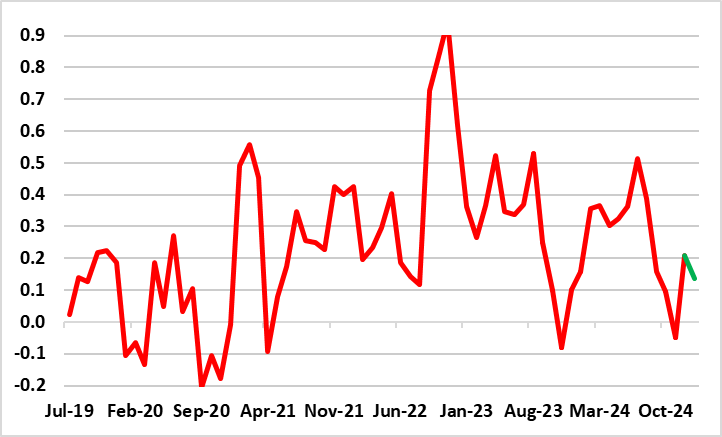

Germany’s disinflation process continues, but there are signs that the downtrend is flattening out and this may be the message into the rest of 2025. After a largely energy but a still relatively broad rise to an 11-mth high of 2.8% in December, we see the rate down 0.2 ppt to 2.6% in the preliminary January reading (Figure 1). The core rate may drop 0.1 ppt reversing half the rise to 3.3% see last time around, which was indicative of resilient services inflation. The drop this time will be partly energy induced but also reflect some easing in services, with friendlier short-term price dynamics (Figure 2)!

Figure 1: Services Inflation Persistence Less Evident?

Source: German Federal Stats Office, CE, % chg y/y

While a further fall in the next month beckons, again due to energy base effects, survey data are pointing not only to more real economy weakness but significant falls in cost and output price pressures. This chimes with weak adjusted core CPI readings from Germany (Figure 2), something we think continued in the January data. Overall, we see HICP headline inflation averaging around, if not just under 2% this year!

Figure 2: Seasonally Adjusted Core Rate Still Very Weak?

Source: German Federal Stats Office, CE, % chg m/m adjusted and smoothed