South Africa’s Fiscal Outlook Under Spotlights as the Elections Are Approaching

Bottom line: South Africa policy makers remain concerned about government debt trajectory, large domestic and international financing needs and elevated country risk premium before fast-approaching elections on May 29. We think South Africa’s general government fiscal balance and debt trajectory would remain cloudy due to problems in revenue collection, high cost of servicing the public debt, social spending needs and weak institutional fiscal framework, if a new government won’t prioritize on solving financial issues. We foresee post-election fiscal uncertainties as the ability of the likely coalition government to control the budget deficit is in question after May 29.

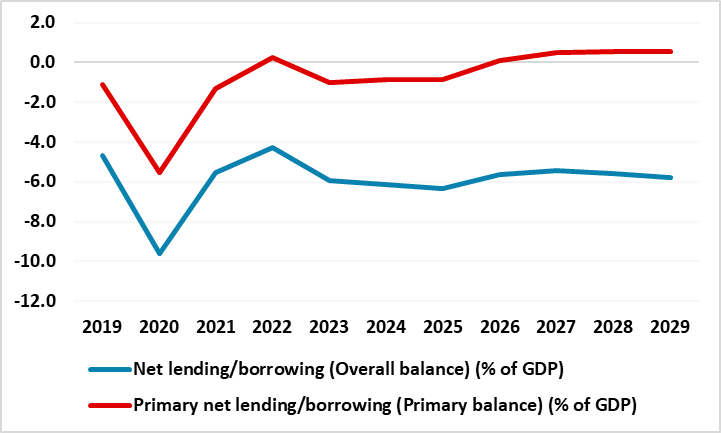

Figure 1: General Government Overall Balance and Primary Balance, 2019-2029 (% GDP)

Source: IMF April Fiscal Report

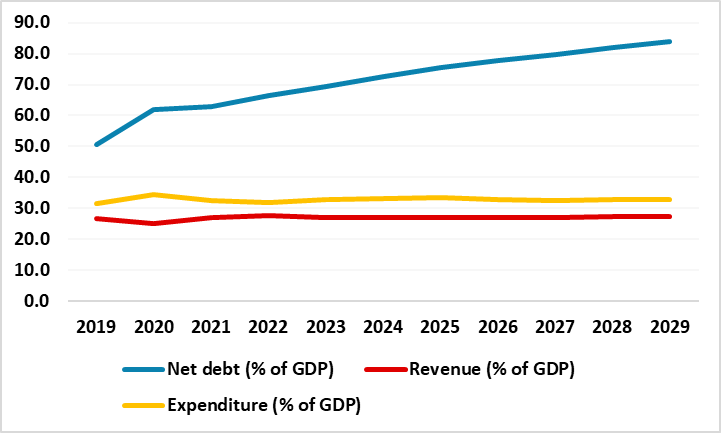

Figure 2: Net Debt, Revenue and Expenditure 2019-2029 (% GDP)

Source: IMF

According to the IMF Fiscal Report published in April 2024, South Africa’s general government fiscal balance (% of GDP), which recorded -4.3% and -6.0% in 2022 and 2023, is projected to jump to -6.1% and -6.3% in 2024 and 2025, respectively, while the primary balance is envisaged to have a deficit (-0.9%) in 2024 and 2025. (Figure 1).

IMF calculations demonstrate that the gross government debt-to-GDP ratio is expected to rise from 69.5% in 2023 to 72.5% in 2024 as the surges in debt-to-GDP ratio stem from a lower-than-anticipated cash drawdown/weak real GDP and valuation effects of exchange rate depreciation on FX debt. According to the fiscal monitor, the debt-to-GDP ratio is projected to increase by 12% between 2024 and 2029, almost reaching 84% of GDP by 2029, reflecting persistently weak growth and relatively high interest rates.

IMF also highlighted that South Africa’s primary deficit is expected to stand at 0.9% of GDP in 2024 while a surplus of 0.6% of GDP is projected in 2029. Revenues (% of GDP) are projected to remain stable between 2024 and 2029, hitting 27.1% and 27.2%, respectively. The country will likely undergo stronger fiscal consolidation over the medium term through cuts in expenditures, as expenditures (% of GDP) are predicted to fall from 33.2% in 2024 to 32.8% in 2028.

Visiting the revenues and expenditures front in detail raises questions however. There was an increase in the revenues between 2019 and 2022 as the revenue-to-GDP ratio rose from 26.7% in 2019 to 27.7% in 2022 backed up by the improvement in domestic revenues aided by recovery in the services sector after COVID-19 pandemic died out and favourable mineral prices. However, revenues fell to 27% in 2023 with revenue collection shrinking due to slowing commodity exports, slower growth, downward revisions of the tax base growth, and slowing corporate tax collections, according to the National Treasury’s Medium Term Budget Policy Statement (MTBPS) published in November 2023. The expenditure-to-GDP ratio increased from 31.4% of GDP in 2019 to 32.9% of GDP as of 2023 due to various reasons like wage increases, cushioned SOE transfers and grants to local governments (Figure 2).

The minister of finance presented South Africa’s financial year 2024-25 (FY24-25, April 2024 to March 2025) budget in February 2024. The government expects the budget deficit to reach 4.5% of GDP in FY24-25 and 3.7% in FY25-26 when compared to rates of 4.6%, and 4.2%, respectively, announced as part of the MTBPS.

In his budget speech, Finance Minister Godongwana outlined on February 21 that 2024 budget wasn’t designed to curry favour with voters before the elections on May 29, and the country’s top two problems were fixing its debilitating power and logistics problems. Godongwana announced that the cash-strapped country’s debt burden will be eased to the tune of 150 billion rand ($7.9 billion) by tapping profits on its gold and foreign exchange reserves, while lifting social spending. (Note: Budget analysts consider that the increasing debt trajectory, coupled with high funding costs and elevated country risk premium prompted the National Treasury to activate the Government Finance Emergency Contingency Reserve Account (GFECRA) to reduce debt servicing costs while use of GFECRA is seen as a temporary measure to maintain financial stability before the elections). According to the budget projections, debt as a share of the overall economy will peak at 75.3% in 2025-26, down from 77.7% estimated by MTBPS in November. Godongwana also indicated that electricity shortages and the snarled logistics were problems one and two constraining South African economy, followed by the imperative of tackling crime and corruption.

It is worth mentioning that the budget did not announce any new support for State Owned Entities (SOEs) but provided an update on the progress of reforms - particularly Eskom and Transnet - with the aim of reducing fiscal risk and driving key economic reforms.

As the elections are approaching fast, the recent rise of the load shedding problem, growing government debt, higher expenditure pressures, and weaker growth concerns (after sluggish growth in 2023) continue to darken the fiscal trajectory and deteriorate the fiscal position. We think the new government would need accelerated reforms in the short and medium terms to address long-standing structural impediments, particularly in the energy and transportation sectors.

Taking into account that the latest opinion polls, we will likely see an ANC-led coalition with the Democratic Alliance and/or other smaller parties would probably run the government. However, a low ANC vote could produce bitter infighting in the ANC that seeks to take on board EFF or Zuma’s party market unfriendly policy. We believe it would be an urgency for the new government to focus on decreasing borrowing costs and public debt, prioritizing fiscal consolidation efforts to strengthen institutional fiscal framework and enhancing revenue collections since it appears fiscal room remains limited to fund structural reforms, productive investments, social spending needs and renewable energy efforts that the country desperately needs. We foresee post-election fiscal uncertainties however as the ability of the likely coalition government to control the budget deficit is in question after May 29, and we think a coalition government is unlikely to provide that clarity and prospective strategies in the near future.