EZ Monetary Insight: Politics Making Banks More Risk Averse Accentuating EZ Divergences

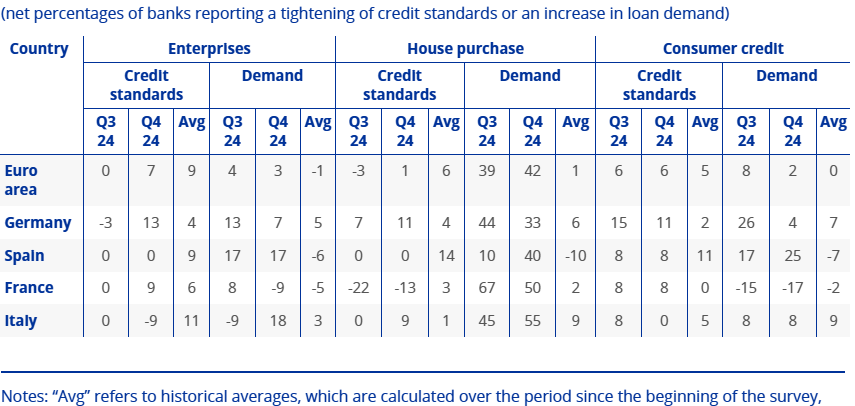

Ahead of what seems to be a routine decision tomorrow, recent monetary data complicate the policy outlook for the ECB in the months ahead. Positively, ECB compiled money data show discernible signs of as revival in bank lending, even for companies, although still hardly any growth in real terms. This chimes with the results if the latest ECB Bank Lending Survey (BLS) which showed further signs of a recovery in demand for credit, namely a response to falling interest rates. But the BLS still showed muted demand both by firms for capex and overall demand by consumer outside of housing. More notably, the BLS suggested a fresh tightening in both rejection rates and credit standards by banks that could nullify some of that rise in credit demand. Troubling for the ECB that rise in credit standards largely reflected added perceived risks by banks in Germany and France based around political concerns with standards actually falling in Italy. It seems that the divergence ingrowth that looming Q4 GDP data may further highlight is also evident in credit and bank thinking, the question being whether it may act to accentuate what are already clear EZ growth disparities.

Figure 1: Recovery Credit Demand but Tighter Credit Standards

Source: ECB BLS

It is unlikely that the Q4 GDP numbers will make much difference to the ECB decision tomorrow (ie a 25 bp rate cut), but they may have some impact on the policy outlook that the ECB may wish to offer. The ECB will be encouraged by signs that its rate cuts are having some impact, this very much again evident in a reported further rise in credit demand reported by both forms and households in the ECB’s latest BLS. Admittedly, any such recovery is tepid with little sign that companies are entertaining any pick up in investment spending while consumer credit demand faltered possibly on the back of banks tightening credit standards for such lending – this threatening that the recovery in actual consumer lending reported in the December ECB monetary data is fragile. In addition, the reported further pick-up in household deposits hardly sits with EZ consumers running down what the ECB regards are elevated household savings.

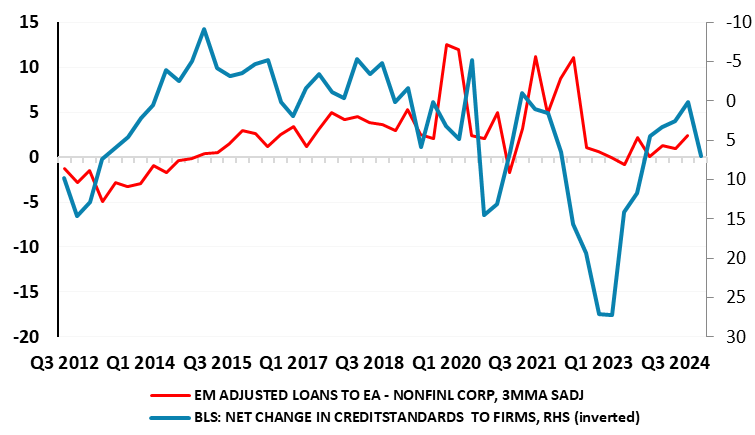

But the main concern must be the fresh rise in credit standards that the BLS reported in regard to both house purchases and particularly corporate credit supply. This came alongside banks reporting a net increase in the share of rejected loan applications for firms; this net increase was the largest since late-2023. It does seem as if this bank wariness is largely a result of political concerns in France and Germany making banks more risk averse. If so, and where little easing in such political concerns is envisaged in the near future, there is little the ECB can to counter it save for easing policy further, although ECB hawks may respond that the EZ troubles are becoming even more structural than cyclical. Regardless, if banks in France and Germany are getting more cautious and thus less likely to supply credit than this may merely extend, or even accentuate the clear divergences in growth performances that the EZ has seen of late. And as Figure 2 shows.

Figure 2: Recovery in Credit Demand Threated by Tighter Credit Standards

Source: ECB, net percentage balance in BLS. Note: Higher LHS number equates to net tightening or higher demand