USD, JPY, CHF flows: USD quieter, crosses to dominate

Majors mostly consolidating. Verbal intervention from Japan helping cap USD/JPY but little USD momentum seen. Scope for action on crosses

A relatively quiet overnight session with little news saw some initial JPY gains but these were reversed by the end of the session. The early JPY strength came before the comments from Finance Minister Kato, who was relatively aggressive in threatening action against “one-sided, rapid” JPY moves. Even so, we doubt there is any real risk of intervention this side of 156.

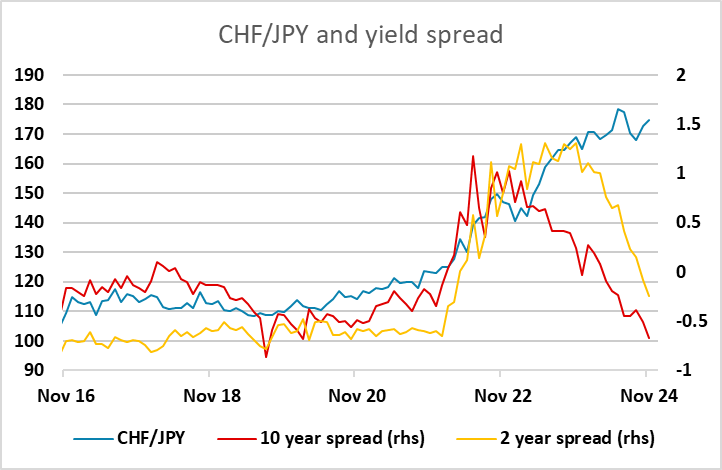

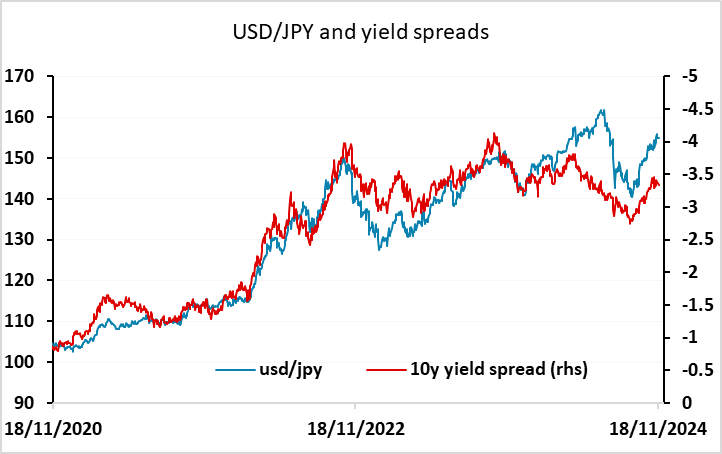

The main data today is the Canadian CPI data, but there is UK BoE testimony at 10 GMT in the European session. See FX Daily Strategy for a preview. The USD has lost a little of the post-election shine in the past few sessions as the equity market slipped off its highs. While there is still some optimism about tax cuts under Trump, there is concern about tariffs and if not tariffs, about the rise in the deficit that tax cuts will lead to. All in all, there is plenty of uncertainty about both fiscal and monetary policy, and this suggests choppy waters until the Trump presidency gets underway next year. We favour some further mild correction to the post-election USD gains, but would look to developments outside the US to drive significant moves in the next month. One cross that is interesting is CHF/JPY, which has historically been relatively neutral from a risk perspective, but has gained more than 50% in the last few years (in both real and nominal terms) as the JPY has weakened. Much of this appeared to be driven by yield spreads in the early stages, but the yield spread moves have now fully reversed and December BoJ and SNB decisions could trigger a sharp reversal lower.