Bottom Line: Fed easing expectations have been reset to higher for longer. However, softer real sector data, plus less worrying inflation monthly outcomes, can rebuild easing expectations. We see the first 25bps coming at the September 19 FOMC meeting and around this time a noticeable increase in easing expectations can occur for the following 3-18 months.

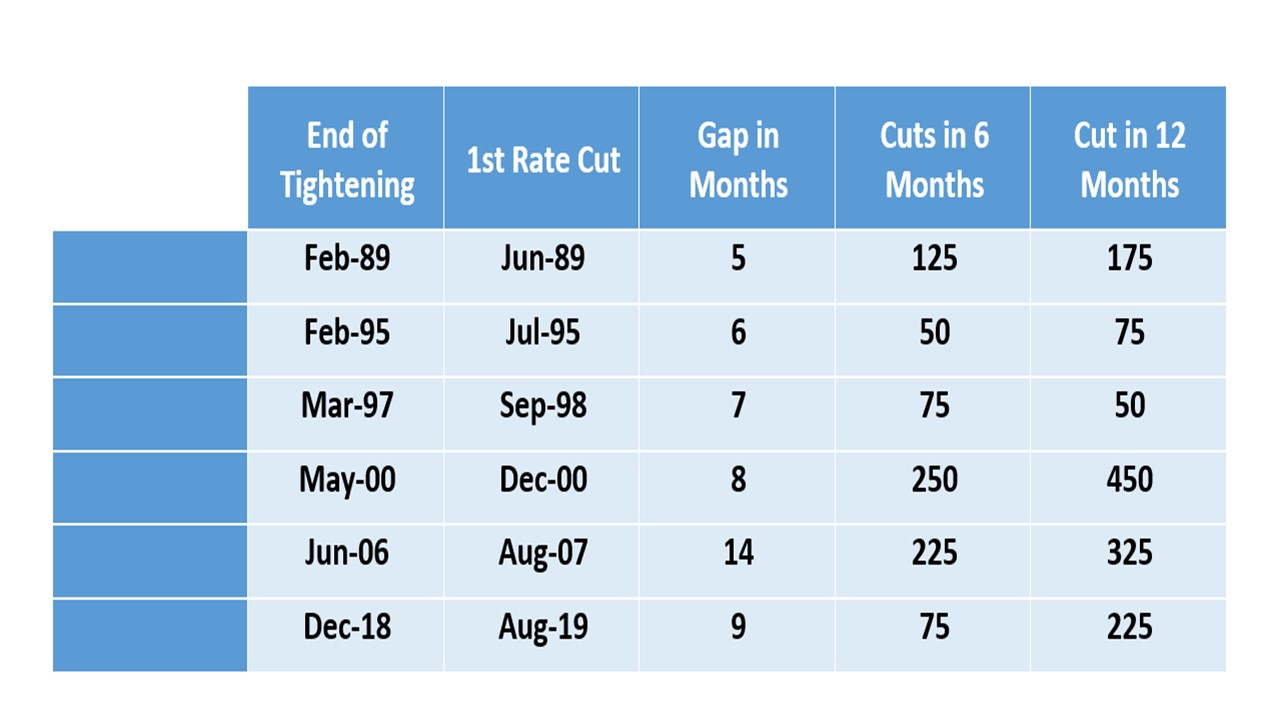

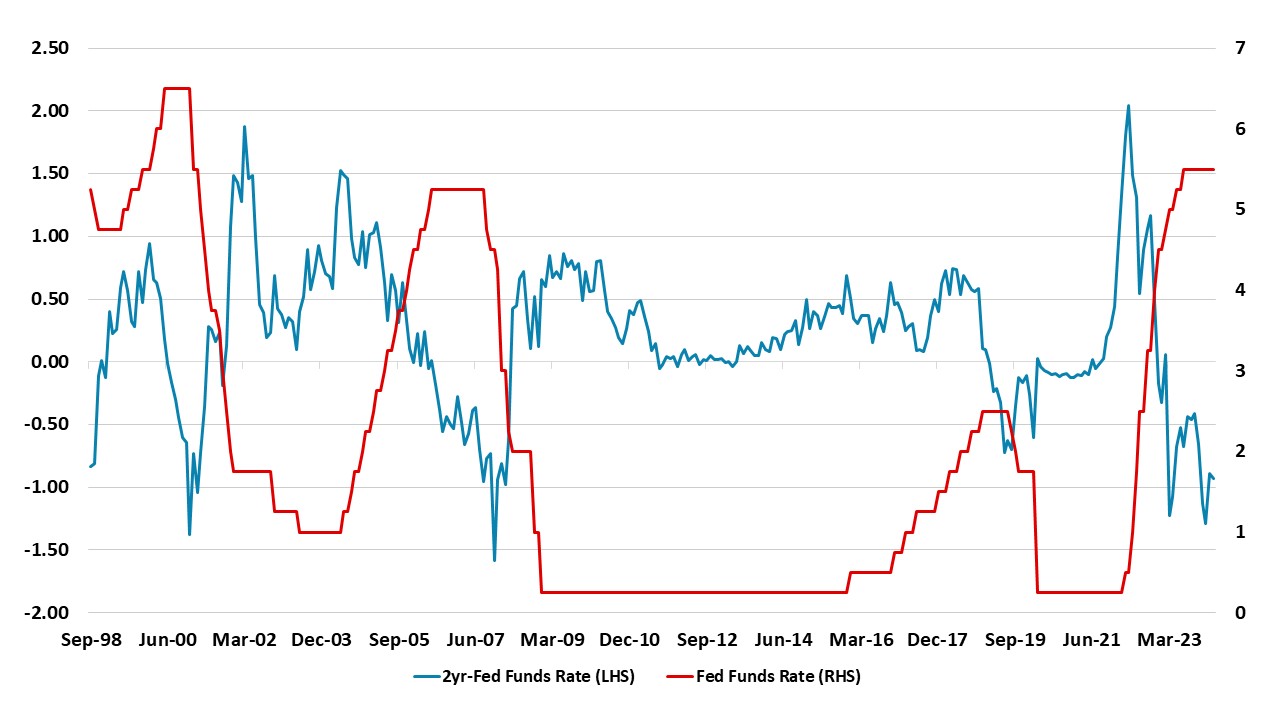

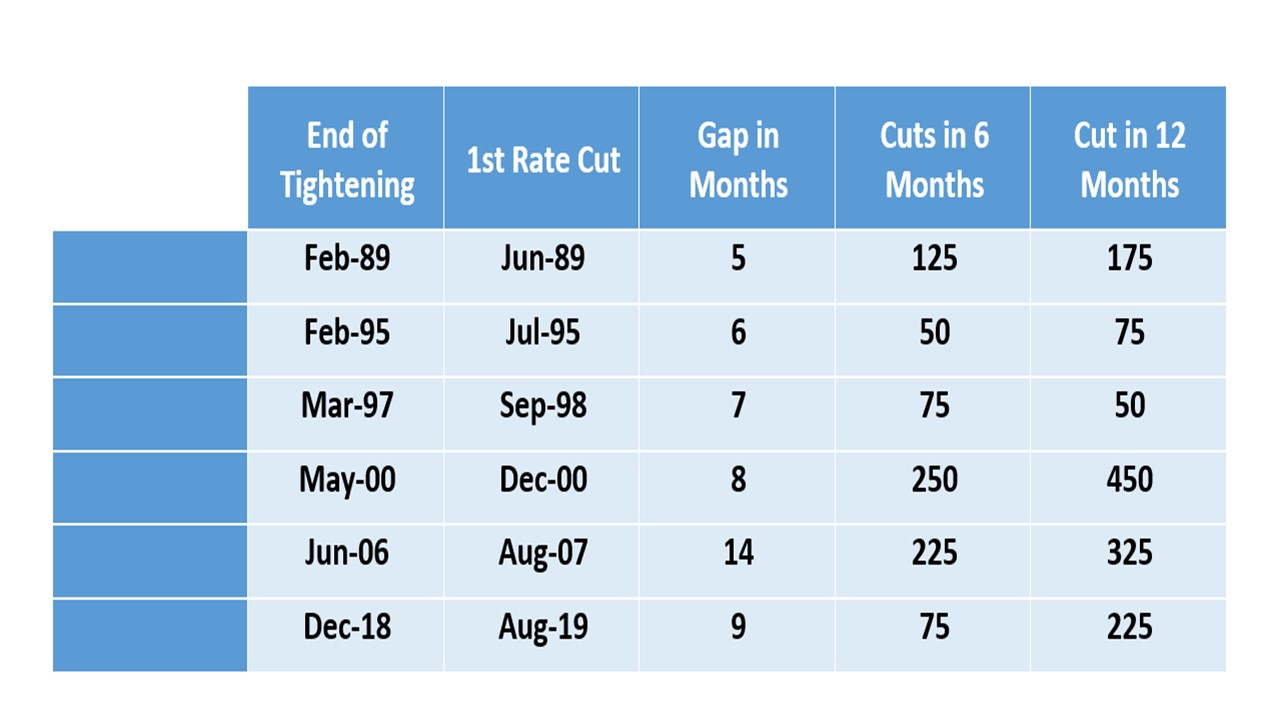

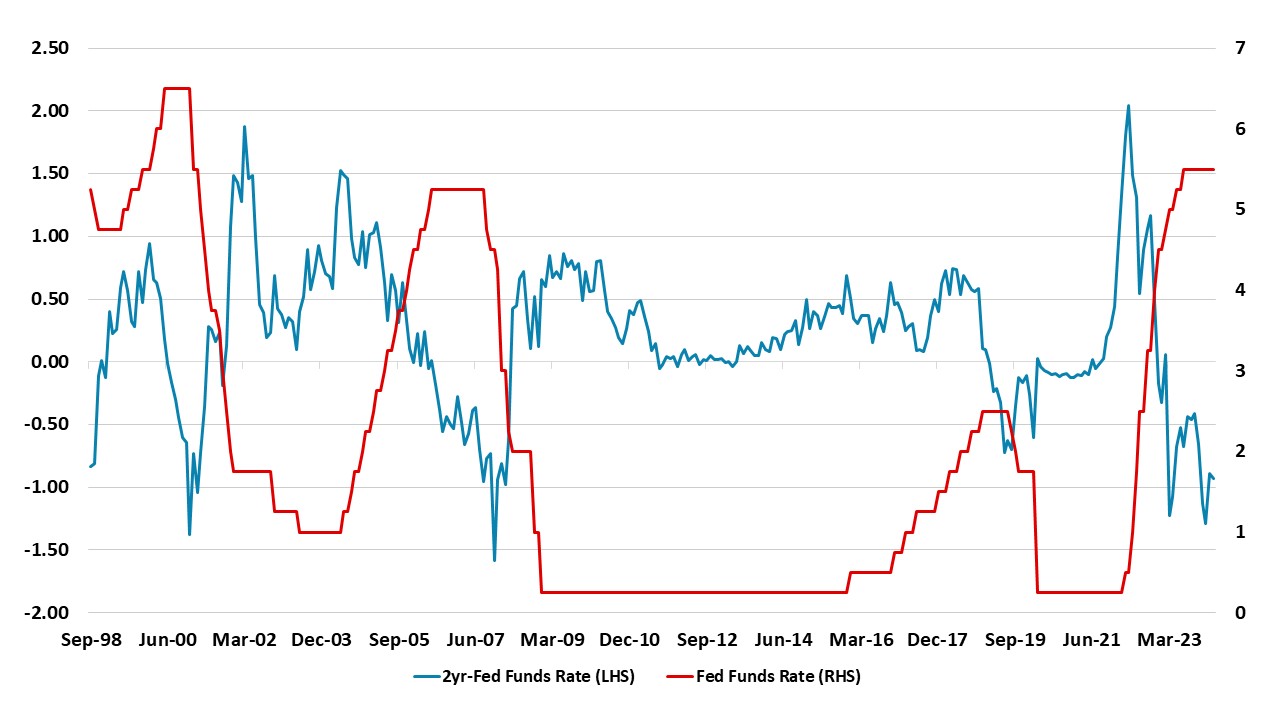

Figure 1: Previous Fed Easing Cycles  Source: Continuum Economics U.S. money markets accept the higher for longer narrative, with only one 25bps cut currently discounted this year at the November 7 FOMC meeting. Further out only 130bps of cumulative easing is seen in the next 2 years and the Fed terminal policy rate expected to be in the 3.75-4.00% region. Fed speakers have set these expectations against a backdrop of a robust economy and stubborn inflation figures in Q1. However, this set of expectations is unlikely to last and we see expectations as volatile and data driven. A number of points are worth considering• Tightening lags. The aggressive tightening in the 2022-23 period is still feeding through. Some have argue that policy is less effective than in the past, as households mortgages have largely been refinanced to low interest rates in the post GFC era and the household sector is so wealthy. However, households also have borrowing for autos and other reasons that are more sensitive to rate hikes. Housebuilding is also being hurt by restrictive policy. Meanwhile, though the Fed senior loan officer survey shows a less negative lending environment than 2023 (here), conditions are still tighter than the 2011-19 period and suggests that lending constraints are a modest headwind.• Economy/Inflation. The economy is showing signs of slowing in April and now the May figures will be crucial to understanding whether the economic picture could shift from robust to slowing. U.S. consumers have largely exhausted excess pandemic savings, while exports are not helped by the strong USD. Meanwhile, April CPI has been more controlled and the focus shifts to the May figures, plus the softening of the labor market and future wage inflation trends and the ability of companies to pass on price increases. We forecast a softening of the economy in H2 2024 and core PCE inflation falling below 2.5% later in the year. This will likely build the case for Fed easing from currently restrictive policy. We look for three cuts in 2024 starting with September based on some increase in the unemployment rate and slower inflation. • 1st cut and more confidence on rate cutting cycle. The 1st cut from the Fed should then build confidence about more cuts in the following 3-18 months. Previous Fed easing cycles since the 1980’s have been quick (Figure 1). Also once the Fed starts easing, then Fed communications will likely encourage more easing ideas. Current policy is restrictive with the Fed SEP long run estimate of the Fed Funds rate at 2.6%. We can see money markets swing to discount 200bps of cumulative easing by early 2026. For traders this reset of expectations will largely occur closer to the 1st cut, which we see at the September 19 FOMC meeting and guidance of a cut could only arrive early September after the August employment report. For asset allocators, this means a summer of opportunity to prepare for a repricing to occur late summer/September, which can bring government bond yields down. 2yr U.S. Treasury yields to the Fed Funds rate are currently at less of a discount than prior to the 2000 or 2007 easing cycle (Figure 2).

Source: Continuum Economics U.S. money markets accept the higher for longer narrative, with only one 25bps cut currently discounted this year at the November 7 FOMC meeting. Further out only 130bps of cumulative easing is seen in the next 2 years and the Fed terminal policy rate expected to be in the 3.75-4.00% region. Fed speakers have set these expectations against a backdrop of a robust economy and stubborn inflation figures in Q1. However, this set of expectations is unlikely to last and we see expectations as volatile and data driven. A number of points are worth considering• Tightening lags. The aggressive tightening in the 2022-23 period is still feeding through. Some have argue that policy is less effective than in the past, as households mortgages have largely been refinanced to low interest rates in the post GFC era and the household sector is so wealthy. However, households also have borrowing for autos and other reasons that are more sensitive to rate hikes. Housebuilding is also being hurt by restrictive policy. Meanwhile, though the Fed senior loan officer survey shows a less negative lending environment than 2023 (here), conditions are still tighter than the 2011-19 period and suggests that lending constraints are a modest headwind.• Economy/Inflation. The economy is showing signs of slowing in April and now the May figures will be crucial to understanding whether the economic picture could shift from robust to slowing. U.S. consumers have largely exhausted excess pandemic savings, while exports are not helped by the strong USD. Meanwhile, April CPI has been more controlled and the focus shifts to the May figures, plus the softening of the labor market and future wage inflation trends and the ability of companies to pass on price increases. We forecast a softening of the economy in H2 2024 and core PCE inflation falling below 2.5% later in the year. This will likely build the case for Fed easing from currently restrictive policy. We look for three cuts in 2024 starting with September based on some increase in the unemployment rate and slower inflation. • 1st cut and more confidence on rate cutting cycle. The 1st cut from the Fed should then build confidence about more cuts in the following 3-18 months. Previous Fed easing cycles since the 1980’s have been quick (Figure 1). Also once the Fed starts easing, then Fed communications will likely encourage more easing ideas. Current policy is restrictive with the Fed SEP long run estimate of the Fed Funds rate at 2.6%. We can see money markets swing to discount 200bps of cumulative easing by early 2026. For traders this reset of expectations will largely occur closer to the 1st cut, which we see at the September 19 FOMC meeting and guidance of a cut could only arrive early September after the August employment report. For asset allocators, this means a summer of opportunity to prepare for a repricing to occur late summer/September, which can bring government bond yields down. 2yr U.S. Treasury yields to the Fed Funds rate are currently at less of a discount than prior to the 2000 or 2007 easing cycle (Figure 2).

Figure 2: 2yr-Fed Funds Spread (LHS) and Fed Funds (RHS) (%)

Source: Continuum Economics