Mexico: Exports Loosing Traction

At the beginning of the year, Mexico's exports are losing traction, stagnating as imports surpass exports. This could be due to adjustments to U.S. demand and inflation effects. With internal demand cooling and the U.S. economy decelerating, growth may shift to Mexico’s internal economy, bolstered by government projects. Nearshoring progress is slow, with existing firms expanding rather than new ones forming, and could be impacted by U.S. political changes.

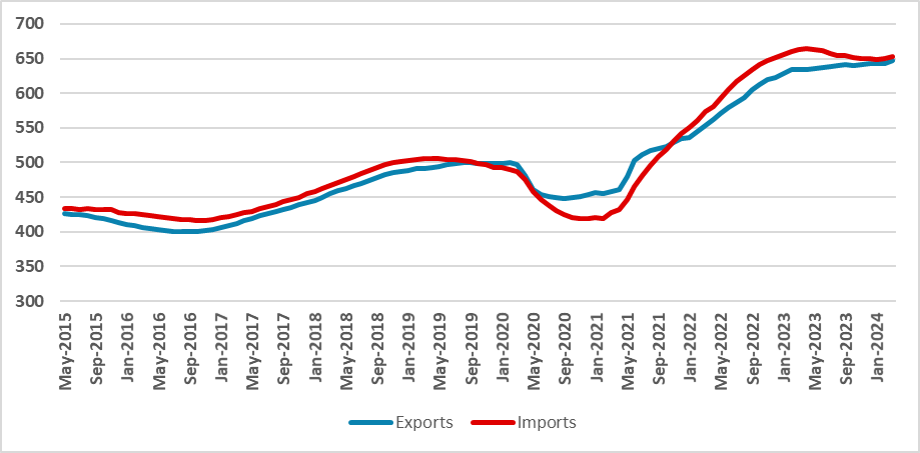

Figure 1: Mexico Exports (USD Billions, 12 months’ sum)

Source: INEGI

At the beginning of the year, Mexico's exports are clearly losing traction. Exports were one of the main motors of Mexican growth in the past year. At the moment, exports seem to be stagnating, with imports surpassing exports in the last 12 months. Much of this could be related to two processes. First, it is possible that in recent years Mexican exports were adjusting to the new demand from the U.S., which partially switched its imports from Asia towards Mexico. Once this normalization finishes, export growth will depend mostly on U.S. demand, which at the moment seems to be weakening. Another possibility is that the higher level of exports in USD was a direct consequence of inflation in export products. Once inflation stabilizes, export growth also starts to slow.

Although much of this process could be a combination of both situations, in terms of imports surpassing exports, we believe this is much more a consequence of the heated demand within Mexico in 2023. In the first three months of the 2024, imports have already started to decelerate, which we see as evidence that internal demand is cooling down.

We see no further reason to believe that Mexican exports will come out of the current plateau. Their biggest commercial partner (the U.S.) is seeing its economy decelerate. The continuity of this scenario means that growth for Mexico will likely come from the internal economy. Big construction projects will kick off in Mexico, mainly fostered by government spending, and they will likely contribute to some growth, especially in the second half of the year.

Most important for Mexico is the prospect of nearshoring. The recent deceleration of exports suggests that if nearshoring is set to happen, it will be a slow process. The FDI figures are not expanding rapidly as one would expect if new U.S. companies were looking to establish fresh facilities there. We continue to view that the current firms already established in Mexico are expanding their production capabilities and intensifying the existing value chains rather than creating new ones. The prospect of nearshoring is contingent on the creation of new value chains with the U.S. and could be jeopardized in case of the election of Trump in the U.S.t 25bps we have seen so far.