UK Labor Market: Job Losses Weighing on Wages

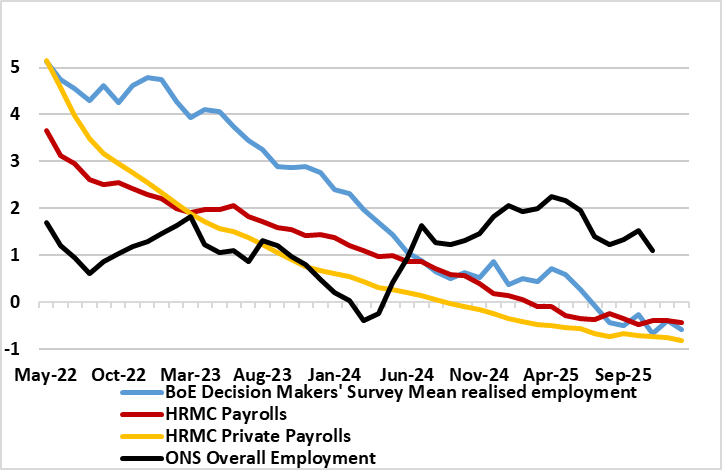

There are further signs that the labor market is haemorrhaging jobs both clearly and broadly with fresh and deep falls in the more authoritative measure of jobs covering payrolls. Indeed, private sector payrolls are still falling, down almost a full ppt in y/y terms and more steeply so (Figure 1). Regardless, the latest official labor market data (still bereft with reliability questions) are showing more comprehensive signs that the labor market is loosening with activity rates rising further and back to almost pre-pandemic levels (Figure 2). Partly as a result, the jobless rate has risen further to 5.2% and, in tandem with what are still weak vacancies, is very much showing that the ratio of the two has hit new highs, also consistent with a looser labor market. This helps explain the clear(er) signs of softer wage pressures with the growth rate of private sector regular pay down to the lowest since end-2021, and where perhaps more authoritative measures suggesting even weaker and inflation target consistent growth (Figure 3).

Figure 1: Private Sector Payrolls Still Falling More Clearly, Surveys Showing Broad Weakness

Source: ONS, CE, % chg y/y

There are still questions about the reliability of official jobs data, making a focus on the now full accredited HMRC payroll data all the more important. This gauge of employment excludes self-employment) and has been showing clear declines of late, albeit some revised away. However, while have been signs that payroll weakness has ebbed this was almost solely a result of a further jump in public sector jobs, mainly in health. Regardless, private sector payrolls are falling and still steeply (Figure 1). To what extent this reflects the on-going impact of recent tax changes (although the jobs declines are not concentrated in the more wage sensitive service sector) is unclear. But as Figure 1 also surveys very much suggest companies are at best freezing hiring and at worse laying staff off or not replacing, this latter development helping explain the fact that vacancies have fallen in every month for over three years.

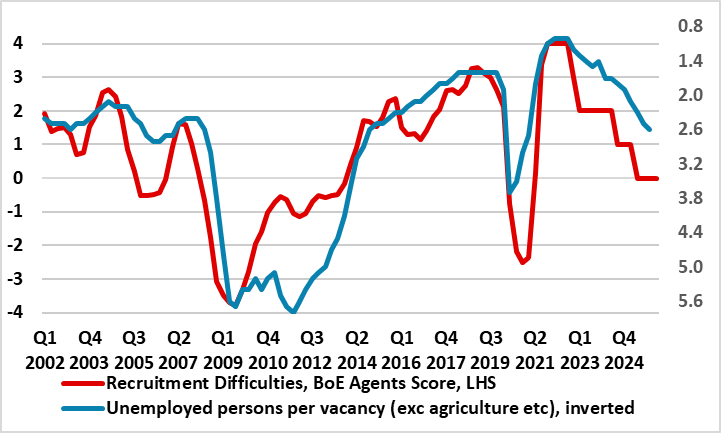

Figure 2: Labor Market Loosening

Source: ONS, CE

This, alongside a further rise in activity (or participation) rates (back almost to pre-pandemic levels), has contributed to a rise in unemployment and a rise in the jobless to vacancies ratio – often seen as a better gauge for the labor market tightness. Indeed, this ratio has risen to there now being 2.6 unemployed for every vacancy – up by a third in the last year. But this data is probably understating labor market looseness as it is still reliant on official ONS data where survey response question reliability. Indeed, (Agents) survey data produced by the BoE very much suggest that labor looseness is more marked than the official data (Figure 2). And, although partly a reflection of a slump in finance sector bonuses, it is this labor market loosening that probably explains the fall in wage pressures – at least in the private sector (base effects have pushed up in public sector wage earnings data – temporarily but where HMRC data actually suggest wage pressures running around, if not below 3%!

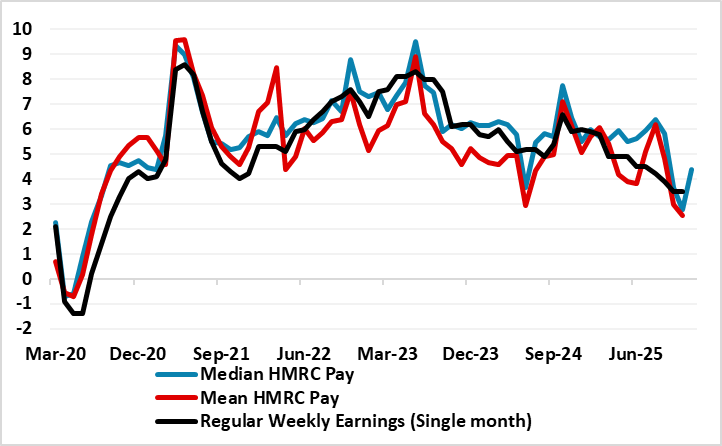

Figure 3: Wage Pressures Also Consistent with CPI Target?

Source: ONS, Continuum Economics, % chg y/y

This is all the more notable as the BoE now suggests that wage growth of around 3-3.25% is consistent with the 2% CPI target, this assuming productivity growth of 1% per year. As suggested above, some measures already suggest wage inflation may be around this rate. Admittedly using ex-bonus private sector earrings data (which are not a pure wage measure as they are affected by overtime/hours worked too), such wage pressures are nearer 3.5% on an adjusted three-month annualised basis. But pay data from HMRC are even weaker, already showing wage readings running below 3% (Figure 3).

Such data should encourage further speculation that the BoE will ease afresh next month and that Bank Rate should even get down to 3.0% by year end; after all, in the weak demand/more spare capacity scenarios in the latest BoE Monetary Policy Report, Bank Rate is seen moving below 3%!