China: GDP 5.2% for 2023, but 2024 To Struggle

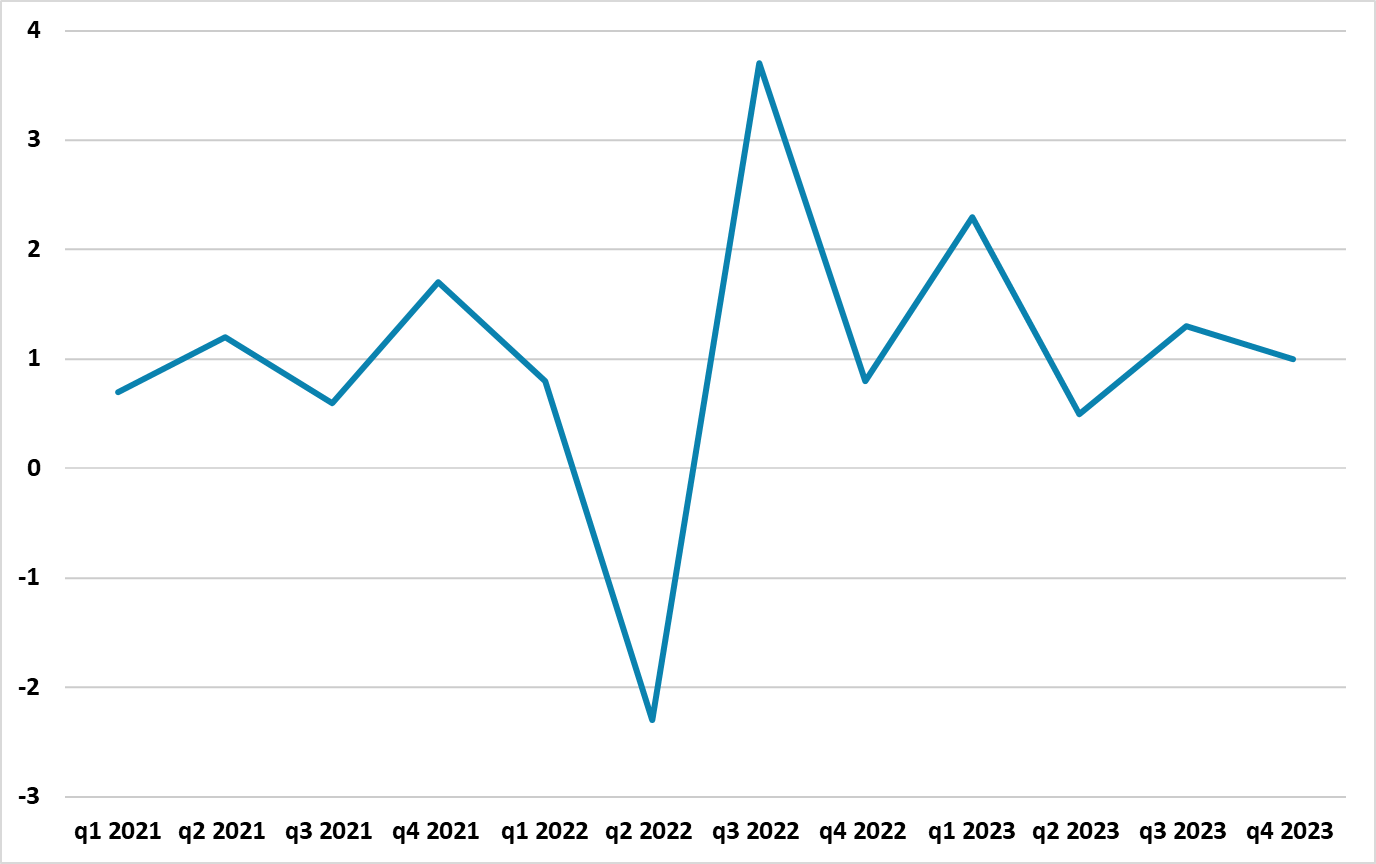

Quarterly GDP is interesting and came in at 1.0% after the 1.3% quarterly gain in Q3. The trend in quarterly GDP (Figure 1) is also not consistent with 5% growth and the Yr/Yr will dip in Q1 2024 when the large gain in Q1 2023 drops out (due to the end of zero COVID policies). We maintain the 4.2% 2024 GDP, as further policy stimulus will likely be targeted rather than aggressive.

Figure 1: Quarterly China GDP Profile and Forecasts (%)

Source: Datastream/Continuum Economics

China 2023 GDP came out at 5.2%, which was marginally lower than economists forecasts of 5.3% but had been leaked on Tuesday by Premier Li in Davos. The monthly numbers in December are difficult to interpret, as the Yr/Yr numbers are inflated by zero COVID policies in December 2022 and YTD numbers now contain 12 months. However, the December retail sales at +7.4% was lower than the consensus at 8.0%, while the breakdown of the data shows tourism/eating out doing well but anything housing related depressed. Though industrial production Yr/Yr was slightly better at 6.8% v 6.6% expected, this is not good news on a longer term basis. Production has been holding up, but without a retail sales pick-up the risk is excess production causes further disinflation and production cuts at a later date.

Other data released today also show lop sided economic growth. Private residential investment at -9.6% Yr/Yr YTD remain terrible, with weak home sales and falling housing prices. A game changer is needed to stabilise the property sector, but China authorities appear reluctant to abandon the three red lines or nationalise property developers. Separate data on fixed investment also showed that it is all state owned enterprises, with private investment down 0.4% Yr/Yr.

Quarterly GDP is also interesting and came in at 1.0% after the 1.3% quarterly gain in Q3. The trend in quarterly GDP (Figure 1) is also not consistent with 5% growth and the Yr/Yr will dip in Q1 2024 when the large gain in Q1 2023 drops out (due to the end of zero COVID policies). The Yuan 1trn package for local government building will kick in during H1 2024, but we feel that the underlying momentum is consistent with around 4% growth – especially as tourism will likely lose momentum in 2024, as pent up demand is satisfied. We maintain the forecast of 4.2% GDP growth for 2024.

Further policy stimulus will be needed, if the authorities set a 4.5-5.0% growth target in March. Reports suggest that the authorities are considering a Yuan1trn special sovereign bond issue for energy and other investment spending and this could come in the spring/summer. However, the scale of fiscal consolidation is not enough to boost growth to 5% in 2024, especially as net exports are also weak with the global economy and shift in some supply chains. Monetary policy stimulus is also likely, but the authorities remain cautious and surprised by not cutting the PBOC medium term facility rate on January 15. A 10bps cut is feasible in February, but we may have to wait until March and a RRR cut instead. Monetary policy is also less effective than fiscal policy, both due to the modest size and as some borrowers are already too indebted.