Yuan Decline: Waiting to Offset Trump Tariffs?

China’s authorities are reluctant to see too quick a decline in the Yuan, as it could accelerate capital outflows and cause political unrest for the communist party. Thus the preference remains for controlled declines in the Yuan with declines followed by periods of forced stabilization. We do see 7.65 by mid-year, but see most of this coming when Trump actually announces tariff increases rather than just threatening to increase tariffs.

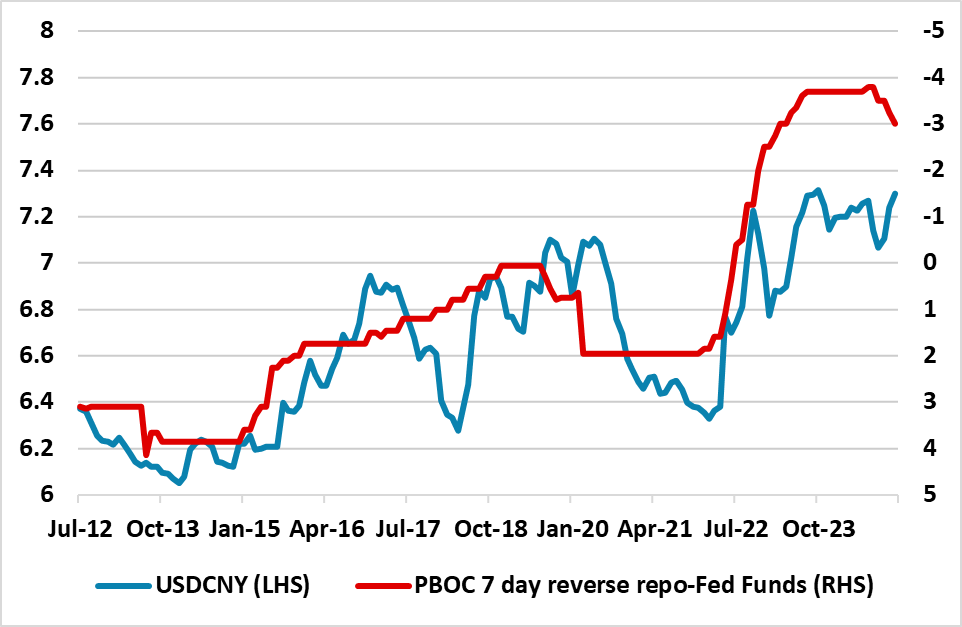

Figure 1: USD/CNY and PBOC 7-day Reverse Repo Rate-Fed Funds inverted (%) Source: Datastream/Continuum Economics

Source: Datastream/Continuum Economics

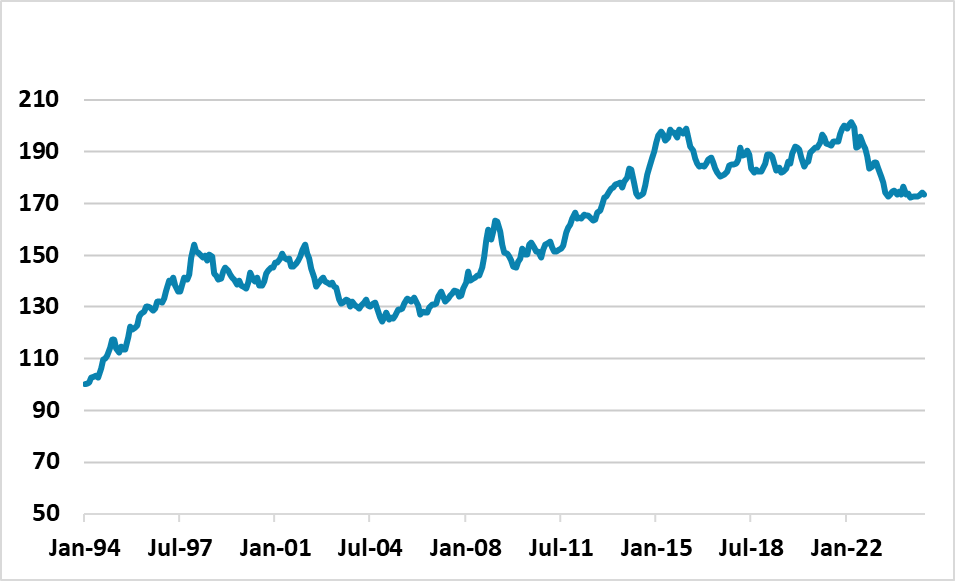

China authorities have stopped the Yuan decline in the early part of 2025, but the prospects remain towards Yuan losses for a number of reasons. • Trump trade threats and China exports. China export growth will likely slow in the coming months just on the fear on higher tariffs from the incoming Trump administration, with global businesses likely to be cautious in ordering from China. Additionally, some reports have suggested that 2024 exports to the U.S. were helped by anticipation of tariffs and this will be a headwind to 2025 exports to the U.S. We also see Trump actually imposing an average 30% tariff against China versus 20% at the moment by mid-year, both as he seeks to push China to a better trade deal than in 2018and also to raise tax revenue. Yuan depreciation is then a partial offset to the net exports drag and in our baseline, we forecast 7.65 on USDCNY by mid-year. • Adverse rate differentials. We see a further 50bps reduction in the Fed Funds rate in 2025 (here), but 40bps in the PBOC 7 day reverse repo rate (here). This means that the short-term rate differentials are unlikely to narrow much further (Figure 1) and is currently consistent with 7.60 on USDCNY. We also see 2026 Fed tighten and no rate change in China. • Real Yuan. Though the Yuan real effective exchange rate fell in 2022-23 it is still higher than the 1990’s (Figure 2). It could be argued that with domestic economic weakness and low interest rates that China needs an undervalued Yuan, both to boost inflation and help exports. Some China policymakers could argue for this privately.

Figure 2: Yuan Real Effective Exchange Rate (Index)

Source: Datastream/Continuum Economics

Source: Datastream/Continuum Economics

However, China’s authorities are reluctant to see too quick a decline in the Yuan, as it could accelerate capital outflows and cause political unrest for the communist party. Thus the preference remains for controlled declines in the Yuan with declines followed by periods of forced stabilization. We do see 7.65 by mid-year, but see most of this coming when Trump actually announces tariff increases rather than just threatening to increase tariffs.