Indonesia CPI Review: CPI Returns To Positive Territory

Indonesia's inflation reached a three-month high and returned to positive territory in March, recording 1.03% yr/yr. The rebound was driven by the expiry of a government electricity discount program and seasonal demand during Ramadan. The housing and utilities category saw the highest price increase (+8.45% m/m), while food prices rose modestly (+1.24% m/m), suggesting possible pressure on consumer purchasing power. The full-year inflation forecast remains at 2.0%.

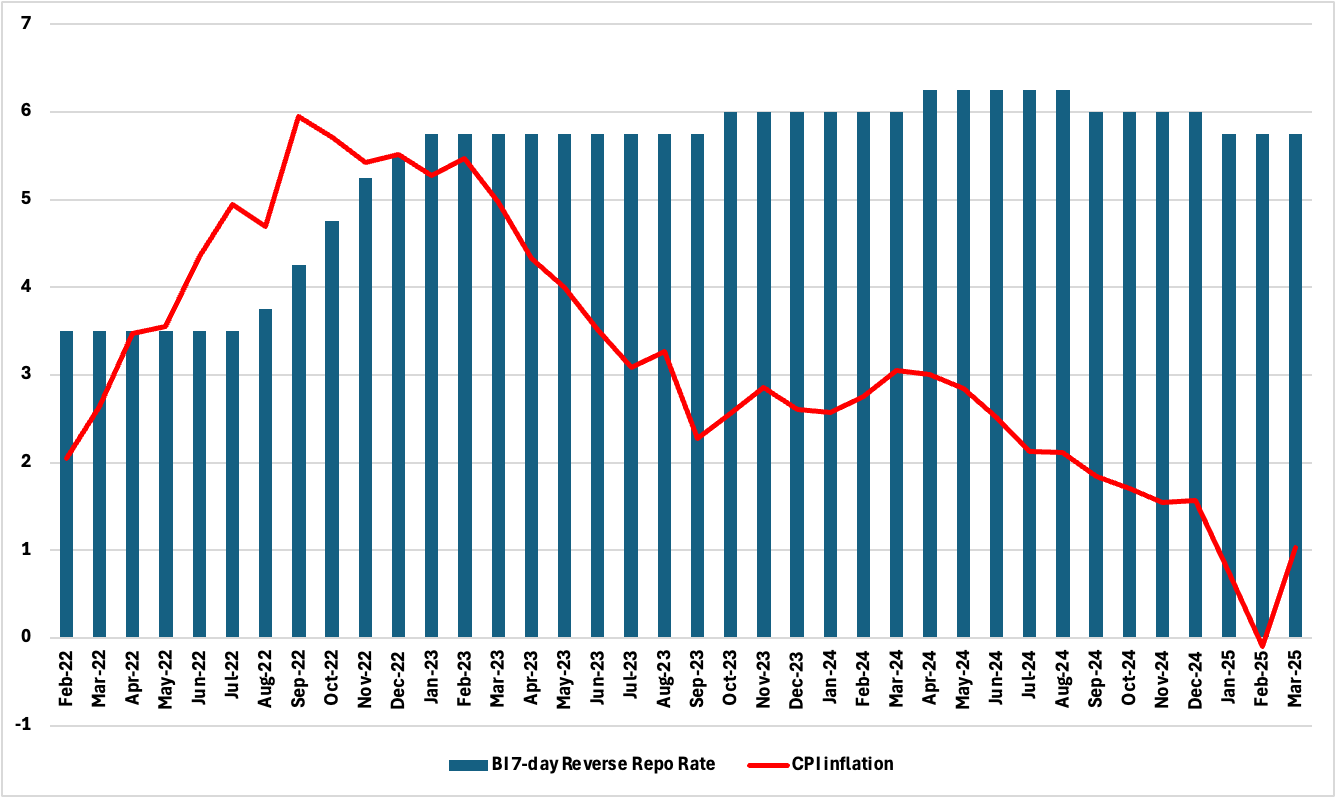

As anticipated, Indonesia’s inflation accelerated sharply in March 2025, rebounding from a period of deflation as government subsidies expired and Ramadan-driven consumption picked up. According to the latest data from Badan Pusat Statistik (BPS), consumer prices rose 1.65% m/m, reversing the -0.17% m/m decline seen in February. On a yr/yr basis inflation also turned positive to 1.03% in March, compared to a deflationary -0.09% in February. While this marks a return to normal price growth, the low y/y figure remains unusual for Indonesia, typically only seen in periods of crisis.

Figure 1: CPI Inflation and Key Policy Rate (%)

The reacceleration was largely driven by the expiry of the government’s two-month electricity rate discount, which had helped suppress inflation in January and February. The program—administered by state-owned electricity firm PLN—provided a 50% rate cut to households using up to 2,200 VA, covering approximately 97% of the customer base. With IDR 12.1 trillion (USD 755 mn) budgeted for the initiative, it is estimated to have benefitted over 81 million households. Though officially ended in February, post-paid customers continued to enjoy the benefits into March, with some of the inflationary effects expected to spill over into April.

The end of the electricity discount pushed up prices in the housing, electricity, water and household fuel category by 8.45% m/m in March, making it the largest contributor to headline inflation. Utilities deflation slowed to 4.86% y/y in March from 12.08% in February.

Ramadan-related spending also played a role in driving up prices, particularly in the food, drinks and tobacco category, which rose 1.24% m/m. The increase, however, was slightly more subdued than usual for the fasting month. Staples such as onions, fresh fish, chili, and chicken led food price gains. Clothing and footwear prices increased by 0.45% m/m, in line with seasonal buying ahead of the Idul Fitri holiday. Surprisingly, the transportation category recorded deflation. The decline was attributed to a government-mandated cut in domestic airfares by 13–14%, applicable from late March through early April. These discounts, along with earlier reductions in fuel prices, reflect the government’s ongoing efforts to protect purchasing power amid VAT increases introduced earlier this year.

Despite the volatility in headline inflation, core inflation remained steady. Core inflation stood at 2.48% y/y nearly unchanged from February. This stability suggests consumers are still spending on non-subsidised goods and services, although recent government support measures may be masking underlying weakness in household finances.

In summary, the March inflation data reflect a shift back to price growth following temporary deflation, driven primarily by subsidy expiry and seasonal consumption. While headline inflation is expected to stay elevated in April due to continued post-paid electricity impacts and Idul Fitri demand, softer food inflation and subdued transport activity raise questions about the strength of consumer demand. For now, the outlook for full-year 2025 inflation remains unchanged at 2.0% y/y.