FX Daily Strategy: Europe, November 19th

CAD under pressure ahead of Canadian CPI

Further modest losses possible but positioning is extreme

GBP could soften if BoE hints at possibility of December rate cut

CAD under pressure ahead of Canadian CPI

Further modest losses possible but positioning is extreme

GBP could soften if BoE hints at possibility of December rate cut

Tuesday sees Canadian CPI and US housing starts, and before that testimony from BoE MPC members to the Treasury select committee.

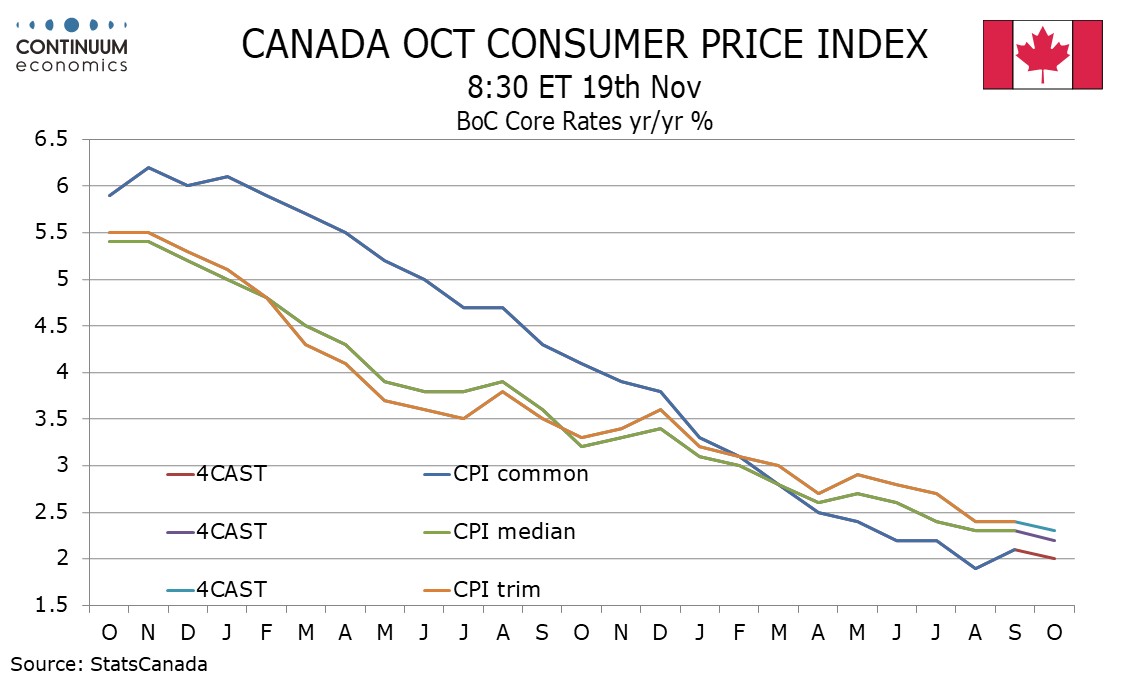

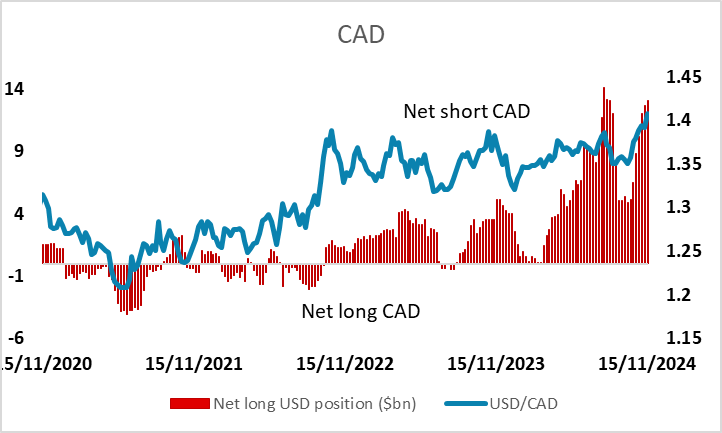

We expect October Canadian CPI to correct higher to 1.8% yr/yr after falling to 1.6% in September from 2.0% in August. This will still leave overall CPI below the 2.0% Bank of Canada target. However, while we expect overall CPI to correct higher we expect the BoC’s core rates to show renewed downward progress after a pause in September. Our views are broadly consistent with the market consensus, although the market medina looks for the headline rate to rise to 1.9% y/y. To the extent that our forecast is slightly below consensus, there is some downside risk for the CAD, which has been under major pressure in the last few weeks due to the widening of yield spreads with the USD. Current yields already suggest scope for gains beyond 1.41, so at this stage we wouldn’t oppose the USD/CAD rise.

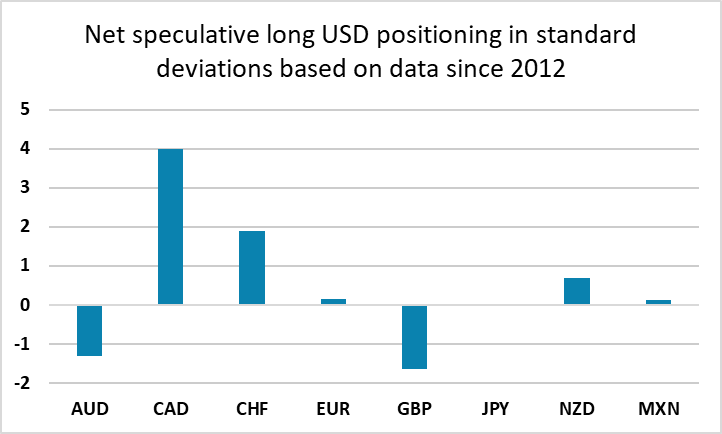

However, bigger picture the CAD is certainly cheap and speculative positioning is very extended, with the CFTC data showing net short CAD positions at 4 standard deviations above the average seen since 2012. Although the positioning is still slightly short of the highs seen in August, it suggests that speculative funds are close to fully committed and further USD/CAD gains will likely need to rely on real money flow. So while the bias may be to the upside, we wouldn’t expect any sharp USD/CAD gains from here on the back of the modestly weaker than expected inflation data we anticipate. There would likely be a sharper move if the data come in significantly above expectations.

The testimony to the Treasury Select Committee from BoE governor Bailey and MPC member (and arch-hawk) Catherine Mann could be influential on the pound. As it stands the market is only pricing around a 20% chance of a 25bp BoE rate cut in December, but we would assess the risks as being greater than this after the weaker than expected GDP data last week. While Mann has been persistently hawkish , her comments last week were perhaps less hawkish than might have been expected, and any signs that she is contemplating voting for a rate cut in December would have a big negative GBP impact. In practice, this is unlikely, but GBP could still suffer if Bailey sounds open to the idea of a December move.

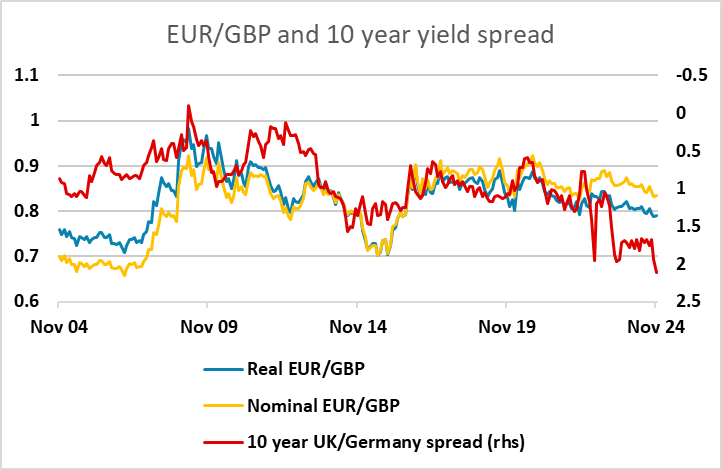

After a brief dip below 0.83 a couple of weeks ago, EUR/GBP has started to edge higher, and the pound looks to have lost some support since the UK Budget, failing to gain from the rise in UK yields that resulted. While the impact hasn’t been as great as was the case after the Truss budget in 2022, GBP certainly looks to be on the back foot and we would see risks as being very much on the downside both against the EUR and the USD.